NEWS RELEASE September 2023

Acquisitions Should Be Guided by Most Profitable Market (MPM) Program

Niche analysis greatly improves the quality of acquisition decisions and also the subsequent integration.

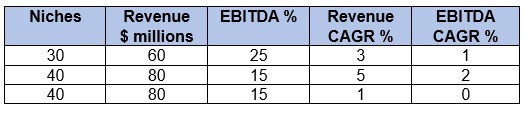

The performance of an acquired company is best anticipated by analyzing each niche. In the example a candidate is pursuing 110 niches for sales of $220 million.

The niches fall in 3 value categories with varying EBITDA and revenue CAGRs. In effect there is a valuation of 3 separate companies, 110 niches, and 1100 sub niches.

The niches fall in 3 value categories with varying EBITDA and revenue CAGRs. In effect there is a valuation of 3 separate companies, 110 niches, and 1100 sub niches.

The potential acquisition is not serving one market. He is pursuing an aggregation of niches.

Ask the salesmen and they will tell you that they are pursuing many sub-niches. In a company with revenues of $220 million salespeople can identify 1100 sub niches and 11,000 sub-sub niches. The problem is that these analyses are not shared and may not even be recorded anywhere.

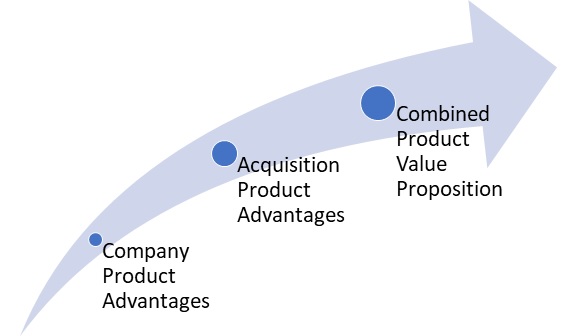

The acquiring company will determine the extent to which the acquisition will boost revenues and profits. Financial strength of the parent, production synergies, and global acumen can be a positive force. Sales synergies are best evaluated with the MPM approach and the synergy of niches. A niche can be one product and two territories or two products and one territory. If the acquired product is sold to the same customers for the same projects, there is the opportunity for substantial EBITDA improvement.

Ingersoll Rand and Atlas Copco are large compressor companies. They have been acquiring pump and valve companies. In LNG and hydrogen, you compress the gas to the point of liquefaction. You then need pumps for the liquid. Valves are required before and after both the compressor and pump.

The performance of the combination is more important than the individual products. So greater EBITDA can be achieved. Revenue increases because there is just one task of validating the value proposition. The advantage of being the first in the door is proven. A package will be evaluated before individual products.

One acquisition strategy has involves buying distributors, pump, valve, and piping companies. The products can be assembled on a skid and delivered ready to operate. By eliminating welding and assembly on site a substantial premium for the package can be achieved.

One EBITDA boosting strategy for system suppliers is to acquire companies who are supplying them with components. Andritz, Alfa Laval, and GEA all own pump companies.

Companies making the main products in a system e.g., mixers, dryers, filters, separators, or combustors frequently buy companies making the auxiliary products. Donaldson did just the opposite. As a filter manufacturer it purchased a company making both filters and bioreactors which create the product to be filtered.

With each acquisition comes the question of how much independence to allow. With the MPM program this question is less relevant. The decisions are made at the local level. They result in value propositions identifying the products and superiority for the application. So, the basis is collaboration at the local level. Whether this is voluntary or institutionalized is of lesser importance.

An acquirer should realize that the MPM niche analyses will be highly valuable both in the initial evaluation but as a way to provide integration in the most optimal manner.

A truism is that cost data is a reference and a guide whereas market data is just a reference. The market data appearing in financial statements and consultant reports is a reference. It may be sufficient for stock purchase decisions but no more useful for acquisition decision making than single entry bookkeeping of detailed costs.

Mcilvaine offers an Air, Water, Energy Most Profitable Market Program focused on the niches.

A company with an MPM program has the following for each sub niche:

Facts x factors = sub-niche forecast x value proposition x validation = 20% + share.

For a potential acquirer, the analysis of sub-niche success will greatly improve the analysis. One of the major pump companies made a recent presentation predicting long term growth in pharmaceuticals, water, and chemicals but a shrinkage in energy. However, there is a huge potential hydrogen market. An even greater potential is in Bioenergy, Carbon, Capture, Sequestration (BECCS). This is carbon negative and therefore is becoming the top choice for environmentalists. It also involves more valves and pumps than any other process.

80% of the present market is in the UK. So, this geographic niche component is significant.

If an acquirer is pursuing a company who cannot supply niche data, Mcilvaine can cost effectively provide far more than just the typical reference data. This is only possible because of systematic analysis of products, suppliers, geographies, industries, and processes.

For more information on the Most Profitable Market Program click on www.mcilvainecompany.com

For more information on acquisition support data contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it. or 847 226 2391