NEWS RELEASE SEPTEMBER 2015

$60 Billion O&M and Upgrade Opportunity for U.S. Fossil and Nuclear Power Plant Suppliers

The outsourcing option is increasingly appealing to power plants around the world. This represents a total available market (TAM) of more than $200 billion/yr. and a serviceable addressable market of over $60 billion. This is the conclusion reached in N043 Fossil and Nuclear Power Generation: World Analysis and Forecast published by the McIlvaine Company.

The U.S. potential is evenly split between upgrades and retrofits. Each has an annual potential of $30 billion. The upgrade potential is driven by regulations and politics. The prohibition on new coal–fired power plants dictates upgrading the existing ones. Life extension for nuclear plants is another driver.

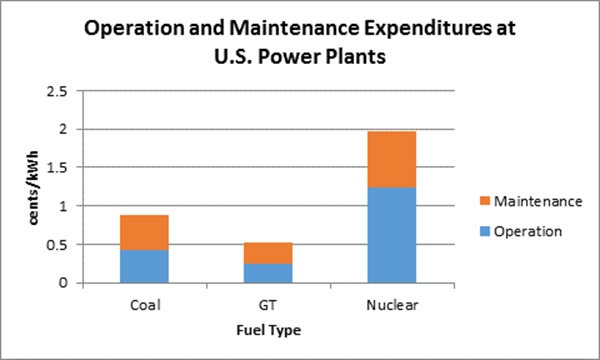

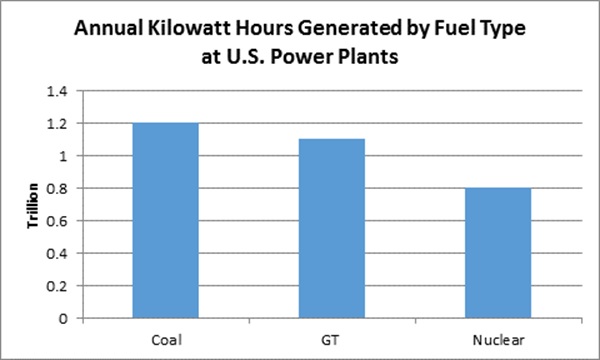

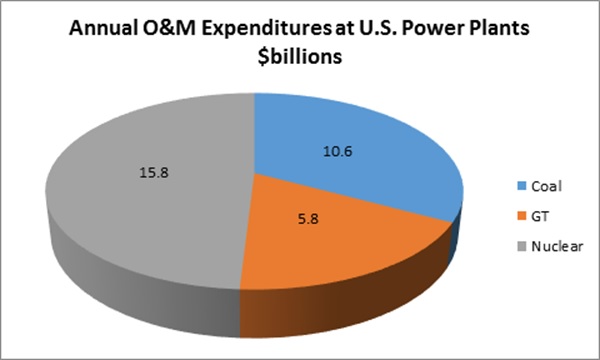

Relative to O&M the largest potential in the U.S. is in the nuclear segment with a TAM of $15.8 billion.

Coal-fired boilers represent an O&M TAM of $10.6 billon. Outsourcing of environmental and non-process functions is the easiest to justify. The outsourcing intensity can range from just utilizing one source to supply all the plant filters to a holistic contract to operate and maintain environmental facilities to meet all applicable regulations.

Babcock & Wilcox (B&W) is a good example of a company which has positioned itself to take advantage of this trend. It purchased a precipitator upgrade division from GE. It also acquired a continuous emissions monitoring company. CEMs measure key parameters of an operation. The Total Solutions provider can leverage remote monitoring to help operate the plant. CEMs also need regular servicing. So this provides an additional reason for continuing activity at the plant.

B&W is one of the largest suppliers of wet flue gas desulfurization systems. It entered the dry scrubbing business decades ago with the purchase of the Joy-Niro technology. Because of its O&M activities relative to boilers, it is well entrenched at many power plants. In the past system suppliers have failed to capture the market for replacement FGD nozzles, dust collector bags and other consumables.

One of the biggest markets is the supply of reagents. B&W has its toe in the water with the supply of chemicals to prevent mercury re-emission from the boiler. There is a very good justification for a Total Solutions approach to this effort. The effectiveness of the chemical is linked to the amount of chloride bleed from the system. The amount of bleed liquor affects pumps, scrubbers, clarification of wastewater and many other aspects which are best understood by a Total Solutions provider.

Nuclear and gas turbine O&M lends itself to Total Solutions to the same extent as coal-fired power plants. In some ways the air and water treatment is more critical. With gas turbines the performance of the intake filters to the turbine affects the combustion efficiency. The name Fukushima suffices to explain the importance of water treatment in the nuclear industry.

For more information on:

N043 Fossil and Nuclear Power Generation: World Analysis and Forecast, click on: http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/113-n043

N027 FGD Market and Strategies, click on: http://home.mcilvainecompany.com/index.php/markets/2-uncategorised/107-n027