NEWS RELEASE JUNE 2016

NOx Catalyst and Reagent Market Grows Nicely While Equipment Slumps

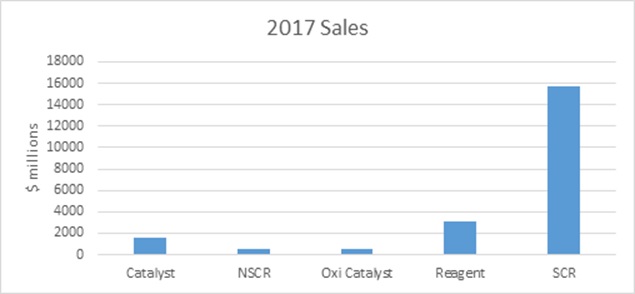

The sales of reagent for stationary NOx control in 2017 will exceed $3 billion. This does not include sales of AdBlue for mobile NOx control which are growing rapidly. The SCR catalyst market will also be down to just under $1.6 billion from a peak two years ago of $1.8 billion. The reason is that there was a surge of orders for new SCR in China which peaked in 2014. It is 3-5 years before this catalyst is replaced. However, the good news for catalyst suppliers is that there are a lot more power plants using SCR than there were a few years ago. The bad news is that with the large number of catalyst manufacturing plants built in China, the world capacity is also way up.

The SCR equipment market will be down by more than 30 percent from its peak a few years ago. A number of Chinese air pollution control companies will be looking to the international markets to fill their order books. The problem is that India and some other countries with lots of coal-fired capacity are not likely to invest in SCR.

The non-selective catalytic reduction (NSCR) catalyst market will show more than 5 percent growth as will the market for oxi catalysts for gas turbines.

There will be good growth in the NSCR market as cement plants and various industrial NOx emitters select hybrid systems.

The market for ozone generation will be growing robustly from a small base as it is increasingly utilized for the last incremental reduction. The cost of this approach is a straight line. It costs no more to go from 80 to 90 percent than it does from 10 to 20 percent. The cost to increase SCR efficiency from 80 to 90 percent will likely be an additional 50 percent. This is particularly true if one is trying to upgrade an existing unit where room was not provided for an additional catalyst bed.

The potential for catalytic filtration is very large. In fact, it could be a game changer. Tougher NOx control laws may come into force due to the potential to remove NOx and dust in the same device. When this is coupled with direct sorbent injection (DSI), three or even four pollutants can be eliminated in one vessel. There are several hundred installations using this technology. The entry of FLSmidth and Haldor Topsoe into this market is a positive sign that the largest suppliers believe in its future.

For more information on: N035 NOx Control World Market, click on: http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/104-n035