SPX, SPX Flow and Celeros in the $750 billion AWE Market

There are 75,000 niches in the air, water, energy market. Copes Vulcan can achieve high EBITDA by concentrating on a tiny niche such as turbine bypass valves. Seital can concentrate on disk centrifuges for breweries.

Sedimentation/Centrifugation Revenues $ billions

Seital has only a 2% market share of the food disk centrifuge market but the share increases in the dairy and brewery segments where Seital concentrates. It has a new direct drive model which is anticipated to increase market share.

Niche growth is the key to increased profits. Homogenization of certain foods improves their taste. APV is not only a leader in this growing niche but with a new water recycling system is actually expanding the potential.

Deltech and Dollinger are pursuing the purification of hydrogen and other gases as part of the initiative to reduce greenhouse gases.

With the combination of threats to nuclear power plants plus increased demand due to the Russian invasion, the Clyde Union nuclear reactor pump system provides a safe shutdown. It expands the opportunity from just a product to a system sale. The brands referenced above are divisions of SPX Flow and Celeros. All at one time were part of SPX.

SPX will be used as an example of the benefits of the comprehensive AWE Market Guide which addresses

- Pursuit of multiple complementary products

- 75,000 niche markets of $10 million each.

- Niches which maximize profits

- Competitor strengths

- Acquisition or organic growth routes

SPX is a good example to show the importance of the guide. Over the past 30 years some 50 companies have become at least temporarily part of what are now three companies.

- SPX

- SPX Flow

- Celeros

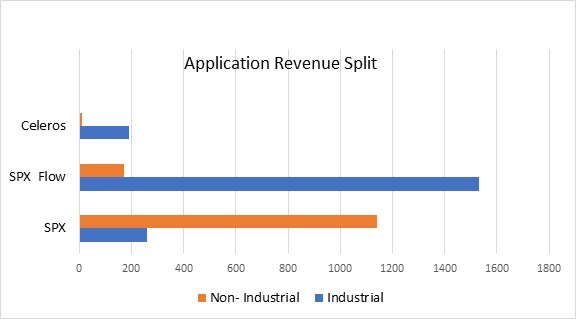

McIlvaine is forecasting an Air, Water, Energy market of $750 billion in 2022. Of this total $ 400 million is industrial process and $350 million is discrete or non-industrial.

SPX has two main divisions HVAC with expected 2022 revenues of $900 million and Measure and Detection with expected revenues of $500 million. Only about 18% of the anticipated revenue will be industrial.

SPX Flow has anticipated revenues of $1.7 billion of which 90% is expected to be in industrial processes.

Celeros revenues of $200 million are anticipated with 95% in industrial process.

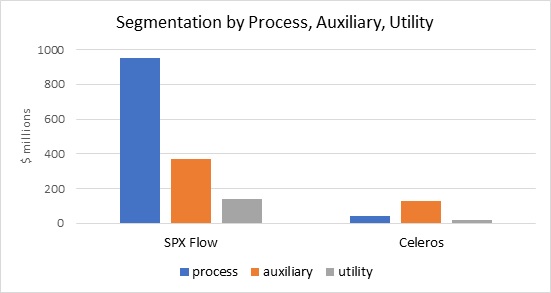

Many of the acquisitions by the various SPX combinations have been predicated on supplying solutions. A dryer, evaporator, mixer or cooling tower needs auxiliaries such as valves, filters, pumps, hose, couplings, fittings, measurement devices, controls and guidance. Auxiliaries are also needed for utilities such as water and compressed air. But these auxiliaries are generally unaffected by the processes.

Certain utilities such as ultrapure water, cleanroom HVAC and air pollution control are specific to the processes.

Companies such as Andritz, GEA, and Alfa Laval are major suppliers of valves and pumps but the AWE process equipment comprises 70 % of the total. Process auxiliaries are 25% and non-process auxiliaries are 5%.

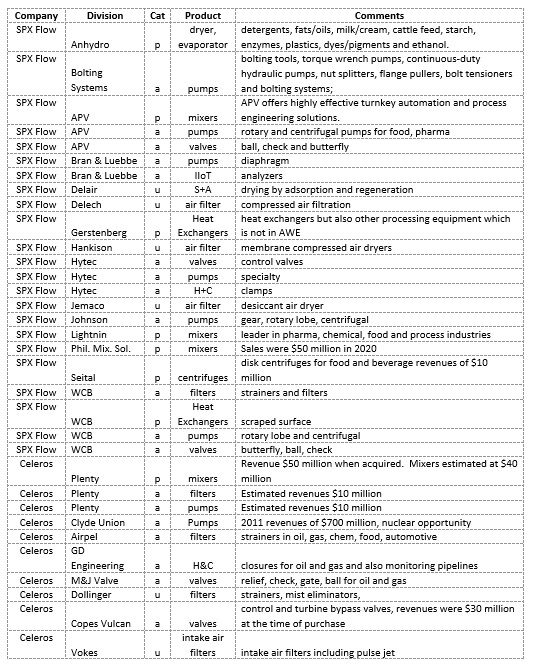

The following chart identifies the products for both SPX Flow and Celeros. The first two columns identify the company and brand. The third column has a “p” if the brand is process equipment, an “a” if it is an auxiliary an a “u” if it is a utility.

Lightnin with the addition of Philadelphia Mixing Solutions is a market leader in the process segment. Anhydro and APV also add to a total of over $900 million in anticipated 2022 process revenues.

The high ratio of process to auxiliary shows a big potential for total solutions with guide, control and measure.

The AWE Market Guide has an umbrella report, individual reports, and monthly Acquisition and Market Share Newsletters.

http://home.mcilvainecompany.com/index.php/48-uncategorised/1732-comprehensive-growth-strategy

Acquisition news remains relevant for decades. The guide leverages this data with database and links to past articles. Here some relevant SPX articles.

SPX Flow/Celeros Articles

SPX Flow

SPX Flow Sold to Lone Star Funds for $ 3.8 billion

At the beginning of 2022 SPX FLOW, Inc. entered into an agreement to be acquired by an affiliate of Lone Star Funds ("Lone Star") in an all-cash transaction valued at $3.8 billion, including the assumption of debt.

SPX Flow 2021 Revenues Up 13% to $1.529 billion

Revenues in 2021, increased 13.2% to $1,529 million, driven primarily by (i) an increase in organic revenue and, to a lesser extent, (ii) revenues associated with businesses acquired in the third quarter of 2020 and first and second quarters of 2021 and (iii) the weakening of the U.S. dollar against various foreign currencies during the period. The increase in organic revenue was driven primarily by higher volumes of revenue from (i) Nutrition and Health segment components and aftermarket products and, to a lesser extent, systems, and (ii) broad-based strengthening across most short-cycle Precision Solutions segment product lines, attributable primarily to increased demand due to reduced adverse effects of the COVID-19 pandemic.

Income before Income Taxes in 2021, increased from $49.5 to $119.9. Among other items, the increase in pre-tax income was due primarily to the effects of an increase in segment income and, to a lesser extent, increases in various components of other income, net, reductions in interest expense, and the effects of recognition of a gain on the sale of the primary assets of a product line (in 2021) and a loss on the sale of a business (in 2020).

Segment Performance

( the following are excerpts from the 2021 Annual Report)

Nutrition and Health: The Nutrition and Health reportable segment operates in a regulated, global industry with customers who demand highly engineered process solutions. Key demand drivers include dairy consumption, emerging market capacity expansion, sustainability and productivity initiatives, customer product innovation and food safety. Key products for the segment include homogenizers, pumps, valves, separators and heat exchangers. We also design and assemble process systems that integrate many of these products for our customers. Key brands include APV, Gerstenberg Schroeder, Seital and Waukesha Cherry-Burrell. The segment's primary competitors are Alfa Laval AB, Fristam Pumps, GEA Group AG, Krones AG, Südmo, Tetra Pak International S.A. and various regional companies.

Precision Solutions: The Precision Solutions reportable segment primarily serves customers in the chemical, air treatment, mining, pharmaceutical, marine, infrastructure construction, general industrial and water treatment industries. Key demand drivers of this segment are tied to macroeconomic conditions and growth in the respective end markets we serve. Key products for the segment are air dryers, filtration equipment, mixers, pumps, hydraulic technologies and heat exchangers. Key brands include Airpel, APV, Bolting Systems, Bran+Luebbe, Deltech, Hankison, Jamix, Jemaco, Johnson Pump, LIGHTNIN, Philadelphia Mixing Solutions, POSI LOCK, Power Team, Stelzer, Stone and Uutechnic. The segment's primary competitors are Alfa Laval AB, Chemineer Inc., EKATO, Enerpac, IDEX Viking Pump, Ingersoll Rand Inc., KSB AG, Lewa, Parker Domnick Hunter, Prominent and various regional companies.

Acquisitions

As part of our long-term strategy, we plan to evaluate potential acquisitions that (a) are complementary to our existing products and services, (b) increase our relevance to customers and our capabilities to serve them, (c) expand our global capabilities and accelerate our localization strategy and (d) expand our end market reach.

During the first quarter of 2021, we completed the acquisition of approximately 98% of the issued and outstanding shares of Plc Uutechnic Group Oyj ("UTG Mixing Group"), a former public company and producer of various mixing solutions for the chemical, food, metallurgical and fertilizer, environmental technology, water treatment and pharmaceuticals markets, for a cash purchase price of $38.0. The remaining 2% of issued and outstanding shares were acquired during the second quarter of 2021, with nominal impact to the total cash purchase price. UTG Mixing Group generated approximately $19.6 in revenues from the acquisition date through December 31, 2021, and its results are reported in our Precision Solutions reportable segment.

During the second quarter of 2021, we completed the acquisition of Philadelphia Mixing Solutions, Ltd. ("Philadelphia Mixing"), a manufacturer of in-tank mixing solutions and provider of various technical services and field support, for a cash purchase price of $64.3. Philadelphia Mixing generated approximately $31.8 in revenues from the acquisition date through December 31, 2021, and its results are reported in our Precision Solutions reportable segment.

Divestitures

We periodically review and negotiate potential divestitures in the ordinary course of business, some of which are or may be material. As a result of this continuous review, we initiated a process in 2019 to divest a substantial portion of our former Power and Energy reportable segment, excluding the Bran+Luebbe product line (collectively, the “Disposal Group”). In connection with this initiative, we narrowed our strategic focus by separating our process solutions technologies, comprised of our Nutrition and Health and our Precision Solutions reportable segments, plus the Bran+Luebbe product line, from our flow control application technologies, comprised of the Disposal Group. Given the specific capabilities that are unique to each category of technologies and businesses, our further intent was that each business would, through a process of separation, be positioned to improve its respective service to customers through the narrowing of such strategic focus.

SPX Buys Philadelphia Mixing Solutions

In April 2021 – SPX FLOW, Inc. acquired mixing solutions provider Philadelphia Mixing Solutions, Ltd. from Thunder Basin Corporation, an affiliate of Wind River Holdings, L.P. The all-cash transaction was valued at $65 million.

Based in Palmyra, Pennsylvania, Philadelphia Mixing Solutions employs approximately 150 people and generated nearly $50 million in revenue in 2020. The company has more than six decades of industry experience in multi-industry mixing products and service,

The Philadelphia Mixing Solutions team’s proven track record of customer focus, technical expertise, quality and on-time delivery closely aligns with our own strategy, culture and growth priorities,” said Marc Michael, President and CEO of SPX FLOW. “The combination of these two great mixer businesses will create new opportunities for synergy and growth, while also broadening our portfolio of comprehensive mixing solutions for customers in the chemical, water & wastewater, petrochemical, pharmaceutical, and nutrition & health markets.”

In 2012 SPX Bought Seital

SPX acquired Seital S.r.l, a leading supplier of disk centrifuges (separators and clarifiers) to the global food and beverage, biotechnology, pharmaceutical and chemical industries..

Founded in 1983 and based in Santorso, Italy, Seital has approximately 50 employees and exports its products to more than 80 countries. Seital's disk centrifuges (separators and clarifiers), rotary brush strainers and hydrocyclones, and standardizers are used primarily by customers in the food and beverage industry. Applications include dairy, wine, beverages and essential oils, as well as oils and fats.

SPX Buys United Dominion for $1.83 billion in 2001

SPX Corp purchased United Dominion Industries Ltd. for $954 million in stock plus the assumption of $876 million in debt, bring the total transaction value to $1.83 billion.

United Dominion Buys Bran & Luebbe in 1997

United Dominion Industries, Ltd., parent company to Waukesha Cherry-Burrell, has signed a definitive agreement to purchase Bran + Luebbe, a manufacturer of precision metering pumps, analyzing equipment, and integrated blending systems for a broad range of process industries.

Bran + Luebbe enjoys a reputation for high-quality metering devices. Its pump line includes dosing pumps for high precision control of processed liquids and triplex pumps used in handling liquids under extreme conditions.

The company's analyzer line includes continuous flow analyzers for laboratory analysis of large number of samples as well as process analyzers that can be positioned "in-line" to control liquids, pastes, and powders.

Bran+Luebbe also integrates its metering equipment and analyzers into complete systems for metering and blending.

Worldwide markets include the chemical, petrochemical, pulp and paper, pharmaceutical, oil and gas, and food and beverage industries.

UDI Flow Technology Sales in 1999 were $1 billion

Flow-technology products manufactured by WCB and seven other subsidiaries represent the parent company’s largest business segment. In 1999, these products accounted for nearly half of UDI’s $2 billion-plus sales.

Celeros

SPX Flow Sells Power and Energy for $400 million in 2020

SPX FLOW, Inc. sold its Power and Energy segment to funds managed by affiliates of Apollo Global Management, Inc. with net proceeds totaling approximately $400 million after adjustments, fees and taxes. 2021 sales were estimated at $170 million

By completing the sale of its Power and Energy business, the company's exposure to oil and power generation is de minimis.

SPX Bought Plenty in 2001

SPX acquired the assets and the ongoing business operations of the Plenty Group from Smiths Group plc.

Plenty had annual revenues of more than $50 million.

Plenty is a global manufacturer of mixers, pipeline products, pumps and filters used in a range of applications servicing the oil and gas, chemical, water and other industries. Headquartered in Newbury, UK, Plenty has operations throughout the world.

In 2000 SPX Purchased Copes Vulcan with Revenues of $30 million

SPX - DeZurik completed the acquisition of the US and UK assets of Copes-Vulcan.

Based in Lake City, Pennsylvania, and Winsford, England, Copes-Vulcan is a manufacturer of control valves, desuperheater and turbine bypass systems, and associated equipment for severe duty and general service process market requirements worldwide. Copes-Vulcan has annual revenues of approximately $30 million.

Copes-Vulcan has been providing valves to the power, pulp and paper, water, oil and gas, and petrochemical industries since 1903

SPX Sells Dezurik

SPX Corp. has sold the remaining portion of its DeZurik product line to Sartell Valves Inc., a water and wastewater-treatment company.

In 2011 SPX Bought Clyde Union Pumps for $1.25 billion

SPX acquired Clyde Union for a price of £750m ($1.25bn) – £700m

With projected 2011 revenues of £400 million, ClydeUnion Pumps operates eight manufacturing facilities and 25 service centres worldwide with approximately 2000 employees.

ClydeUnion Pumps was formed by Clyde Blowers Capital chairman and chief executive Jim McColl out of two major acquisitions – the £48 million purchase of the former Weir Pumps business in Cathcart, Glasgow, Scotland from the Weir Group in 2007 and the acquisition of Union Pumps from Textron Inc in 2008.

One of the growth markets is nuclear pumps. This is due to the Russian invasion of Ukraine. The CUP-TWL is one of the few proven technologies that can currently meet the demanding requirements of a station black out scenario, offering both existing and new nuclear power sites a solution to improve the safety and integrity of their plant.