Pump Purchaser Direct Sales Program Candidates

The sea change in the market for pumps will require prioritizing corporate prospects and then initiating a program for each on a progressive basis? Which is the best first target? Here are the criteria.

Size. The top 3000 purchasers are buying most of the high-performance pumps (performance is more important than initial price). Their average purchases are $7 million. However the top 50 each purchase over $50 million per year. The largest is Sinopec with purchases of over $800 million per year. Gaining a market share of 10% with any of these 50 companies could therefore add revenues of $5 to $80 million per year. So any of the top 50 prospects would warrant significant effort.

| Pump Purchases in 2018 | ||||

|

Company |

Type |

Corporate Location |

Industry |

Pump Purchases |

| Sinopec | Operator | China | Oil & Gas | 607 |

| Sinopec | Operator | China | Chemical | 108 |

| Sinopec | EPC | China | All | 90 |

| Sinopec | Total | China | Multiple | 805 |

| NTPC | Operator | India | Power | 224 |

| EDF | Operator | France | Power | 220 |

| Eskom | Operator | South Africa | Power | 192 |

| Bechtel | EPC | U.S. | All | 320 |

| BASF | Operator | Germany | Chemical | 157 |

Product Fit. There are a number of different pump types. Each is available in multiple materials depending on the service. A pump company specializing in exotic alloy pumps would want to focus on industries such as chlorine manufacture where exotic alloys are required. Here are pump purchases for the top chlorine manufacturers.

| Chlorine Producer Pump Purchases $ millions - 2018 |

||

| Company | % | $ |

| Total | 100 | 300 |

| Olin | 6 | 18 |

| Oxy | 4 | 12 |

| Formosa | 3 | 9 |

| Dow | 3 | 9 |

These are just purchases for chlorine service. All these manufacturers also purchase pumps for processes using chlorine, as well as for power, water, wastewater and cooling. For these specialized applications it is possible to achieve high market shares. A 30% market share at one company can result in revenues of more than $5 million/yr.

There is lots of differentiation in materials to withstand corrosion, temperature and erosion. Manufacturers are willing to spend whatever is necessary to minimize leaks of dangerous acids. The company which can provide the lowest total cost of ownership validation (LTCOV) can capture a large market share.

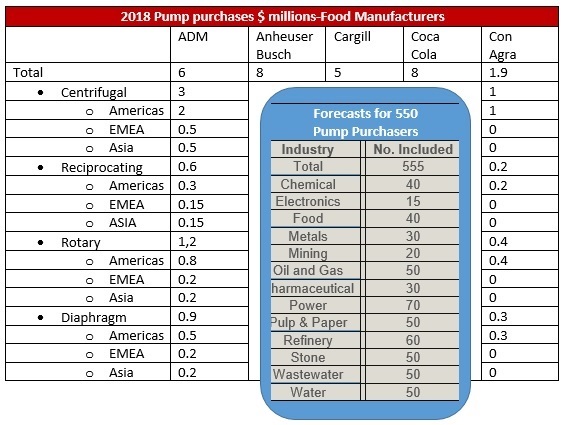

Sales Fit. The corporate office is likely to be the primary decision maker but local sales and service will also be important. If you have strong sales and service support in the Americas you will want to consider that the second largest purchaser in the food industry (ADM) buys 66% of its pumps for the Americas region.

The McIlvaine Company has a 5-step customer based market program which is explained at www.mcilvainecompany.com

Forecasts of pump purchases for hundreds of pump companies are included in N019 Pumps World Market

For answers to your questions contact Bob McIlvaine at 847 784 0012 ext. 112 or This email address is being protected from spambots. You need JavaScript enabled to view it..