NEWS RELEASE May 2019

Pump Companies Continuing to Change Strategy and Ownership

Pump companies continue to change strategies and buy and sell divisions. But few are addressing a fundamental problem. The pump market is shifting to Asia where most international suppliers have a small market share. IDEX has less than 20 percent of its sales in Asia but even so is generating EBITA of more than 20 percent. The worry is that the pump companies who gain the lion’s share of the Asian market can utilize this position to pursue ROW. The most cited example is the Japanese auto market. In 1946 the U.S. auto companies were not interested in designing automobiles with right side steering. Today Japanese automakers have a large share of the U.S. market.

Grundfos has gained considerable market share in Asia but is an exception. Ingersoll Rand and Gardner Denver are combing their pump groups but neither has a significant share of the Asian market. Only 20 percent of the Flowserve sales are in Asia. Weir has sold its Flow Control Group to an institutional investor. Its oil and gas strategy is to focus on fracking systems. It is counting on the U.S. market where 80 percent of its oil and gas sales are generated. But this may be the perfect example of where the dominant player in a big offshore market will move into the U.S.

Sinopec has entered the U.S. fracking truck pump market in a big way. It now makes its own pumps and trucks. It is also one of the world’s largest users of pumps for oil and gas, petrochemicals operations and also for its OEM activities such as frack trucks. Chinese scrubber companies are now the largest purchasers of FGD pumps such as sold by Weir and KSB. They are employing these pumps in not only Chinese plants but in Vietnam and other Asian countries

Ingersoll-Rand and Gardner Denver to Form Two Companies

Gardner Denver and Ingersoll Rand will combine and then split into two companies. One is industrial and one is climate oriented. For the power industry the companies offer compressors, blowers and multiple pump types. The problem is that Asia represents less than 20 perent of the present market for each company. Forty-seven percent of the world pump sales will be in Asia next year and the percentage will increase in future years. So the combined company will be challenged to better penetrate the Asian market.

| World Pump Sales $ millions | |||

| Continent | 2019 | 2020 | 2021 |

| Total | 56,044 | 58,071 | 60,211 |

| Africa | 2,270 | 2,352 | 2,428 |

| America | 17,151 | 17,537 | 17,967 |

| Asia | 25,689 | 27,103 | 28,534 |

| Europe | 10,934 | 11,081 | 11,283 |

It has been shown that lower total cost of ownership can be the route to success in Asia. Electricity prices are higher, so that a pump or blower which is more efficient will compare better in Asia. In one case Gardner Denver won an order for FGD oxidation blowers because of higher blower efficiency despite higher price.

Ingersoll-Rand plc is to spin off its Industrial segment (Ingersoll Rand Industrial) and combine it with Gardner Denver Holdings Inc, creating an industrial company (IndustrialCo) valued at approximately US$15 billion. Ingersoll Rand’s current HVAC and transport refrigeration assets will become a pure play global leader in climate control solutions for buildings, homes and transportation (ClimateCo).

IndustrialCo, which is expected to be called Ingersoll Rand and trade under Ingersoll Rand’s existing ticker (NYSE: IR), will be home to Gardner Denver and Ingersoll Rand Industrial, including Ingersoll Rand’s pending acquisition of Precision Flow Systems (PFS), which is expected to close by mid-2019. IndustrialCo will have 2019 pro forma revenue of around US$6.6 billion.

Gardner Denver CEO Vicente Reynal and executives from both companies will lead IndustrialCo. The IndustrialCo board will be headed by Gardner Denver chairman Peter Stavros and include seven Gardner Denver and three Ingersoll Rand designated directors. IndustrialCo’s corporate operations will be located in Davidson, North Carolina.

The transaction is expected to close by early 2020, subject to approval by Gardner Denver stockholders, regulatory approvals and customary closing conditions.

Grundfos Delivered a 4.2% Increase in 2018 Net Turnover to Reach a Record DKK26.7 billion

Organic sales growth was 6.6 percent, the highest rate since the end of the financial crisis almost 10 years ago. The Danish company’s 2018 earnings before interest and tax (EBIT) were DKK53 million higher at DKK2400 million, while profit after tax grew DKK7 million to DKK1762 million.

“It has been another strong year for Grundfos, where we have gained global market share,” said Mads Nipper, CEO and group president of Grundfos.

Sales increased in important markets including China, the US and Western Europe and the global service business contributed significantly to the company’s organic growth. “Despite growth in EBIT, however, our profitability ended slightly below our own expectations, due to investments in growth, increasing material prices, and negative currency developments,” added Nipper. Nipper said that Grundfos has seen continued strong traction on its strategic initiatives especially within digitalization and service.

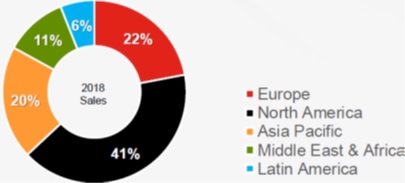

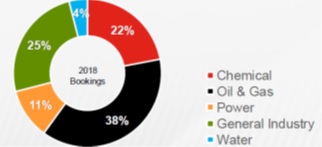

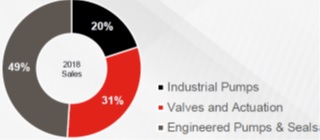

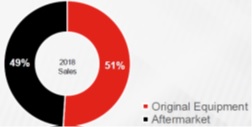

Flowserve Sales were $3.83 billion

This is up 4.7%, or 3.8% on a constant currency basis and included approximately 1% negative impact related to divested businesses. 20% of 2018 sales were in Asia. The company estimates 2019 sales will increase between 4-6%.

Weir 2018 revenue was 2.4 billion Euro.

In the oil and gas division Asia Pacific was 6% and Americas 80% due to fracking. Weir Minerals generated 15% of its revenues in Asia Pacific except Australasia and 15% in Australasia. Flow Control with over Euro 300 million in revenues is being sold. Weir Group PLC entered into an agreement to sell its Flow Control division to First Reserve, a leading global private equity investment firm focused exclusively on energy, for an Enterprise Value of £275m, payable in cash and subject to customary working capital and debt-like adjustments at closing. The transaction remains subject to certain regulatory and other approvals, with completion expected in Q2 2019.

Pump company forecasts and analysis are provided on a continuing basis in N019 Pumps World Market

For more information contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 226 23