Valve Forecast Changes Webinar - September 11, 2015

This 40 minute webinar will review changes to the forecasts in Industrial Valves: World Market Explanations will be given for key factor selections such as oil prices and Chinese economic growth. Examples of the type of information to be presented are shown below

The market for industrial valves is impacted by many different factors. Some of these factors are constantly changing. Two of the biggest changes in the last month have been the economic slowdown in China and the lower prices for oil and gas.

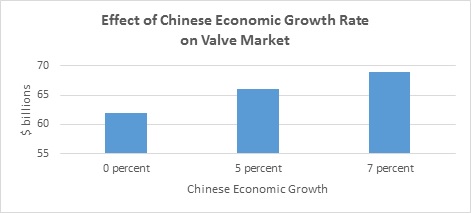

Valve sales in 2015 will be $ 57 billion of which China will account for 17%. If Chinese economic growth continues at 7% over the next 4 years there will be an expansion of the valve market by $ 12 billion. Under a zero annual economic growth in China the world valve market would only grow $ 5 billion/yr. by 2019. This takes into account not only the lower purchases in China but reduced purchases by suppliers to China

It now looks as if the economic growth for China in 2016 will be less than the anticipated 7%. Predictions range to as low as 2 %. This could be followed by a return to 7% growth in succeeding years including 2019. However, the political and financial management of the economy is facing a confidence crisis which it must weather if it is to resume its previous growth levels. There are also questions about the reliability of some of the government statistics which are used to assess growth. It is therefore necessary to look beyond the easily available statistics and to continue to analyze the fundamentals. Even though the stock market has dropped dramatically in the third quarter of 2015 it still remains at high levels compared to previous years. Consumer demand is high and with reductions in interest rates industrial expansion will be encouraged.

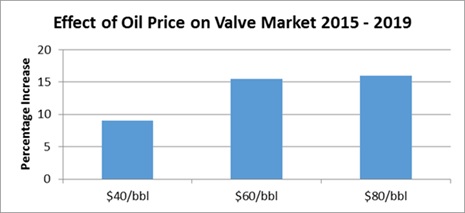

The drop in oil prices to under $ 40 /barrel late in the third quarter 2015 has immediate impacts on the valve market. Drilling activity has been reduced. A number of large projects have been delayed on canceled. However, the overall impact on the valve market is softened by the fact that the majority of valve are sold for applications unaffected by oil prices.

The market for industrial valves will grow by 16 percent from 2015 to 2019 at oil prices of $80/barrel during the period. At $40/barrel, the growth will only be 9 percent.

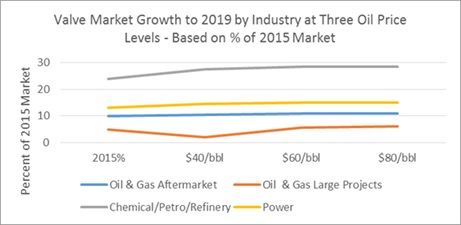

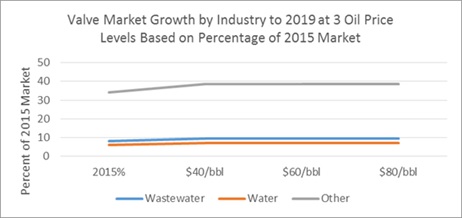

The industrial valve market is led by oil and gas which represents 15 percent of the present market. However water and wastewater, power, refining, petrochemical and other industries account for 85 percent of the market. The impact of future oil prices on the market can be best predicted by estimating the impact on the individual segments.

Oil and gas can be divided into two segments. The aftermarket and routine purchases for small projects represent two-thirds of the total or 10 percent of the present total pump market. The longer term large project revenues represent only 5 percent of the current market. If the price of oil were to continue to remain at $40/bbl through 2019, revenues in this segment would shrink over the period.

The chart shows percentages of the present 2015 market for the year 2019. At $40/barrel oil the long range valve product revenue from the oil and gas largeproject segment would shrink by 60 percent from 5 percent of the current market in 2015 to an amount in 2019 which is equivalent to 2 percent of the 2015 market. On the other hand, the oil and gas aftermarket and market for small projects would grow slightly during the four year period. In fact, the market for pipeline valves will be positively impacted as low cost oil and gas needs to be moved to more places.

The petrochemical market will grow faster at $40 oil. Municipal water and wastewater will be unaffected by the fluctuation in oil prices. Lower prices will result in more gasoline being consumed and more oil being refined. The power market will be impacted by greater use of gas turbine combined cycle power plants but total revenues for valves in the power industry will not be impacted greatly by fluctuating oil prices.

McIlvaine will continue to assess the likely changes in oil prices based on the following factors:

- The breakeven cost for a new well

- Hydraulic fracturing breakeven point is $30 to $50/barrel equivalent based on improved management practices and the extraction of more product from existing wells.

- Oil and tar sands projects break even at $65/barrel.

- Subsea is more expensive.

- New Technology developments

- Bechtel experience with coal seam gas to LNG in Australia indicates lower break even costs than subsea extraction.

- China coal to syngas and chemicals could be an alternative which is more than competitive at $40 oil. McIlvaine has recommended marrying the two stage (HCl/SO2) scrubbing along with conventional hydrochloric acid leaching to extract rare earths and generate by product revenue.

- Demand

- The slowdown in China could impact demand as could economic problems in Greece and other countries.

- Demand is a function of industrial activity. There is little equipment needed to extract Saudi oil. On the other hand, over 2,000 companies rely on the Alberta oil sands market for their revenues. The greater the industrial activity the greater the oil demand.

- Supply

- Saudi Arabia could choose to restrict production. In many ways the situation is analogous to the gold in Ft. Knox. You could sell it at any price and generate positive cash flow. However, it is a precious and finite resource which is important to future generations.

- Market driven companies will typically be reactive rather than proactive and will only increase drilling after oil prices rise to a level to make drilling profitable.

- Political developments

- Lifting the Iran embargo on oil exports.

- Russian activities in the Ukraine and elsewhere.

- Chinese efforts to manage the economy.

- Uncertainties in North Korea, Greece and Venezuela.

- Regulatory initiatives

- Export restrictions.

- Climate change regulations.

- Pollution control requirements for hydraulic fracturing.

- Traumatic events

- Major oil spills.

- Large meteorite impact, earthquake or major volcano eruption.

Some of these developments are more predictable than others. The low oil prices lead to lower extraction activity which eventually leads to shortages and higher prices. On the other hand, wars, oil spills and earthquakes cannot be easily predicted. As a result, there will be the need for continuous changes in the forecasts to take into account the surprises.