NEWS RELEASE April 2020

Coronavirus Impact on the Filtration Market - Large or Small?

The filtration market is being transformed by the COVID-19 virus. Suppliers need answers to the following.

- Magnitude of the impact in the short term

- Magnitude of the impact in the long term

The answers depend on the following factors

- To what extent is the virus transmitted through the air?

- Will the virus keep reoccurring?

- Will COVID-19 devastation result in permanent upgrades in health expenditures for flu, HAI and other major infectious diseases?

- How can masks and air filters best be used to meet the new goals?

The market impacts can be categorized from least to most important.

The range of impacts for surgical and N95 masks is

- Least - surge in mask use for the next six weeks and then an oversupply from China makes for a very weak long term market

- Most - the world and individual environment is segmented based on safe zones ranging from unsafe to very safe. Time spent in any unsafe or less safe zone would be with a mask.

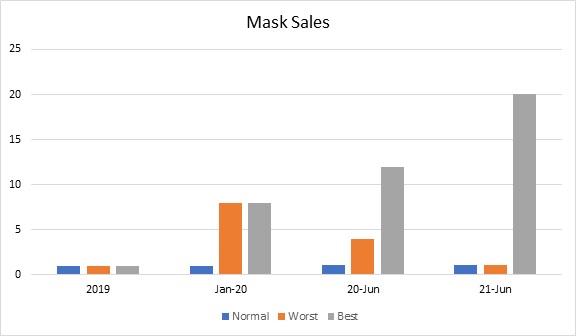

The following chart shows worst and best case scenarios. The normal scenario would have been for a small percent increase in sales in 2020 over 2019.

In the worst and best case scenario sales skyrocketed in the first quarter of 2020 with China increasing production to 200 million masks per day. N95 masks increased from 200,000 to 1.2 million. In the worst case scenario the sales decline rapidly in the third quarter 2020 and fall to normal levels in 2021. This causes major supplier problems because of overcapacity.

In the best case scenario many of the world’s 8 billion people are routinely wearing masks in unsafe and semi safe areas. Even if masks are reused 20 times this is 400 million masks purchased each day.

One variable is the efficiency of masks selected. You have the lower quality, the N95 and even the N100 for better virus capture. Another variable is single use vs reusable. A $15 reusable mask with 20 reuses would generate the same revenues as a 75 cent disposable mask.

The range of impacts for HVAC filters and room purifiers is

- Least - sales are higher for the next few months but then revert back to the level which would have been achieved without the coronavirus

- Most - the recognition of viruses and other infectious diseases spurs a permanent increase in the healthcare, commercial and residential markets of 30 percent or more. There would be safe zones which are protected by local filtration systems. There would be a need to create safe zones on a temporary basis. This could lead to a big rental market. The number of air changes per hour in many buildings could be increased along with the installation of HEPA filters.

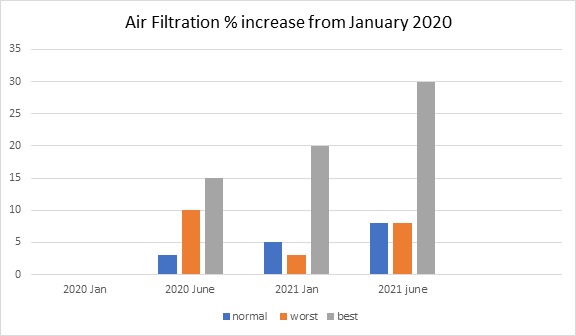

The normal growth for air filtration in healthcare, commercial and residential would have been about 5 percent per year. In the worst case scenario sales are up 10 percent by June of this year. They drop to just 3 percent above the January 2020 level at the beginning of 2021 and are back to pre-corona growth levels by June 2021.

With the best case scenario sales are up 15 percent from the January level by June 30. They rise to 20 percent above 2020 by the beginning of 2021. By June 2021 they are 30 percent higher than in January 2020.

The spread for HEPA filters is more than 100 percent in the sales forecast. For room air purifiers with HEPA filters the spread is more than 200 percent. The rental market could develop from 0 to hundreds of millions of dollars worldwide.

The widespread in the size of the future market makes it highly desirable to make the best possible forecasts and update them continually. McIlvaine is providing this in Coronavirus Market Intelligence Click here for more information

Bob McIlvaine can answer your questions at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.