NEWS RELEASE April 2024

Continuous Solid Liquid Separation is a $20 Billion Market

Continuous filtration and separation involves products that can be cleaned. This includes centrifuges, filter presses belt filters, clarifiers, dissolved air flotation, and similar devices. The two main goals are either purification of liquids or recovery of solids. In both cases the product may be valuable, or it may be a function of waste treatment.

These devices are typically employed to remove particles from one to 200 µm. Smaller particles are removed in reverse osmosis, ultrafiltration, and microfiltration systems. Particles larger than 200 µm are re-removed by screens and other devices.

There is also a $20 billon cartridge filter market which is treated separately. Cartridges are not cleanable and therefore used when the particulate loading is low. Taste and odor can be impacted by addition of diatomaceous earth or activated carbon.

The filtration devices are separated by their ability to obtain dry solids, for example in municipal wastewater treatment. Belt filter presses can bring the solids content up to 20% or so. Centrifuges can raise the solid content to 30%. Filter presses can raise the solids to a much higher level, the choice depends on how these sludges are going to be disposed. If the sludge is going to an incinerator, the drier, the solids, the more efficient the process will be.

There are two types of centrifuges, disk and decanter. The decanter centrifuges are a workhorse in wastewater treatment, but both types are heavily used in food processing. Alfa Laval and GEA are both large centrifuge manufacturers. But their primary revenue comes from food and chemical processing plants in which the centrifuges play a key role.

Minerals processing is essentially a series of separation steps using centrifuges clarifiers, and filters along with dryers and other process equipment. Mining is a $300 million market. Gold, lithium and copper extraction involve a series of filtration and separation processes.

This market is very international. Some of the biggest producers of ores are small countries such as Chile for copper and Australia for lithium, etc.

Food processing is also distributed around the world without regard to the GDP of the countries in which the products are produced. For example, Brazil and India would be major cane sugar producers.

The market is distinguished by a large number of unique applications such as in the food and chemical industries. Each application requires its own value proposition. A filter for chocolate is unique because of the viscosity. It has to be pursued separately. Unique designs are required. Filter presses capture the product from many liquids in the chemical industry, but each is a unique application impacted by corrosion, particle characteristics and other factors. The opportunities should be addressed separately.

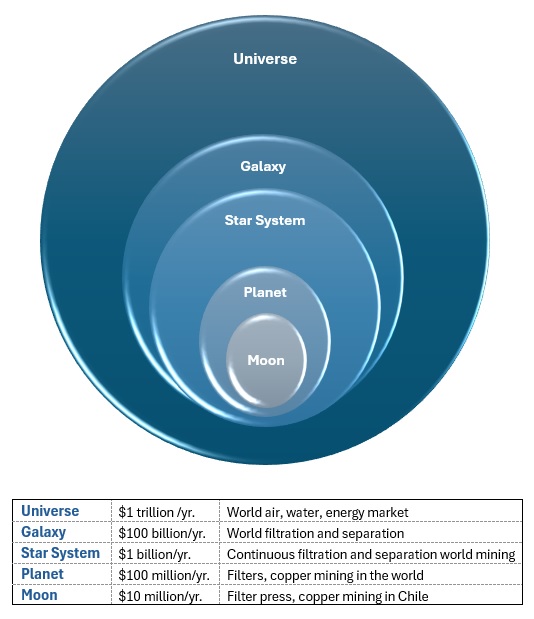

The continuous solid-liquid separation market can be viewed as a $20 billion combination of stars in the filtration galaxy. It includes hundred-million-dollar planets with $10 million moons. Each $10 million moon opportunity deserves its own value proposition. For example, the filter presses for copper mining in chili provide a very unique set of factors on which decisions will be made.

The $20 billion continuous filtration market includes stars representing, mining, chemicals, petrochemicals, food, oil and gas, refining, pulp and paper, pharmaceuticals, iron and steel, municipal water, and municipal wastewater. The Mcilvaine Company contends that the most profitable market is an aggregation of the moons which can generate 30% EBITA and 40% market share.

The solid liquid separation market

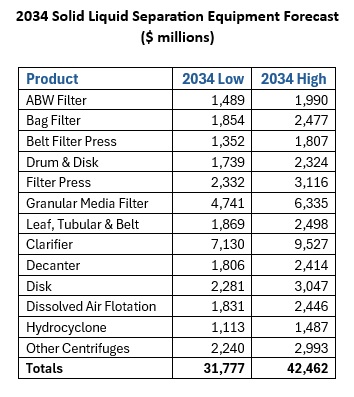

The market for this equipment has been segmented by the individual products, each of which needs to be addressed separately and has a potential different growth rate. The present market is $26 billion and will grow to between $31 billion and $42 billion in 2034.

Companies are market leaders in one or two segments. make large profits in one product area and others make large profits and other product areas, Alfa Laval and GEA are market leaders in centrifuges.

Andritz is a participant in the largest number of individual product areas.

The lunar landings for products in specific markets and locations have to be strategically analyzed. For example, to succeeded in FGD in India you need to be successful with NTPC.

The use of dissolved air, flotation results in recovery of paper and the avoidance of virgin product.

For success in the municipal wastewater treatment industry in the United States attention has to be paid to the consulting engineers, who are many cases making the decisions.

The Galactic strategy depends on the details such as the equivalent of lunar landings for the smaller opportunities.

A $1 million order may not be worthwhile pursuing in its own right, but if it can lead to successful installations and use by larger companies, it is a successful strategy.

Another opportunity is in the pharmaceutical manufacturing industry, where a lemon can be turned into lemonade, single use centrifuges and fillers, are being used for bio, bio pharmaceuticals, particularly cell and gene therapy. An alternative is to supply a duplicate centrifuge or filter. One can be cleaned while the other is in operation.

Most companies are either in the solid liquid separation or they're in filtration with throwaway type filters.

One company that has expanded into the solid liquid separation is the filtration group with the acquisition of Amafilter.

The needs in municipal wastewater treatment are changing. The amount of municipal waste that is being used for fertilizer is being reduced. whereas the amount that's being converted to biogas or is used in waste to energy plants is increasing so this puts increased emphasis on dryer, filtration processes, such as the filter press.

Another growing application is dredging due to the fact that particularly in the United States there are a number of waterways which need to have the sediment removed, but in a manner that does not create additional pollution.

Zero liquid discharge is another growing opportunity where a plant recycles all the water rather than discharge wastewater and this requires final dewatering.

Synthetic sands for hydraulic fracturing are another growing market. natural sands were used in the United States, but it was found that using local sands near the fracturing sites was a better option, and particularly since natural sands are running out. This opportunity is now expanded to Argentina and China and other areas that are pursuing hydraulic fracturing, including even Saudi Arabia, where you would think there was plenty of sand, but actually you need a synthetic sand rather than what's locally available.

Recommendations along with detailed forecast are available from the McIlvaine Company. For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.