NEWS RELEASE May 2024

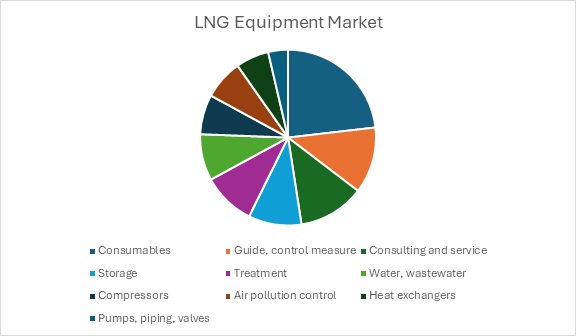

$80 billion market for AWE products in LNG

Introduction

The LNG market for AWE products is $80 billion per year and growing rapidly. But the question for the manufacturers of the products is whether this is one of the most profitable opportunities to pursue. The answer is found with awe digital forecaster.

- Analysis of the main segments: liquefaction, transport, and regasification.

- Find each $10 million/yr. opportunity with 30% EBITDA and 40% market share.

These favorable opportunities are created by product, technology, customer, and location synergies.

LNG Market

Oil and Gas can be viewed as a $300 billion dollar galaxy in the $2.5 trillion air, water, energy universe.

Natural gas is growing at 3% per year. What is most impressive is that the percentage of gas converted to LNG is predicted to increase at 6% per year through 2040.

The primary reason for the high level of growth is the ability to economically move natural gas from source to use.

This economy is due to liquefaction and the fact that the process reduces the gas to 1/600th of its original un-liquified volume and to half the weight of water.

Russia and Middle East countries have been the leading gas producers in the past. But horizontal drilling and hydraulic fracturing have created large new sources of gas.

According to IEA In 2024, global gas demand is forecast to grow by 2.5%, or 100 billion cubic metres (bcm). Price-sensitive industrial sectors will see a return to growth. Power generation is forecast to increase only marginally, as higher gas burn in the Asia Pacific region, North America and the Middle East is forecast to be partly offset by reduced demand in Europe.

While growth in natural gas use will be modest, the percentage which is converted to LNG will grow by 6%/yr. through 2040.

The U.S. has leveraged hydraulic fracturing to become the world’s largest gas producer. It has invested in liquefaction terminals and exports LNG around the world.

As of October 2023, U.S. terminals for liquefied natural gas exports had a combined capacity of 92.9 million metric tons per year.

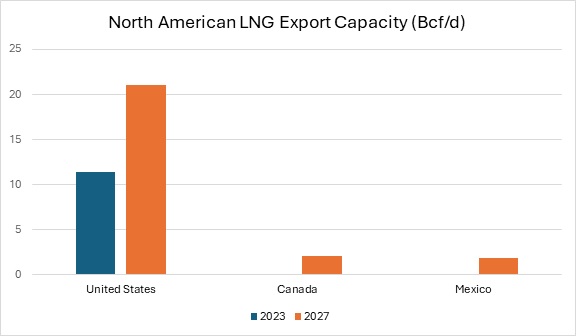

North America’s liquefied natural gas (LNG) export capacity will expand to 24.3 billion cubic feet per day (Bcf/d) from 11.4 Bcf/d today as Mexico and Canada place their first LNG export terminals into service and the United States adds to its existing LNG capacity. By the end of 2027, LNG export capacity will grow by 1.1 Bcf/d in Mexico, 2.1 Bcf/d in Canada, and 9.7 Bcf/d in the United States from a total of 10 new projects across the three countries.

Five LNG export projects are currently under construction in the U.S. with a combined 9.7 Bcf/d of LNG export capacity - Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. Developers expect LNG exports from Golden Pass LNG and Plaquemines LNG to start in 2024.

Exxon Mobil and other major oil and gas companies have invested in large tankers which have double the capacity of the earlier models.

In addition to ship and rail, virtual pipelines are experiencing strong growth. Gas which was formerly flared due to lack of a pipeline is now liquefied and moved by tanker trucks to power generators and other users. Recipient countries in Europe and Asia have invested in regasification facilities.

Companies active in Qatar can synchronize LNG with other opportunities. Synchronization can be segmented into the three main LNG activities: Exxon Mobil and other large oil and gas companies are involved in the complete supply chain but may not be involved in the tanker process equipment decisions.

Mcilvaine provides a digital forecaster for each industry for the air, water, energy industry which is part of the Most Profitable Market Program. For more information click on https://home.mcilvainecompany.com

AWE Digital Market Forecaster

AWE digital market niche forecaster now available. This tool has market forecasts for each product in each location and industry. This tool can immediately be used to set targets for territory and product managers.

In many cases that will be necessary to add segmentation.

So, in the above example, LNG would be added as a sub segment to midstream oil and gas.

Triple office triple offset would be an additional segment under butterfly valves.

This digital tool is updated continually in its standard format and customized as needed by individual subscribers.

For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.

NEWS RELEASE May 2024

Precision Mapping of Your Orders

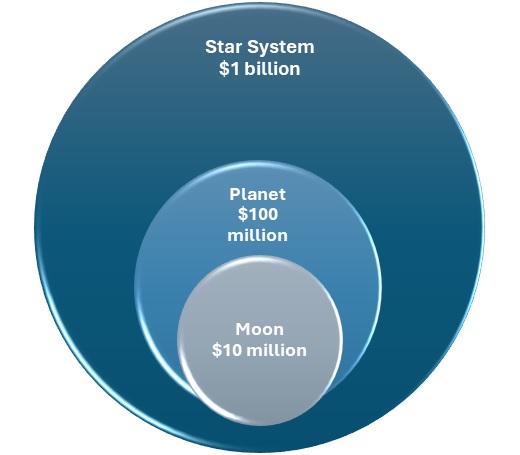

It is possible to map the route to most of your orders with precision such as NASA generates on its space flights. What makes this possible is the synchronization of all the moons, planets and stars.

The same is true in the trillion-dollar Air, Water, Energy Universe. The orders for one product are made predictable by mapping the orders for others in the same orbit.

The potential order is not some random meteorite which suddenly appears in a sales lead. 95% plus of the orders are either replacements or for greenfield sites being constructed by a purchaser with product experience.

Furthermore, that purchaser is buying all the products which are useful in the mapping. They include systems which use the product, devices connected to the product, and juxtaposed products.

Mcilvaine uses the equivalent of the James Webb space telescope to provide the orbits needed for the mapping.

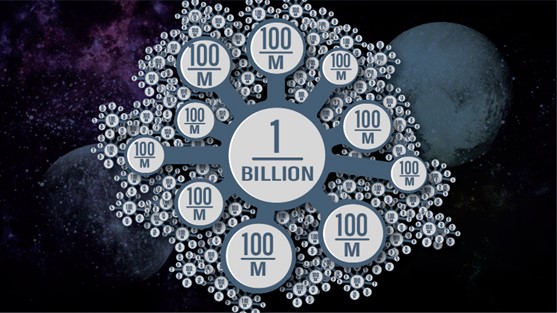

Each million-dollar order can be viewed as a lunar landing. A moon can have 10 or more successful landing sites. Q0 more moons can orbit a $100 million planet which in turn orbits a billion-dollar sun.

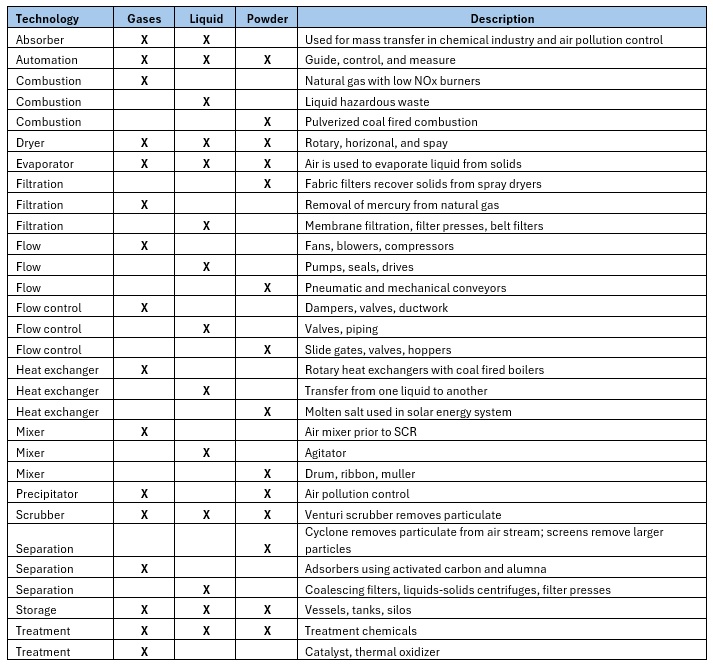

The markets for flow, measurement, treatment, separation and other physical and chemical processes for gases, liquids, and free flowing solids can be quantified by analyzing all the products involved.

Here is an analysis which shows many of the specific products and which are used by media type.

https://home.mcilvainecompany.com/index.php/news/47-uncategorised/news/1782-nr2780

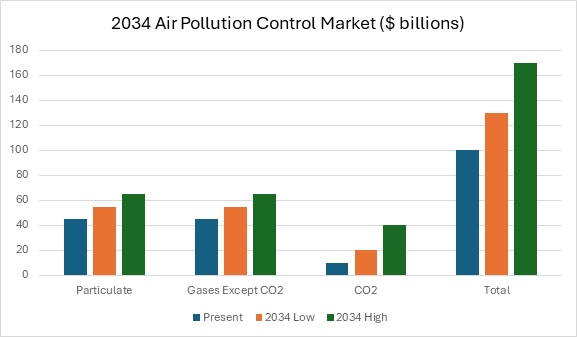

Air pollution control and CO2 recovery is a 100-billion-dollar galaxy which could grow to 170 billion dollars by 2034. The development of a 99% efficient CO2 absorber, up from 99%, is a better predicter of the future market than nearly any other factor.

https://home.mcilvainecompany.com/index.php/news/47-uncategorised/news/1784-nr2781

There is a 20-billion-dollar market for solid/liquid separation which removes particles between one and two hundred microns. This involves products such as centrifuges and filter presses. The leading suppliers are not the same companies making cartridges and reverse osmosis products.

https://home.mcilvainecompany.com/index.php/news/47-uncategorised/news/1781-nr2759

The Mcilvaine Most Profitable Market Program using the mapping technique can be implemented one planet at a time. It is a continuous process. Step 1 is to rank the opportunities. Then individual opportunities are pursued sequentially.

For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.

NEWS RELEASE May 2024

Air Pollution Control Market Could Surge to $170 billion/yr.

There is presently a $100 billion market for air pollution control. Investments are down in Europe and the U.S but growing steadily in Asia. As a result, It has not been viewed as a growth market. But that has suddenly changed. Absorbers are now available which can take out 99% of the CO2.

If power, cement and waste to energy plants were to follow the lead of the largest coal plant in Europe, the CO2 in the atmosphere would be reduced and we would be talking about net negative and not net zero.

Sales of CO2 absorbers, compressors, and related products could rise to $40 billion per year in just ten years time.

Given this new development we are predicting the market could rise to $170 billion/yr. by 2034.

Air pollution control involves more than just the treatment of air. Most gypsum wall board originates as gypsum formed in SO2 scrubbers. Most cement contains fly ash captured by precipitators. Power plants consume 10 times as much water as municipalities.

Air pollution control is needed in most industrial facilities. Semiconductor plants capture toxic fumes at each tool. Food plants use odor scrubbers to keep the neighbors happy.

In this dynamic market a game plan is a challenge. Suppliers and their market researchers should take the lead from distributors and juxtaposition the activities of each type of process equipment and the needed components.

Mcilvaine views air pollution control as a galaxy in the trillion-dollar air, water, energy universe. The galaxy has stars and planets involved in specific processes, industries, and locations. Each move in synchronization.

The Mcilvaine program starts with a space telescope to map out the program.

Here is a preview of the air pollution map.

Air Pollution Control Market Overview

For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.

NEWS RELEASE May 2024

Industrial Pump Market to Reach $100 billion by 2034

Whether it's mixing drying evaporation or liquid treatment, pumps are a key element in the process.

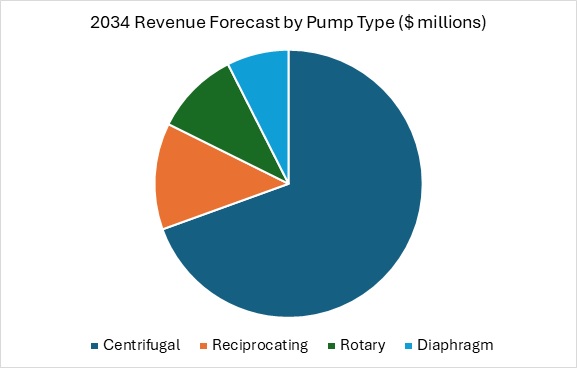

The split in 2034 by pump type will be as follows.

The market share for critical and severe service will increase while the market for general service will decrease.

The market for severe service pumps is increasing in a number of applications. One is hydraulic fracturing. This has taken over the oil and gas production in the United States and promises to be a big application in Argentina China, and other countries. The pumps wear out very quickly and parts are replaced sometimes, as often as every few weeks. So, hydraulic fracturing is at the very top of the list of severe service applications.

Critical service is also expanding at the expensive general service. Critical service includes the sanitary pumps that are used at hygienic applications in the food and pharmaceutical industry, where no contamination of the product can be tolerated.

There are some pumps that are classified under both severe service and critical service but are included for statistical purposes in the severe service category. One example would be pumps for chocolate. This is a very viscous liquid and is a severe service application but as a food it is also a critical application.

A new category is single use pumps in cell gene therapy. The cost of cleaning a pump between batches is significant and justifies the actual use of a pump with replaceable single use parts.

Pump use for hydrogen production is expanding. It has several aspects. One is using electrolyzers to generate electricity and converting water to hydrogen. This requires water to make the hydrogen provided by pumps which also need to overcome the pressure pressures of reverse osmosis.

Once the hydrogen is formed, it must be liquefied and transported, and this is a tough application for pumps and the need for very superior seals.

The mining industry uses a number of pumps for the processes, but also in many remote mines the ore is liquefied with a slurry and pumped to the ocean for transport. So, there are very large pumps moving ore long distances.

The industry is changing in a number of ways distributors are making skids and shipping those skids to the end-user. Those skids contain the pumps and valves and save a great deal of time and expense for the end-user.

There is a trend towards synergistic product offerings. Ingersoll Rand and Atlas Copco are buying pump valve and compressor companies and are able to furnish all of the products together in a package.

The pump market is most accurately assessed by understanding the process equipment to which the pumps are applied.

Example, in large cofired power plants capturing CO2, limestone is the common reagent. Pumps circulating as much as 400,000 GPM of gypsum slurry are required. Alternatively, the power plant can elect to use lime rather than limestone. This cuts the size of the pumps in half. This is a very large application for repair parts and a database of all the power plants in the world is utilized to more accurately assess the size of the replacement market.

Another big pump application is desalination. The water needs of the earth keep increasing and desalination is increasingly being relied upon to provide the freshwater needed.

More information on Pumps World Markets click on https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

NEWS RELEASE April 2024

Leveraging the Entire Universe of Process Equipment in Your Market Strategy

The Air, Water, Energy Universe generates revenues of $ 1 trillion for treatment of gases, liquids, and powders.

There are individual galaxies which generate revenues of more than $50 billion. Examples would be filtration, pumps, valves, air pollution control, combustion, fans/compressors, and mixers/dryers/evaporators.

There are many stars within the galaxies with revenues of more than $1 billion. Each could have 10 planets generating revenues in excess of $100 million. Each planet could have 10 moons generating annual revenues of $10 million.

Suppliers can benefit by approaching the market as a universe for several reasons.

The market, like the universe, is interdependent. Just as planets revolve around stars, the market for pumps and valves revolves around the selection of filtration and separation equipment.

An FGD supplier can choose to use limestone and needs twice the number of pumps as needed if he chooses lime.

To reduce energy consumption, a large municipal wastewater plant operator in China chose to replace all the large compressors supplying aeration air and replaced them with a number of small units.

The Mcilvaine Company includes all the AWE products in its analyses and forecasts. Here are examples:

The advantages for clients are:

- More accurate long-range forecasts

- Forecasts for each lunar landing ($10 million niche)

- Technology needs and trends

- OEM prospects

- Distributor collaboration

- Acquisitions

These analyses are part of the Most Profitable Market Program

For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.