NEWS RELEASE December 2018

Detailed Valve Market Share Forecasting

Detailed forecasting of market shares by valve type and industry are available. Valve forecasts are first segmented by control vs on/off and then by eight valve types and then by fifteen industries. This results in 240 forecasts for each supplier.

There are no authoritative sources for valve sales and certainly not for market shares. In fact since many valves are sold through distributors the supplier may not know how many of his valves are being purchased by a particular industry. However, it is well worthwhile to create approximate segmentations. A detailed analysis is much more valuable for decisions relative to R&D, sales, and manufacturing than a general forecast. Here is an example showing estimated 2018 Metso globe control valve sales.

| Metso | ||

| Globe - $ mil | ||

| Industry | On/Off | Control |

| Total | ||

| Chemical | 35 | |

| Electronics | ||

| Food | ||

| Iron & Steel | ||

| Metals | ||

| Mining | ||

| Oil & Gas | 43 | |

| Other Electronics | ||

| Other Industries | ||

| Pharmaceutical | ||

| Power | 40 | |

| Pulp & Paper | ||

| Refining | 39 | |

| Wastewater | 14 | |

| Water | ||

|

Metso 2018 Globe Control Valve Sales and Market Shares for Selected Industries |

|||

| Industry | Estimates of Metso 2018 Sales $ millions | World Valve Sales $ millions | % of total valve market |

| Chemical | 35 | 1162 | 2.0 |

| Power | 40 | 1739 | 2.3 |

| Refining | 39 | 1606 | 2.4 |

| Wastewater | 14 | 789 | 1.7 |

Estimated Metso sales range between 1.7% to 2.3 % for control globe valves in selected industries. Market shares in some other industry/valve type categories are just a fraction of 1%. Metso is the 7th largest valve supplier. Its total market share is 1.4%. Its share in control valves is higher than in on off valves.

Similar forecasts are available for the valve types shown in the following chart.

| Valve Type | On/Off | Control |

| Ball | x | x |

| Butterfly | x | x |

| Check | x | x |

| Gate | x | x |

| Globe | x | x |

| Plug | x | x |

| Other | x | x |

| Safety Relief | x | x |

The accuracy of the forecasts and value are a function of the amount of effort needed to make the forecasts.

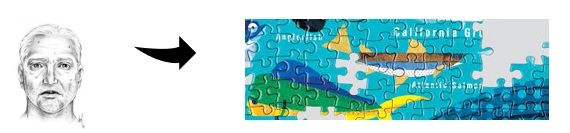

The output can be viewed as a range from a police sketch through a 240 piece puzzle. The least expensive is the police sketch. Some details are known but the rest have to be guesstimated. A victim is more likely to identify a perpetrator if shown a sketch that expands upon known details. The same is true of valve market analysis. The total market share estimate is best determined by aggregating the 240 components even if some of them are uncertain but minor.

The ideal output is the 240 piece puzzle where each of the components is known. This ideal is rarely achieved. One of the challenges is that each one of the 240 pieces is in turn something between a police sketch and a clear picture. The contours of the piece are created by drawing on knowledge of each industry, each purchaser in that industry, each process operated by each purchaser, valve type preferences, and other factors. For example there are component listings for power plants in the McIlvaine’s 42EI Utility Tracking System.

| Knife Gate Valves supplier: |

| startup | plant name | unit id | utility name | state | reagent | process | size MW |

| 2006 | Mitchell-AEP | 2 | American Electric Power | WV | limestone | wet | 816.3 |

| 2007 | Mitchell-AEP | 1 | American Electric Power | WV | limestone | wet | 816 |

| 2008 | Mountaineer | 1 | American Electric Power | WV | limestone | wet | 1300 |

Case histories and bidder specifications are provided in the valve intelligence system which is part of N028 Industrial Valves: World Market.

Since many valve supplier decisions rest on assumptions about the market and market share it is well worthwhile to invest in market share analyses even if it is only the equivalent of a police sketch. The more accurate analysis can be part of a program which also tracks purchases by each major prospect.

For more information contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 784 0012 ext. 122.