NEWS RELEASE November 2022

Increasing Pump Profits is a Chess Game Where the Opponents and Rules Keep Changing

Pumps are pawns on the Air, Water, Energy chessboard. Even grand masters benefit from intelligence systems. But what if the opponents and rules keep changing. The need for a comprehensive support program is much greater.

With the Russian aggression and a Chinese change, of course the rules are radically different than they were at the beginning of the year.

The opponents keep changing. One minute the opponent was another pump company and suddenly it is Ingersoll Rand or Valmet selling packages with pumps as just one of the deliverables

Keeping up with all this activity is a continuing and major challenge.

The acquisition strategy is ascendant as the path to higher EBITDA. The best moves of the pump pawn are determined by the more powerful pieces which are the combustors, mixers, Separators, and dryers. Other pawns such as the compressors, valves, and instrumentation have to be analyzed when they are in the competitor arsenal.

The queen is represented by solutions which can be complete systems or just IIOT packages.

Analyzing all the potential moves on the chessboard is important. You may just be moving the pump pawn, but the move needs to be coordinated with the scrubber knight.

Flue gas scrubber options include dry vs wet and sodium, limestone, or MgO. For a 1000 MW power plant the limestone option results in millions of dollars for pumps. It is twice as much for spray tower designs than for intensive scrubbing. But system cost, efficiency and other factors are involved.

The pumps may be the pawn, but their moves can be decisive. If a 70,000 gpm pump with high abrasion and corrosion resistance is available, the purchase of the limestone stray tower is more likely.

Scrubber system suppliers such as Mitsubishi, B&W, Andritz, BHEL, and Longking always include the scrubbers in their quotes.

Weir and KSB at one time were the only companies able to supply the very large limestone pumps. Weir is now Trillium. The company was acquired by First Reserve and earlier this year acquired Termomeccanica. So, Trillium can offer a new power plant the water and desalination pumps along with the slurry pumps.

In our October 2022 Pump Acquisitions and Market Shares we cover a number of major acquisitions. We are seeing changes in pump company ownership as high as 5% per year.

As startling as this may be the change in ownership in pump packages annually approaches $20 billion. This is 25% of the $ 80 billion/year of pump revenue.

Another way of explaining this is that pump companies are quickly becoming part of solutions companies with a $400 billion annual market.

It can be argued that this is an exaggerated view. Just because Ingersoll Rand is now in the top 100 pump companies, it does not necessarily follow that the combination of compressor and pump revenues will grow. The F.L Smidth/ABB consortium is pursuing the multi-billion dollar mining market. But it may have a modest impact on the slurry pump market share.

The takeaway is the total EBITDA can increase well above that attributable to the pumps

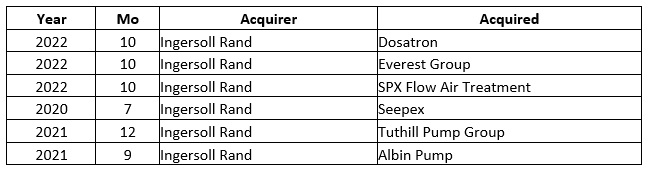

Here is the acquisition finder listing for Ingersoll Rand

These are just pump acquisitions and not all the IR acquisitions in the $950 billion air, water, energy space.

Dosatron is a leader in niche markets in agriculture and horticulture. Compressor/blower applications include on site power plants which generate CO2 needed for plant growth.

Everest gives IR geographic expansion in India for vacuum pumps and blowers.

The SPX Flow air treatment acquisition makes IR a market leader in treating compressed air. There are lots of filter replacements. So, the combined compressor/air treatment service opportunity is enhanced. The Seepex pump purchase expands the opportunity to sell progressive cavity pumps for food applications along with compressors for gases used in temperature control.

Tuthill makes pumps used in lubrication of compressors. Albin makes peristaltic pumps for agriculture and other applications to complement the other pump acquisitions.

Details on the pump report are found at: http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

The Growth Strategy Program discussion is featured at www.mcilvainecompany.com