Coronavirus Face Mask Market Update

March 12, 2020

Overview

-

- Demand is Greater than Supply

- WHO Analyzes Mask Shortage

- Shortage of Masks Sparks Controversies Among Countries

Chinese Mask Supply

-

- Sinopec Moving from Resin to Mask Supplier

- Chinese Car Companies become Mask Suppliers

- Chinese Supply vs Demand

- Chinese Melt Blown Media Supply and Suppliers

Suppliers and Associations

-

- ASHRAE Guidance on Coronavirus

- Johnson Controls and Chinese Hospital

- Medline encounters Supply Problems

- Monadnock has Range of Medical Face Mask Media

- Secure Mask Supply Association battles for U.S. Based Supply Capability

- Superior Filter has Both Melt Blown and Needle Punched Media for Masks

- SWM supplies Melt Blown Media and Film for Surface Layer

______________________________________________________________________________

Overview

Demand is Greater than Supply

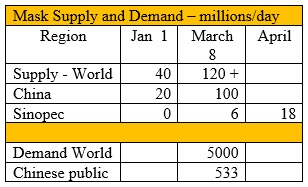

The problem with demand is that individuals are buying the masks and causing a shortage for health care workers who need them. If world demand per capita reaches that in China, 5 billion masks would be used each day. This is far above world capacity. Governments will have to regulate mask sales so that those at most risk receive them. Here is the type of analysis which is the basis for our projections.

The mask production depends on meltblown media. A ton of media will make 1 million disposable masks or 200,000 N95 masks. We will be probing the demand and capacity on a continuing basis for each country.

Sinopec is a major Chinese petrochemical producer. They have teamed with mask makers and are building assembly lines at an astounding rate. The first project completed a few days ago took less than three months and has two non-woven production lines and three spunbond production lines and can produce up to 4 tons of melt-blown fabric for 1.2 million N95 disposable masks or 6 tons for 6 million disposable masks per day.

Sinopec plans to start production at eight more meltblown nonwoven fabric production lines in Jiangsu province by the middle of next month. Upon completion, the ten production lines will be able to produce fabric for 3.6 million N95 respirators or 18 million surgical masks every day.

WHO Analyzes Mask Shortage

The World Health Organization is sounding the alarm about a growing shortage of personal protective equipment (PPE), and the issue extends well beyond the much-publicized medical mask shortage.

Last week the organization’s director-general, Tedros Adhanom Ghebreyesus, MSc, PhD, said the lack of supplies undermines the entire global effort to stop the spread of COVID-19. “We can’t stop COVID-19 without protecting health workers first,” Ghebreyesus said.

From the earliest days of the current coronavirus threat, news organizations featured videos of Chinese residents wearing facial masks on the street in hopes of protecting themselves from transmission of the virus. As the virus has spread, so too has demand for masks.

However, epidemiologists and other public health officials in the United States and elsewhere have repeatedly urged the public to avoid purchasing masks, noting that the masks don’t offer the general public meaningful protection from the virus. In a series of tweets and public appearances, United States Surgeon General Jerome Adams, MD, MPH, has repeatedly asked the public to stop buying masks.

“They are NOT effective in preventing general public from catching #Coronavirus, but if healthcare providers can’t get them to care for sick patients, it puts them and our communities at risk!” he wrote, in a February 29th tweet.

However, the WHO’s update this week makes clear that the dangerous lack of medical supplies is not limited to masks. Global supplies of gloves, respirators, goggles, face shields, medical gowns, and aprons are also increasingly under stress.

The WHO late last month put out guidelines for what it says are “rational and appropriate” use of PPE in health care organizations. They include eliminating the need for PPE in some instances by using telemedicine and restricting the number of workers who enter the rooms of patients with COVID-19.

The organization said its models suggest some 89 million medical masks will be needed each month to deal with the spread of COVID-19, along with 76 million examination gloves, and 1.6 million sets of goggles.

Ghebreyesus said meeting that demand will not only take restraint on the part of the general public, but also action on the part of governments and the medical supply industry.

“Without secure supply chains, the risk to healthcare workers around the world is real,” Ghebreyesus said. “Industry and governments must act quickly to boost supply, ease export restrictions and put measures in place to stop speculation and hoarding.”

With the shortages have come spikes in prices, the WHO said. Mask prices have grown six-fold, N95 respirators have tripled in costs, and the cost of gowns has doubled.

Ghebreyesus said medical supply companies will need to ramp up production by about 40% in order to meet demand. Governments could aid in this effort by creating incentives for companies to manufacture the equipment, he said.

For its part, US Department of Health and Human Services this week announced it will purchase 500 million N95 respirators over the coming 18 months to add to the nation’s Strategic National Stockpile.

Meanwhile, the WHO said it has sent PPE supplies to 47 countries so far, mostly to smaller countries in Africa and Asia.

Shortage of Masks Sparks Controversies among Countries

South Korea, Germany and Russia announced export bans of masks and other protective gear. They join others nation or territories including India, Taiwan, Thailand, and Kazakhstan that earlier put export bans in place.

Before the epidemic, China produced about half of the world’s output of masks with daily production of about 20 million units, according to state media Xinhua. Factories have since boosted production more than five-fold and are enlisting carmakers to manufacture them. That’s still not enough.

In the U.S., increased efforts by mask makers 3M Co. and DuPont De Nemours Inc. are also falling short of demand. DuPont, which makes masks and protective body suits worn by first responders, said it’s increased production by more than three times its usual global capacity. 3M, the biggest American manufacturer of N95 respirators, has increased production since the outbreak in China.

“We’ve added staff, we’ve added overtime, we’ve added technology, we’ve been increasing manufacturing lines,” said 3M spokeswoman Jennifer Ehrlich. “We expect this demand for respirators and other supplies to continue to outpace supply for the foreseeable future.”

The dependence on China and a few other countries for masks has some calling for a rethink of supply chains. The World Medical Association, which represents physicians, wants governments to establish factories in major markets like the European Union and the U.S. to ensure adequate supply of critical drugs, vaccines and other medical necessities.

The U.S only has about 1% of the 3.5 billion masks it needs to combat a serious outbreak, Health and Human Services Secretary Alex Azar has said. The country plans to buy 500 million surgical masks and N95 respirators for the national stockpile.

South Korea said on March 5 that it will bolster its control over the production of key materials used for protective masks, as the country is struggling to expand the supply of sanitary products amid the spread of the novel coronavirus here.

The country will ban all exports of melt-blown nonwoven fabric filter, the key material essential for the production of protective masks, although exceptions can be granted. The country will help companies expand their production capabilities as well, while reaching out to other countries to import the fabric.

Chinese Mask Supply

Sinopec Moving from Resin to Mask Supplier

China Petrochemical Corp known as Sinopec Corp, put its first melt-blown non-woven fabric assembly line into operation at its Yanshan factory in Beijing on March 6. The Yanshan factory is a converted 3600 square meter old warehouse that has found new life as a global production base following the challenges brought by the coronavirus outbreak.

The 14,400-ton capacity Yanshan facility is one of Sinopec's two melt-blown non-woven fabric assembly bases and is co-managed with China National Machinery Industry Corporation. The base has two non-woven production lines and three spunbond production lines and can produce up to 4 tons of melt-blown fabric for 1.2 million N95 disposable masks or 6 tons for 6 million disposable masks per day.

The new facility also takes advantage of Sinopec's integrated upstream supply-chain by sourcing local materials from Yanshan and support from the on-site synthetic resin production line.

"It normally takes about half a year to complete the construction of a 10,000-ton melt-blown fabric factory - We have done it in 12 days, 48 hours ahead of schedule. In a challenging time like this, saving 48 hours means that we can produce an extra 12 million disposable masks," said Lv Dapeng, Spokesperson of Sinopec Corp.

The largest medical material supplier in China, Sinopec is a significant supplier of polypropylene, a key component in the production of disposable masks for medical use. The new assembly line will ensure a stable supply of medical supplies, such as masks and clothing, can be distributed across the nation and worldwide.

"We are privileged to support those who are protecting us from the virus. Sinopec will utilize all of our resources to ensure supplies to the frontline are guaranteed," said Lv.

Sinopec plans to start production at eight more meltblown nonwoven fabric production lines in Jiangsu province by the middle of next month after commissioning two new units in Beijing on Saturday. Upon completion, the 10 production lines will be able to produce fabric for 3.6 million N95 respirators or 18 million surgical masks every day, it said.

The price of meltblown nonwoven fabric has been surging since the outbreak started, from around 12,000 yuan ($1,726) per ton to 400,000 yuan per ton. The price surged to 700,000 yuan per ton on Feb 24, The market price of the product is expected to gradually come down from its current peak, said Li Li, research director at energy consulting company ICIS China.

China's centrally administered State-owned enterprises have been accelerating work in the production of meltblown nonwoven fabric to help the anti-epidemic fight, with daily production capacity of meltblown nonwoven fabric reaching 26 tons as of March 6 and the same is expected to grow significantly in the coming weeks, said the State-owned Assets Supervision and Administration Commission.

Chinese Car Companies become Mask Suppliers

Chinese automakers BYD Co. and GAC Motor Co. are preparing to produce face masks and disinfectants to help motorists and the public ward off the ongoing coronavirus outbreak in China.

Two BYD plants in the south China province of Guangdong were expected to be churning out 5 million face masks and 50,000 bottles of disinfectants a day by the end of the March. The first batch of face masks and disinfectants was donated to drivers of public buses, taxis and ride-hailing fleets as well as volunteers fighting the viral outbreak.

Masks and disinfectant will also be sold to the public at factory prices. The two plants will keep producing masks and disinfectant until the end of the epidemic. The company is currently mobilizing employees to find sources of meltblown cloth. It is not only BYD that lacks melt-blown cloth. Many companies preparing to produce masks across borders also face this problem.

GAC, a state-owned automaker based in the south China city of Guangzhou, has dispatched a team of employees to an equipment manufacturer in nearby Dongguan to learn how to produce face masks.

Hainan Ganlin Technology Group is a company engaged in agricultural business. The general manager of the company said that because farmers could not find sufficient and reliable masks, which affected agricultural production, he purchased mask machines to build production lines, hoping to connect with sufficient meltblown cloth resources. At present, the company has contacted Sinopec but found that meltblown cloth is still scarce.

Chinese Supply vs Demand

Medical surgical masks and N95 masks generally use a multilayer structure, referred to as the SMS structure: a single layer of spunbond on the inside and outside; the middle is the meltblown layer, generally divided into single layers or multiple layers.

Among them, the outer layer is a non-woven fabric with a waterproof treatment, which is mainly used to isolate the droplets sprayed by patients; the middle melt-blown layer is a specially-treated melt-blown non-woven fabric with good filterability. Shielding, thermal insulation and oil absorption, is an important raw material for the production of masks; the inner layer is ordinary non-woven fabric.

Although the spunbond layer of the mask and the meltblown layer are non-woven fabrics, and the raw materials are polypropylene, the manufacturing process is not the same.

Among them, the diameter of the spunbond layer fibers on the inner and outer sides is relatively thick, about 20 microns; the fiber diameter of the meltblown layer in the middle is only 2 microns, and it is made of a polypropylene material called high-melt-finger fiber.

China is the world’s largest non-woven fabric producer. The production volume of non-woven fabrics in 2018 was about 5.94 million tons, but the output of meltblown non-woven fabrics was very low.

According to the statistics of China Industrial Textile Industry Association, the production technology of China’s nonwovens industry is mainly spunbond. In 2018, the output of spunbond non-woven fabrics was 2.971 million tons, accounting for 50% of the total output of non-woven fabrics, mainly used in sanitary materials and other fields; meltblown processes accounted for only 0.9%.

From this calculation, in 2018, the output of domestic meltblown nonwovens was 53,500 tons / year. These meltblown cloths are used not only for masks, but also for environmental protection materials, clothing materials, battery separator materials, wiping materials, and the like.

During the epidemic, the demand for masks has increased significantly. According to the data of the Fourth National Economic Census, the total employment of domestic legal entities and self-employed households is as high as 533 million people. Based on one mask per person per day, at least 533 million masks are required per day.

Chinese Melt Blown Media Supply and Suppliers

Data from the Ministry of Industry and Information Technology shows that currently the maximum daily production capacity of domestic masks is 20 million as of January 2020.

The gap in masks is huge, and many companies are beginning to produce masks across borders. According to the data of Tian’s Eye Examination, based on the changes in industrial and commercial registration information, from January 1 to February 7, 2020, more than 3,000 companies across the country have added “masks, protective clothing, disinfectants, thermometers, medical equipment, etc.”

Compared to mask manufacturers, there are not many manufacturers of meltblown nonwovens.

The current companies producing meltblown nonwovens are Hengtian Jiahua Nonwoven Co., Ltd. (hereinafter referred to as Hengtian Jiahua), Xinlong Holdings, Sinopec, Shandong Dongying Junfu Non-woven Co., Ltd., and Quantum Golden Boat (Tianjin) Nonwoven Co., Ltd.

Hengtian Jiahua is a non-woven fabric manufacturing enterprise jointly invested in by China Hengtian Group and Xiantao Jiahua Plastic Products Co., Ltd. China Hengtian Group is the world’s largest textile machinery manufacturing company.

On January 27, Hengtian Jiahua announced that the company’s entire plant was put into production and the output reached 120 tons/day. The products include non-woven fabrics for face masks, non-woven fabrics for meltblown filtration, and non-woven fabrics for bottom surfaces.

Xinlong Holdings was established in Hainan Province in July 1993 and listed on the Shenzhen Stock Exchange in 1999. It claims to be the first listed company in China’s non-woven industry, and it is also the construction and operation unit of the “National Nonwoven Materials Engineering Technology Research Center”.

Xinlong Holding’s meltblown non-woven workshop for mask bacteria filtering runs 24 hours to ensure the supply of raw materials to downstream mask manufacturers. Xinlong Holdings owns production bases in Hainan, Hubei and Hunan.

Shandong Dongying Junfu Nonwovens Co., Ltd. is a non-woven fabrics manufacturing enterprise jointly established by Hong Kong Tianyi Industrial Co., Ltd. and Guangdong Junfu Group. The company’s total investment exceeds 100 million yuan, and the goal is to build a large non-woven fabric production base in northern China.

The company is a meltblown non-woven fabric manufacturer, which mainly supplies raw materials for the production of daily protective masks, medical masks and industrial dust masks. Recently, in order to ensure the production for the epidemic, the company received advance funds from Shandong provincial finance and can use it for half a year without compensation.

Quantum Jinzhou (Tianjin) Non-Woven Co., Ltd. is also a manufacturer of meltblown fabrics, PP / PET two-component nonwovens and other products. At present, the company has two meltblown cloth production lines with a daily output of 4 tons.

In addition to large-capacity enterprises, there are also small-scale meltblown non-woven enterprises with a daily output of about 1 ton, such as Dalian Hualun Nonwoven Equipment Engineering Co., Ltd. and Zhejiang Jiarui Filtration Technology Co., Ltd.

Dalian Hualun Nonwoven Equipment Engineering Co., Ltd. is a company specializing in engineering general contracting, chemical fiber and non-woven engineering design, and equipment manufacturing. At present, the company has invested funds to transform the original two meltblown equipment production lines (production of air filter materials) into mask filter material production lines. Since its upgrade it has supplied 3.07 million BFE99 medical mask filters per day.

Mr. Huang from Dalian Hualun Nonwoven Equipment Engineering Co., Ltd. told Interface News that the company’s meltblown cloth production is currently 1 ton/day and the ex-factory price is 70,000 yuan per ton.

On February 12, the price quoted by a small meltblown cloth manufacturer to the Interface journalist reached 80,000 yuan per ton.

On January 28, the client of the People ’s Daily quoted that according to local companies, the market price of melt-blown cloth for filter materials for masks rose from the original 18,000 yuan/ton to 29,000 yuan/ton. From this calculation, the market price of meltblown cloth has increased more than threefold recently.

Dailian Jualiun says that in the next seven days, it will be able to expand production to 1.5 tons-2 tons/day; in the next two months, the output of meltblown cloth will be expanded to 3 tons/ day.

Zhejiang Jiarui Filtration Technology Co., Ltd. also told Interface News that the company’s current meltblown cloth output is 1 ton/day, which can only supply small customers and cannot meet the supply needs of large companies such as BYD.

Suppliers and Associations

ASHRAE Guidance on Coronavirus

In response to ongoing developments, ASHRAE has released proactive guidance to help address coronavirus disease 2019 (COVID-19) concerns with respect to the operation and maintenance of heating, ventilating, and air-conditioning systems. The ASHRAE COVID-19 Preparedness Resources webpage provides easily accessible resources from ASHRAE to building industry professionals.

“The recent escalation in the spread of coronavirus disease 2019 is alarming on a global scale,” said 2019-20 ASHRAE President Darryl K. Boyce, P.Eng. “While ASHRAE supports expanded research to fully understand how coronavirus is transmitted, we know that healthy buildings are a part of the solution. ASHRAE’s COVID-19 Preparedness Resources are available as guidance to building owners, operators and engineers on how to best protect occupants from exposure to the virus, in particular in relation to airborne particles that might be circulated by HVAC systems.”

Available on the webpage is ASHRAE’s recently approved position document on Airborne Infectious Diseases. The Society’s position is that facilities of all types should follow, as a minimum, the latest practical standards and guidelines.

Johnson Controls and Chinese Hospital

A team from Johnson Controls went to Wuhan to meet the emergency needs of a people hard hit by the novel coronavirus outbreak. The Johnson Controls team was working hard to help Taikang Tongji (Wuhan) Hospital construct a makeshift hospital.

It took just 45 minutes for the Johnson Controls team to make the key arrangements and plan for this mission, which was to provide full support for building the infrastructure of the makeshift hospital, including the communications system, the safety system and the elevator alarm system.

Johnson Controls Engineers Testing the IT Equipment and Installing Wireless Access Points

Within 12 hours, the company's first batch of medical protective supplies such as protective clothing, goggles, and masks had arrived. At the same time, colleagues from all over China sent forth material goods and well wishes to support the team.

On February 9 the Trion air filters were delivered.

Medine Encounters Supply Problems

With more than 20,000 employees worldwide, Medline reported $11.7 billion in 2018 revenue. It's not the only company that relies on Chinese manufacturers for medical supplies and other products.

It's always more concerning when supply and demand aren't moving in the same direction, which is the case with personal protective equipment, said Sunil Chopra, IBM professor of operations management at Northwestern University's Kellogg School of Management.

"The demand for facemasks is going up, for obvious reasons," Chopra said. "On the other hand, given that many are made in China where factories might be down because of the coronavirus, the impact on the supply chain here is much more significant. . . .When demand is rising but supply is dropping, it really hurts."

Other medical supplies made in China, including wound care products and surgical gowns, "likely will be impacted by the events in China if the restrictions continue for an extended time," Medline said.

A surgical gown shortage is even more problematic considering Cardinal Health earlier this year voluntarily recalled more than 2.5 million packs containing surgical gowns that may have been exposed to bacteria and other contaminants.

As a result of the recall, Medline in January said it was "ramping up" capacity of its level 3 surgical gowns based on the anticipated impact to health care providers.

"Our top priority is to ensure current Medline customers have the essential supplies they need to protect both patients and staff," the company said this week. "We have put in place inventory management programs to protect as much inventory as possible for our customers. In addition, we are actively working on options to increase production in other areas of our global supply chain, while diligently monitoring the situation in China.

Monadnock has a Range of Medical Face Mask Media

Monadnock has a firmly established surgical face mask business supplying qualified roll goods to converters and producers of medical face masks for the dental and hospital markets. The key is to produce consistent media with a suitable combination of filtration and breathability that is easy to process and convert into a variety of face mask configurations. A standard test is the Bacterial Filtration Efficiency test (BFE).

In combination with other non-wovens, these products meet the F 1862 standard for low, moderate and high resistance to synthetic blood penetration and particle retention — typically 95%, 99%, or better than 99% efficiency. Monadnock uses NIOSH Respirator Test Protocols to qualify the media including critical solid particle challenges. Products made with Monadnock’s face mask media meet the most rigorous BFE requirements.

The Monadnock range of medical face mask media has been developed over 20 years and now includes a family of roll goods to meet most market requirements including the fast growing consumer or home market. Especially developed production machines provide slit rolls typically in the 170mm-200mm (nominally 6 ¾”-7 ½”) size. Typically large master rolls are provided and converted into masks which are then sold separately or in packs.

Secure Mask Supply Association battles for U.S. Supply based Capability

The SMSA (Secure Mask Supply Association) is an organization founded by domestically-owned and operated surgical and respirator mask manufacturers to raise awareness regarding the importance of prevention and readiness by creating and maintaining an infrastructure for an American-made mask supply. Currently, most of the US mask and respirator supply is made outside of the United States, putting the supply at risk in the hands of foreign government-controlled manufacturing.

During the relatively mild H1N1 outbreak of 2009/2010, two of the five foreign manufacturers that made America's vaccines diverted vaccines intended for America to their own country, reducing the US supply. SMSA envisions a similar scenario in the case of an infectious disease pandemic. Simply put, the United States is not prepared to meet the needs of the country with its domestic manufacturing capacity for masks and respirators.

To strengthen America’s future vaccine supply, the US government funded three domestic vaccine manufacturing facilities. The government believes that a US-controlled supply is a more secure supply.

Though the government has explicitly expressed concerned about the availability of America’s foreign-controlled mask and respirator supply during global emergencies, it has no stated plans to encourage the return of mask manufacturing to the United States. SMSA believes it is critical that domestic manufacturing capacity be increased by encouraging US companies to bring their factories back to the United States.

To be clear, it is not the intent of the SMSA to make claims or recommendations pertaining to the appropriate use of masks and/or respirators other than for what they are cleared or certified for through appropriate regulatory agencies. We defer those question to more qualified scientific and public health experts. Our emphasis is on preparedness – having sufficient supply of such resources as science and policy may warrant.

In the midst of the 2009 H1N1 threat, the CDC changed its formal recommendation for healthcare worker protection against the virus from requiring surgical masks for “barrier protection” from large sprays or droplets, to a recommendation for the use of N95 respirators to protect against airborne, respirable transmission. This change was prompted by the uncertainty of how the H1N1 virus may be transmitted – direct large particle droplets or surface-to-hand-to-mucosa (eyes, nose, mouth, etc.) versus airborne transmission of small, inhalable particles. This policy change resulted in immediate N95 respirator supply shortages with backorders of up to two years. Similarly, surgical mask demand skyrocketed globally and manufacturing capacity was tapped out as orders were filled on a first-come-first-served basis, regardless of global origin of demand: a global free-for-all.

As we see today with healthcare worker protocols surrounding the Ebola virus, there is continuous suspicion and uncertainty surrounding best methods to assure protection against and containment of a virus that is not fully understood and may be undergoing genetic mutations in its mission to survive. This underscores the need for broad-based domestic agility and preparedness to respond to changing infectious threat dynamics.

Superior Felt and Filtration has Both Meltblown and Needle Punched Media for Masks

Superior Felt & Filtration manufactures and supplies a wide array of nonwoven synthetic fabrics for the manufacturing of safety & personal protection filters. It is among the top nonwoven synthetic filter media suppliers for medical and emergency response textiles, such as respirators and masks. It is one of the largest manufacturers of micron and sub-micron filter media for respirator and medical applications in the U.S.

The company offers non wovens that can be utilized in masks, air purifiers, medical equipment, personal safety apparel and cleanrooms that are highly efficient against 0.1 micron particles. The electrostatically charged high alpha perm melt blown and needle punched products can be easily molded into masks, pleated and die cut to offer protection over 99.9% against 0.1 micron particles which are considered to be the most penetrating particle sizes (MPPS). The electrostatic media offers low air flow resistance for more breathable masks or devices that help reduce fatigue & improve comfort levels.

Technostat® can also be utilized with breathable laminates, activated carbon and other materials for combined dust and gas filtration. For these reasons, Technostat® is ideal for nonwoven synthetic filter media for respiratory applications. In addition to Technostat® filter media, the company also offers Technostat® Plus – a triboelectric media of needle-punched felt that offers 20% improvement in filtration efficiency over standard electrostatic filter media. This nonwoven synthetic fabric produces its triboelectric properties when 2 dissimilar fibers used during the manufacturing process create a charge that enhances filtration capabilities.

Superior Felt & Filtration also provides electrostatic filter media rolls (electrostatically-charged synthetic needle punch fibers) and melt blown fibers. These nonwoven synthetic fabrics aid in producing some of the highest levels of filtration for health care providers and emergency responders.

SWM supplies Melt Blown Media and Film for Surface Layer

SWM International says it stands ready to supply converters and manufacturers of face masks with advanced nonwoven materials necessary to meet the global challenge presented by the coronavirus outbreak.

“SWM has a long history of supplying high-quality media integral to the construction and performance of face masks used in the dental and surgical sectors as well as the industrial sector,” said Bart Sistrunk, SWM’s Commercial Director – Filtration. “Our DelporeTM meltblown media is widely used in face masks because it provides excellent breathability without sacrificing Bacterial Filtration Efficiency (BFE) and its lightweight nature allows for comfortable wear.”

A leading producer of meltblown media, SWM also offers DelnetTM apertured film, a lightweight nonwoven that is extruded, oriented, and uniquely embossed for use as a flexible surface layer for medical facemasks or as a comfort barrier in finger bandages.

“SWM is prepared to prioritize production of Delpore meltblown media and Delnet apertured film for customers who need materials for face mask production,” said Sistrunk. “We are committed to continued support during the current world health emergency.”