NEWS RELEASE August 2022

Pump Company Acquisitions Increase Niche Market Shares

Pump company market strategy is governed by two axioms

- The greater the pump company market niche leadership the higher the EBITA %.

- Acquisitions are a quick way to achieve market niche leadership

There are pump companies with large revenues but low EBITA. They have the lowest price and quick delivery. They provide pumps for general service as opposed to severe, critical or unique. This latter group is considered high performance with a 2022 projected revenue of $40 billion.

Companies with high performance pumps and market niche leadership can achieve EBITA of 30%.

IDEX has made many strategic acquisitions over the years. Viking, Pulsafeeder and Warren Rupp were early acquisitions. There has been a steady stream of acquisitions recently. Many have complementary products such as flow control.

Abel is a recent acquisition. It manufactures highly engineered reciprocating positive displacement pumps. It is a market leader in several niches.

Richter is a market leader in PFA lined centrifugal pumps for the fertilizer industry.

Even the largest pump companies are niche leaders and do not participate in all the applications.

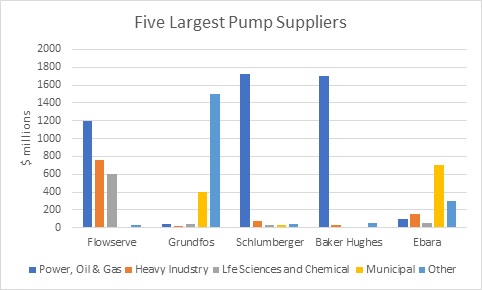

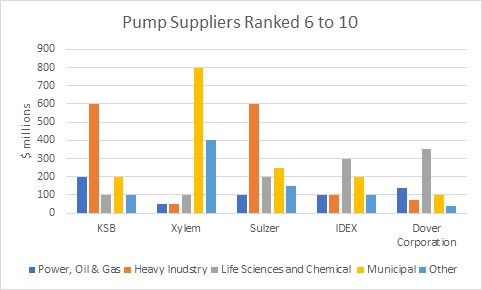

Below are two graphs showing sales of the top 10 pump companies.

Among the top 5 suppliers # 1 Flowserve has almost no revenues in municipal water and wastewater. The # 2 Supplier Grundfos has 50% of its revenues in municipal applications.

The second tier of pump companies 6 thru 10 also shows imbalance. More than 50% of Xylem revenues are in the municipal sector.

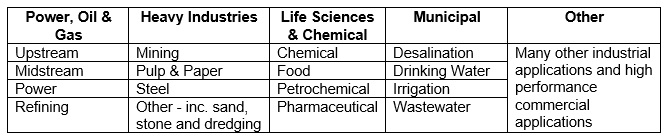

There are thousands of niches the major segmentation in the five areas.

Many of the recent acquisitions have added niche strength to the acquirers.

Termomeccania adds $200 million to Trillium pump sales. Much of it is in water infrastructure. Trillium is a First Reserve company.

Valmet-Neles bought Flowrox and boosted mining pump revenues.

Ingersoll Rand purchased Tuthill Pumps with sales of $25 million and also peristaltic pump company Albin. It had purchased Gardner Denver who in turn had purchased Oina in 2019. This added both application and product market niches.

Dover-Wilden has purchased Griswold pumps bringing the Wilden division pump sales to $140 million/yr. Griswold centrifugal pumps are used in petrochemical and pulp and paper.

Atlas Copco purchased Wangen with sales of $50 million and also IVS with sales of $5 million/yr. They provide geographical niche market leadership.

In Pumps: World Markets there are both market share and acquisition databases and continuous reporting of new developments.

More information on the world pump market report is found at: http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

Bob McIlvaine can answer your questions at 847 226 3491 This email address is being protected from spambots. You need JavaScript enabled to view it.