NEWS RELEASE JANUARY 2017

IIoT is Creating New Market Paths to the $700 Million Gas Turbine and Reciprocating Engine Air Filter Repair, Replace and Service Market

The Industrial Internet of Things (IIoT) is a powerful new force shaping the way air filters for gas turbines and reciprocating engines are purchased. The impact of IIoT is being continually assessed in the 59EI Gas Turbine and Reciprocating Engine Supplier Program. The markets for air filters for these plants are analyzed in N022 Air Filtration and Purification World Market.

The inventory of existing gas turbine plants is growing at six percent per year and, in the next few years, the base will grow to two million MWs. There are 30,000 individual units which routinely require service, replacement or repair of air filters used for intake air in gas turbines and for inlet air filtration of compressors, diesel and gas engines. The market for replacement filters and services is $700 million per year and will grow by more than six percent per year.

IIoT provides remote delivery of comprehensive information about the operation and health of air filters. This data can be analyzed to identify problems and will create opportunities for the sale of better filters, media, coatings and smarter filters to replace the existing ones. There is much controversy on whether high efficiency microfiberglass filters for GT intakes justify the extra cost. With IIoT the answers for each specific plant will be available.

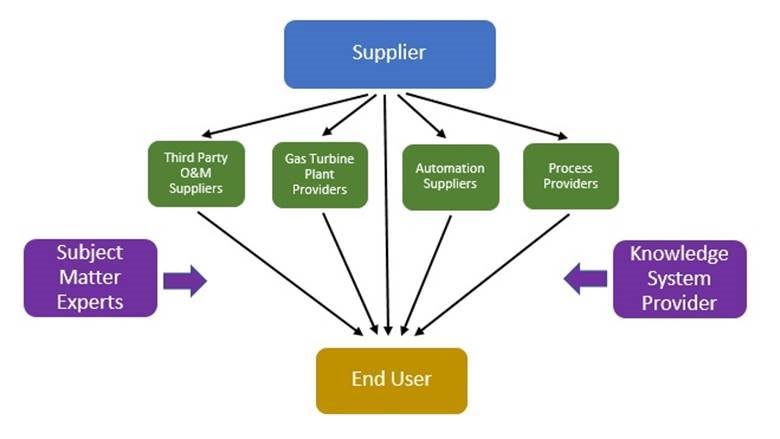

IIoT is creating new channels to market in contrast to the sale of products directly to a single end user.

End Users

Large end users are creating fleetwide purchasing and monitoring systems. Southern Company operates over 280 power generation units at 73 power plants including gas turbine, combined cycle, steam (coal), hydro and solar. Southern Company implemented the first phase of their fleetwide monitoring and diagnostics (M&D) center in 2007.

Duke Energy is growing its fleetwide monitoring and diagnostics center. Duke’s efforts promise to result in maintenance savings and availability improvements, while increasing equipment health visibility and optimizing logistics of maintenance.

The one hundred largest operators of gas turbines around the world account for most purchases. Therefore, working with them should be a high priority. Each of these plants is identified in Gas Turbine and Reciprocating Engine Supplier Program.

Filter manufacturers have the opportunity to offer programs to service and replace all the filters in the fleet. With IIoT cost effective maintenance can reduce costs for the end user while increasing margins for the supplier. When the small compressor filters are included there are many thousands of filters in a large fleet. The cost of purchase and storing small filters is much higher for an individual user than it is for a company supplying all filters. Some of the toughest applications for filters are in remote areas or on floating platforms in oceans. Remote monitoring and central supply is particularly advantageous for these applications.

Gas Turbine Plant Providers

Gas turbine suppliers have remote monitoring centers primarily focused on the health of rotating parts such as turbines. However, this is being expanded. MHPS just opened a remote monitoring center in the Philippines. It is monitoring the balance of plant in addition to the turbines. A filter supplier offering remote filter monitoring for all units can team with a turbine plant supplier for joint analysis of the operating data.

Process Providers

Suppliers of gas turbine intake systems or plant compressed air are also purchasers or influencers relative to products. A plant air compressor supplier can share remote data with the filter supplier.

Automation Suppliers

ABB can provide all required gas turbine control and protection functions utilizing the very same ABB DCS platform that controls the rest of the plant. The typical gas turbine functions implemented include fuel control, startup sequence, speed-load-temperature closed loop control, overspeed protection, anti-surge protection, generator protection, auxiliary control, condition monitoring, auto-synchronization, excitation, frequency control, etc. Parameters such as the pressure drop across the air filter are important. Both the filter supplier and the automation supplier can share relevant data.

Subject Matter Experts

When problems arise which cannot be handled by the dedicated supplier personnel, it is necessary to turn to subject matter experts. An air filter problem for one supplier can turn into an opportunity for another as a result of the recommendations of a subject matter expert. Another opportunity is to supply a better and more expensive product. Mann & Hummel supplies filters with nanofibers for higher performance. So, where gas or diesel engines are operating in dusty areas, the additional cost can be justified. Air filter suppliers need to encourage the participation of subject matter experts who understand the product and can provide lowest total cost of ownership advice.

Knowledge System Providers

Emerson’s use of Seek software allows incorporation of insights and background data which can be opportunistically displayed to help solve problems as they occur.

The gathering and organization of this data for use in the software system is a major challenge. McIlvaine is providing this data in its air filter and gas turbine related services but also in systems structured for a single utility. The beta site is for Berkshire Hathaway Energy (BHE) which operates hundreds of gas turbine and other power plants.

O&M Third Party Providers

Many gas turbine combined cycle power plants are operated and maintained by third parties. The developments in remote monitoring are making it more attractive to sub contract to a company specializing in O&M. These providers include specialized service companies such as Wood Group and EthosEnergy, power plant operators such as Uniper and RWE who are leveraging their experience to help others, and the plant suppliers such as Siemens and GE who have build/own/operate (BOO) contracts.

Air filter suppliers have an opportunity in an expanding gas turbine market to take advantage of the IIoT driven changes and to increase not only revenues but gross margins and profits as a percent of those revenues. This will require direct high level communication with several types of organizations.

For more information, click on: 59EI Gas Turbine and Reciprocating Engine Supplier Program. For more information, click on N022 Air Filtration and Purification World Market