NEWS RELEASE August 2018

Gas Turbines are a Large and Growing Market for CFT Suppliers

Suppliers of Combust, flow, and treat products and services will benefit from a growing world market for gas turbine generated power. The route to success will be complex and a good navigation system will be needed.

The inventory of existing gas turbine plants is growing at six percent per year and in the next few years, the base will grow to two million MWs. There are 30,000 individual units which routinely require service, replacement or repair of CFT components. The successful navigation system will need to chart these forces.

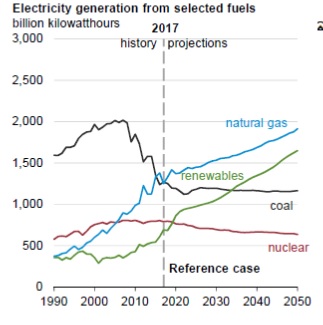

One: U.S. experience will be important. Unlike coal fired generation, the U.S. gas turbine market will remain the world’s largest in the near future. The U.S. is replacing coal with natural gas whereas Europe is moving more aggressively toward wind and solar and Asia is continuing to rely on coal. Natural gas power generation in the U.S. already exceeds coal fired power and will grow at an average of 1.5% per year over the next 30 years.

U.S. Energy Production - quadrillion BTU

By 2020 U.S. CO2 emissions from natural gas power generation will be 1.6 billion tons per year. This is an increase of 600 million tons since 1990. On the other hand coal based emissions will be 1.3 billion tons down from 2.2 billion tons in 2010. Methane is in the short term a major greenhouse gas contributor. So the fugitive emission reduction initiatives by CFT companies will be increasingly valued.

Two: The CFT market is boosted by the conversions of simple cycle plants to combined cycle. Many plants which originally were peaking are now being converted to combined cycle operation and are being used at least for intermittent power to offset fluctuations in wind and solar. CFT companies have attractive markets in raw water intake, ultrapure water, and wastewater treatment. Plants in areas with tough wastewater discharge limits or water scarcity are opting for zero liquid discharge. This substantially increases the CFT investment.

Three: The use of IIoT and Remote O&M will accelerate faster than in other CFT markets. The largest coal fired boiler is four times larger than the largest gas turbine. Owners are challenged with operating multiple units. Furthermore gas turbines are complex enough that OEM guidance is welcomed. MHPS, GE, and other turbine suppliers have remote monitoring centers. These centers are primarily focused on turbine issues but are expanding to cover the balance of the plant. Third party operators such as NAES are contracting to operate a number of plants. The more plants which are remotely monitored the more cost effective the results. GE cites its experience with many thousands of turbines as a major resource.

Many plants have cloud based process management systems. CFT suppliers have the opportunity to supply packages with edge based software and analytics which is tied into the process management system.

Four: There is the opportunity for CFT suppliers to provide extensive O&M services. Air filters, catalyst, treatment chemicals, valves, pumps, measurement devices and other CFT products and services can be sold in tandem with remote monitoring to provide a total solutions approach.

Five: There will be fewer but larger customers. Consolidation is taking place in many ways. The large operators continue to expand. Third parties are expanding their activities with the smaller operators. This provides CFT suppliers with the opportunity for direct sales contact.

The gas turbine markets as well as detailed project and plant information is continually updated in 59EI Gas Turbine and Reciprocating Engine Supplier Program

The market forecasts for specific CFT products are available in a number of reports http://home.mcilvainecompany.com/index.php/markets

The potential for automation and remote monitoring is analyzed in N031 Industrial IOT and Remote O&M