NEWS RELEASE JULY 2011

$6.1 Billion Precipitator Market This Year

Despite some loss of market share to fabric filters, the world electrostatic precipitator industry will enjoy sales of over $6 billion this year. This is the conclusion in the continually updated online, Electrostatic Precipitator: World Markets, published by the McIlvaine Company.

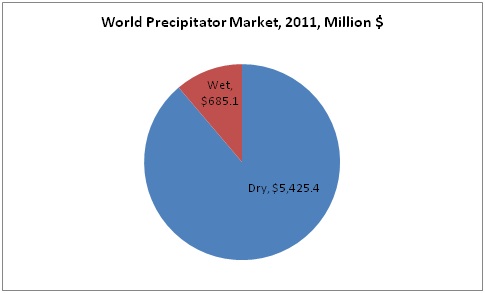

World Precipitator Market ($ Millions-System Type)

Subject 2011

Dry 5,425.4

Wet 685.1

Total 6,110.5

The future opportunities in electrostatic precipitation are greater in the service and upgrade segment than in equipment for greenfield plants.

Electrostatic precipitators have traditionally been the primary particulate removal device for coal-fired power plants, cement kilns, and certain furnace applications. However, other technologies have been developed and are making inroads.

The market for electrostatic precipitators is growing despite the fact that fabric filters are taking an ever increasing market share. Fortunately, the total market is growing fast enough to compensate for the share losses, but this is primarily due to upgrades to the installed base. There is a distinction between sales of new equipment and sales of parts and services. Whereas the sales of new precipitators are lower than the sales of fabric filters, the sales of parts and services are larger.

Precipitator parts and service is potentially a $4.5 billion/yr business. $1.5 billion is parts and $3 billion is operation and maintenance. However, most of this O&M is furnished directly by the owner, reducing the outside service contracting presently to just $300 million/yr.

Some big companies have entered the field. Siemens purchased Wheelabrator who has been a supplier of complete precipitator systems for many decades. GE sold its precipitator upgrade and repair business to Babcock &Wilcox.

Two factors, the emergence of the Chinese suppliers and the entry into the market of the largest international companies, have transformed the market. The world leaders of 20 years ago (Research Cottrell and Western Precipitation) are no longer independent U.S. companies.

The market for wet precipitators is smaller but has much higher growth potential than for dry precipitators. Wet precipitators were first used to capture sulfuric acid mist from metal mining and smelting operations. The installation of catalytic NOx control systems on power plants has resulted in the increase of SO3. As a result, many power plants in the U.S. are faced with SO3 reduction requirements.

Wet precipitators will achieve 90 percent reduction in SO3, actually in the resultant H2SO4 mist. They are expensive at $50/kW -$ 100/kW, but they are effective. As a result, a number of new power plants under construction will utilize wet precipitators following the scrubber.

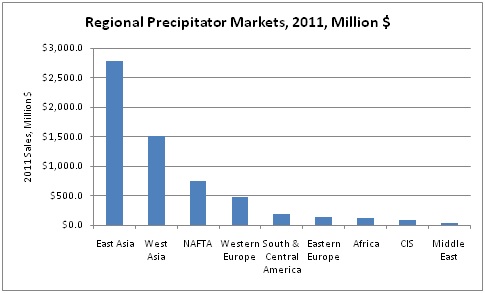

East Asia will be the biggest market followed by West Asia.

Regional Precipitator Markets ($ Millions)

|

World Region |

2011 |

|

East Asia |

$2,776.0 |

|

West Asia |

$1,518.7 |

|

NAFTA |

$756.3 |

|

Western Europe |

$474.8 |

|

South & Central America |

$187.5 |

|

Eastern Europe |

$142.4 |

|

Africa |

$120.0 |

|

CIS |

$90.1 |

|

Middle East |

$44.6 |

|

Total |

$6,110.4 |

For more information on Electrostatic Precipitator: World Markets, click on: http://www.mcilvainecompany.com/brochures/air.html#n018