NEWSRELEASE NOVEMBER 2015

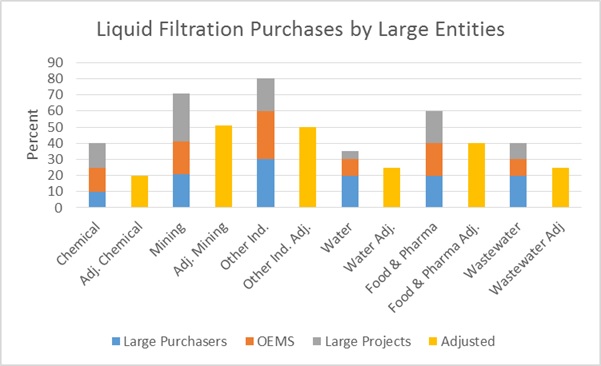

448 Companies and Projects Will Account For 41 Percent of Liquid Macrofiltration Purchases

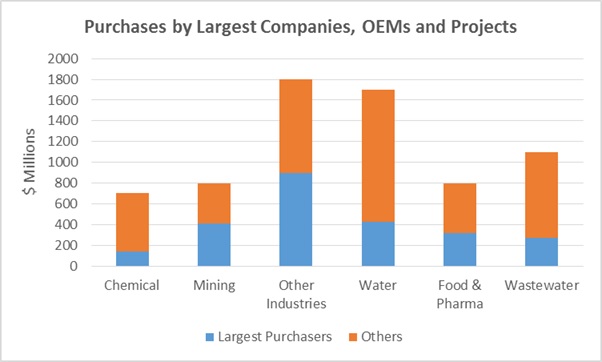

Sales of liquid macrofiltration equipment will be $6.9 billion in 2015. Suppliers who focus on 448 purchasers, engineering firms and large projects will be addressing 36 percent of the total potential. This is the conclusion reached by the McIlvaine Company in N006 Liquid Filtration and Media World Markets.

Large operators, system suppliers and architect engineers influence the majority of the purchases. A relatively small number of large projects also account for much of the market. There is overlap in that most of the large projects involve large operators and many of the filter specifications are made by large engineering firms. Some of the large projects such as a big new potash plant in Canada do not involve major operators. If a supplier pursues the large projects as well as the large operators, suppliers and engineering companies, he will be addressing 36 percent of the market.

The scope of the report includes filter presses, belt filter presses, drum filters, automatic backwashing filters, granular media filters and bag filters.

There are thousands of purchasers of filters. Many of the projects are quite small. These small projects involve filter sales of less than $40,000. Large projects with filter equipment needs of more than $40,000 account for 15 percent of the revenue in the chemical industry and 30 percent of the revenue in the mining industry.

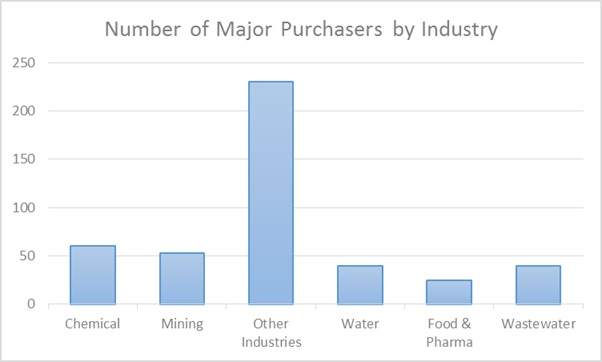

Sixty large companies and projects will address 20 percent of the chemical industry market of $700 million. Average purchases for the 60 will be $2.3 million creating an opportunity of $140 million.

There is a concentration among chemical industry purchasers. For example, BASF will account for 1.8 percent of the liquid filtration purchases in the chemical sector. The top 10 chemical companies will account for 10 percent of the purchases.

In the “other industry” sector, 230 companies/projects have been identified whose purchases will average more than $3.9 million each.

The mining sector is concentrated with just 53 companies making 51 percent of the decisions. ArcelorMittal operates coal and iron mines but also operates close to 100 steel mills as well. It purchases more than 1 percent of all liquid filtration equipment.

It is recommended that liquid filtration suppliers create specific programs to address this combination of companies and projects. The relatively small number of large opportunities makes a proactive approach possible. McIlvaine has created a unique route to market by combining the Detailed Forecasting of Markets, Prospects and Projects with McIlvaine project tracking services.

For more information on this program contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it.