NEWS RELEASE July 2021

Complexities of Selling Flow and Treat Products to Food Processors

The food industry has thousands of market niches where there are unique cost of ownership factors for flow and treat products. Soft drink flow and treat product decisions would be different from those for sugar.

Cane sugar and beet sugar have processes which are unique. However it is helpful to start with ten major segments and then move on to sub segments.

The major differences are in the process segments of the plants. There are less differences in treating utility water, wastewater and cooling. Many food companies have their own power plants. The flow and treat product cost of ownership would be mostly tied into boiler fuel types rather than the type of food product.

The flow and treat market is $20 billion/yr and growing at a CAGR of 5%.

The food industry is moving toward extensive use of IIoT. McIlvaine has provided details at http://home.mcilvainecompany.com/images/Industry_End_Uses/Food.pdf

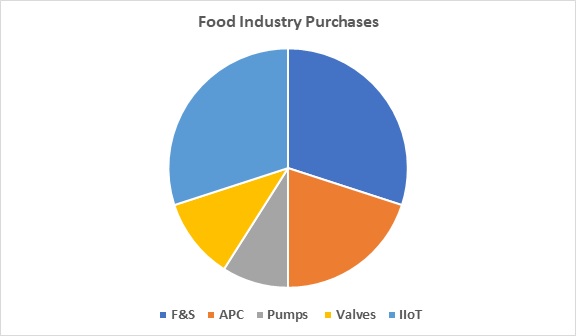

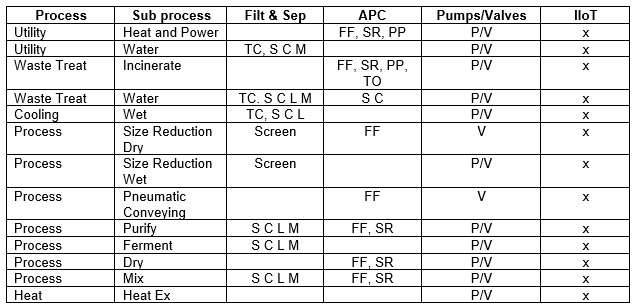

The type of flow and treat product needed can be determined by segmenting the market into utilities, waste treatment, cooling, and various general processes such as drying or purification. The broad segmentation of flow and treat is filtration/separation; air pollution control, pumps, valves, and IIoT. This includes instruments and controls for gases, air, water, liquids and free flowing solids.

See the chart below for explanation of these abbreviations

This has implications for flow and treat suppliers who want to sell products based on the lowest total cost ownership.

- More solid evidence of the cost of ownership is available from the data analysis

- The cost of ownership of an individual product is a function of how it operates in a system. A superior valve which cannot be as easily controlled as that of a competitor is at a disadvantage.

- The routes to market are impacted. A system supplier with the ability to remotely monitor and advise the owner can be in a position to provide the replacement flow and treat products.

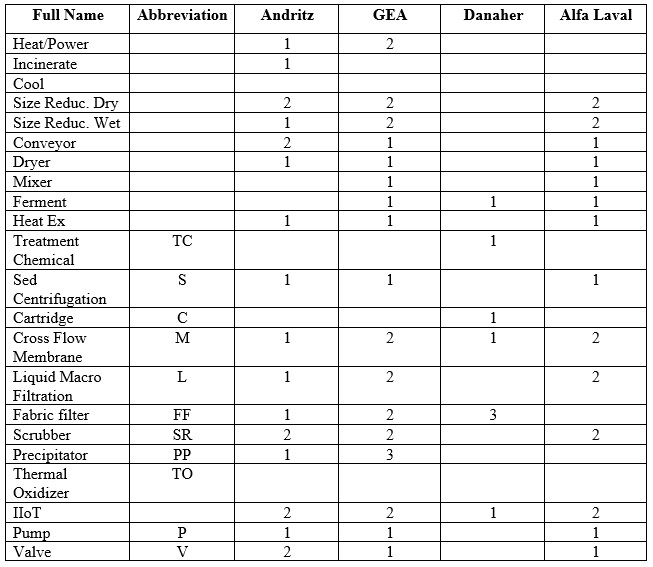

There are a relatively small number of companies with such a strong presence in the world wide food industry that they impact the market for all flow and treat products.

Alfa Laval and GEA were founded based on cream separators. Their food presence is strong compared their presence in other industries. Danaher and Andritz have moved into the food space but their greatest strength is in other industries.

The company strengths regarding specific flow and treat products are indicated below. (1) indicates they are a market leader. (2) indicates that they are in the top 10 and (3) indicates that they are in the top 20.

These four companies supply process equipment as well as flow and treat products. GEA is a leader in spray driers. Andritz offers several dryer types. Alfa Laval is a major heat exchanger supplier.

Their strengths relative to specific flow and treat products differ considerably. Danaher acquired Hach and is the only one of the four companies with a wide range of measurement devices.

Alfa Laval and GEA are by far the market leaders in food centrifuges. But their market share is less than 15%. This means that pump and valve suppliers still have 85% of the OEM market to pursue. Also since much of the pump and valve market is replacement, there is opportunity in the aftermarket.

McIlvaine offers flow and treat market forecasts for each of the products listed above. Details are found under markets at the top of the page at www.mcilvainecompany.com

Content Marketing support based on lowest total cost of ownership is available and explained at http://home.mcilvainecompany.com/index.php/30-general/1658-holistic-content-marketing-program