NEWS RELEASE June 2021

Increasing Pump and Valve Profits Through LTO Perception

McIlvaine has one million current forecasts for pumps and valves. They are divided into general, severe service, critical service and unique service.

Only 40% of the total $120 billion in revenues is associated with general service. For these products, the profitability is largely a function of cost of sales. It is difficult to persuade the purchaser that a superior product is worth an additional investment.

For this segment traditional marketing to achieve name recognition is effective.

However, for the $70 billion remaining market the profitability potential is directly proportional to the perceived total cost of ownership. The purchaser is willing to pay more initially if the life cycle costs are lower.

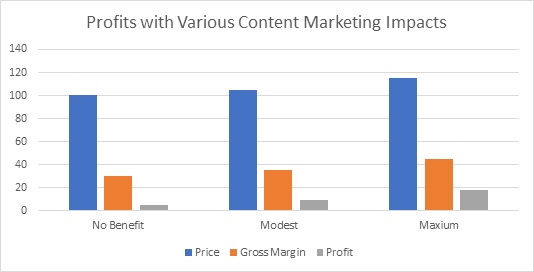

The new emphasis on content marketing is motivated by the large increase in profitability which can be achieved by persuading the customer that a higher price can be justified. However, persuading the customer of the superiority is challenging.

Whether it is in oil and gas, mining or pharmaceutical applications the process and other factors have to be identified in order for a superiority claim to be creditable. These factors are being identified in a new program from McIlvaine http://home.mcilvainecompany.com/index.php/47-news/1655-nr2643

Some pump and valve companies are generating profits below 5% of sales. Others are approaching 20%. The difference in the high performance/ unique segment is $10.5 billion.

If sales volume can be maintained at higher prices, the impact on profits is direct. So for a company with only a profit of 5% on sales a price rise of 5% with sales not being negatively impacted doubles profits. The content marketing investment would be less than 1% of sales. With a maximum effort sales could rise 15% and profits could rise to 18% of sales for a 360% increase. This would be with a content marketing expense of 2% of sales.

This direct impact on profits is a big motivator. It is not possible unless the supplier not only has the lowest total cost of ownership but can so persuade the customer.

There is a cost associated with this persuasion. It can be less than 1% of sales in the most favorable circumstances. The investment is relatively fixed. It will cost just as much to persuade customers in a small niche as ones in a large one.

These niches need to be measured in terms of total profit potential.

- The first step is to determine the Total Available Market (TAM)

- The second step is determine those applications which have the biggest TAM but also where the supplier can demonstrate lowest total cost of ownership (LTCO)

- Once the targets have been ranked the budget can be set for content marketing and persuasion.

Smart Pumps and Valves:

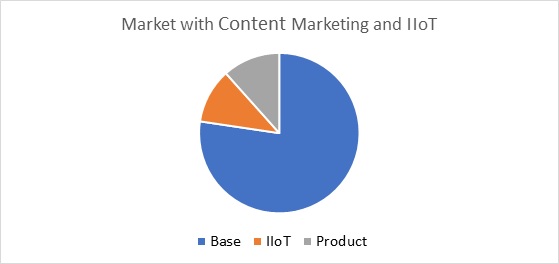

Remote monitoring and control will also contribute to reducing total cost of ownership. Suppliers of high performance/unique valves and pumps have knowledge which can be leveraged to improve the control and maintenance of the product.

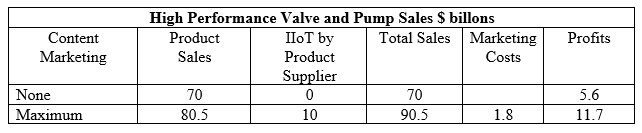

Content marketing will increase the total market due to higher pricing. It will also add monitoring and control revenues. The opportunity can be viewed at the global level.

The pursuit of the lowest total cost of ownership and communication through content marketing could raise profits by 209% in the high performance/unique valve and pump market.

More information on Content Marketing is found at www.mcilvainecompany.com on the lower left side of the home page.

More information on the Valve Market report is found at http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

More information on the Pump Market report is found at http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

Bob McIlvaine can answer your questions at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.