NEWS RELEASE June 2018

Market Program based on Reliable Forecasts of Purchases by Each Coal Fired Boiler

Reliable forecasts can be obtained for purchases of combust, flow and treat (CFT) products and services for each of 12,000 utility coal fired boilers and for 15,000 industrial boilers as well.

Between 2018 and 2021 the capacity of coal plants worldwide will grow from 2440 GW to 2600 GW. The average boiler size is 0.2 GW. There are 12,200 existing boilers. The average size of new boilers is 0.5 MW. So the number of boilers will grow by 320 during the next three years Each existing unit and details on the new boilers are provided in 42EI Utility Tracking System.

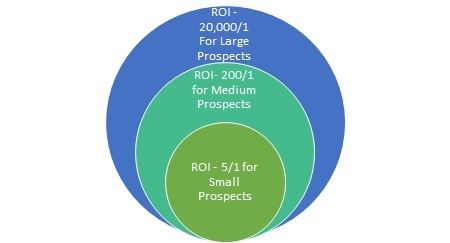

The Total Available Market (TAM) forecasts for specific products e.g. valves, pumps, cartridges, treatment chemicals, membranes, dust bags etc. can be purchased at a cost which will make the investment (ROI) very attractive. The average ROI will be 200 to 1. This is based on a yearly opportunity of $200,000 an increase in market share of 0.5% and a profit margin of 10%. The ROI for the very large 1000 MW units will be 20,000 to 1 whereas the ROI for the small industrial 50 MW units will be just 5 to 1.

These forecasts can be provided in excel format for easy integration into the CRM database.

A program starting with the prospects with the highest ROI can be progressively expanded to eventually cover all customers.

The forecasts can be purchased in an excel file which will provide

| Corporate Name | Unit size: MW |

| Plant Name | Location: City, State, Country, coordinates |

| Unit # | Specific product purchases 2019 $ 1000s |

Example

| Corporate Name: EVN | Unit size: MW 660 |

| Plant Name: Genco 3 Vinh Tan 2 | Vĩnh Tân commune, Tuy Phong district, Bình Thuận province. Vietnam |

| Unit # 1 | Specific product purchases 2019 $1000 |

| Forecasts can be supplied for sixteen of valves, four types of pumps, actuators, limestone, lime, precipitator internals, dust bags, gas instrumentation, liquid instrumentation, controls, treatment chemicals, ammonia, urea, catalyst, cartridges, dewatering filter belts, membrane modules, linings, nozzles, mist eliminators, fans, air compressors, oxidation compressors, motors, VFD, seals, packing, hose, couplings, compressed air filters, lubrication filters | Ball valves $170,000 |

| Butterfly Valves: $120,000 | |

| Globe Valves $190,000 | |

| Plug Valves: $100,000 | |

| Gate Valves: $150,000 |

EVN has multiple generation companies, one of which is Genco 3. The Viinh Tan 2 site has a total of 1330 MW of coal fired capacity with precipitators, SCR and seawater scrubbing. The plant was designed by Shanghai Electric with two sets of turbines and was erected in 2013. The seawater scrubbing contract was awarded to Alstom in 2011 for both 660 MW units. Alstom selected valves, pump and other components as part of its proprietary seawater scrubber system design.

In the above example we provided forecasts for five types of valves but included both control and on/off. There are eight valve categories each further segmented into control and on/off. The 2019 forecast for total valves for the unit is $930,000. The valve forecast for the plant is $1.86 million.

Forecasts can also be provided for all the EVN plants. EVN operates 26,000 MW of coal fired, hydro and gas fired plants. Valve purchases will be $39 million/yr. for all these plants in 2019.

The N028 Industrial Valves: World Market includes the forecast of valve purchases by the top 100 customers. Twenty of these large corporate customers are utilities. For subscribers to the valve report there would be a deduction in the unit forecasts. (Vinh Tan 2 unit 1 would be one unit).

Other Mcilvaine reports provide forecasts for the largest purchasers of pumps, treatment chemicals, cartridges, catalysts etc.

The cost can be greater if additional analysis is needed as would be the case of a special valve type. This will also be the case for products which are only used in some of the plants. For example dust bags for the boilers are only utilized in about 10% of the plants. The dust bags used at all coal fired plants for coal handling dust suppression and pneumatic conveying are small compared to those used to reduce the dust from the boiler exhausts. So the cost per unit for dust bags would be higher.

The purchase forecasts for all customers comprise the first step in a complete business program. There will be a high ROI achieved with direct sales programs for larger prospects. Custom websites can easily be justified for top prospects.

The Utility Upgrade Tracking System has data on each coal fired unit in each plant. New project information is published weekly in this Utility E Alert. The tracking system also has profiles of the major operators and OEMS. There is a complete profile on EVN.

The unit forecasting plus the Tracking System is a significant part of the investment in the direct sales program for the larger units. Whereas the unit forecasts would increase sales penetration by 0.5% the direct sales program can be expected to increase sales penetration by 5% or more. For a customer such as EVN with valve purchases of $39 million per year, a 5% increase in penetration would be $2 million/yr and would provide a very high ROI.

The addition of custom websites for a big customer such as EVN could be expected to increase penetration by 10%/yr or in the EVN case generating additional sales of $4 million per year. The ROI would be very high in the first year and even higher in succeeding years as the cost of forecasting and direct sales support per unit is reduced.

Details on this program are explained at www.mcilvainecompany.com

Bob McIlvaine is available to answer your questions or conduct a GoToMeeting to discuss options. You can reach him at This email address is being protected from spambots. You need JavaScript enabled to view it.847 784 0012 ext. 112