The Combust, Flow and Treat Business Program to Navigate the Sea Change in the Market

Published by the McIlvaine Company

June 2018

Table of Contents

PROGRAM OVERVIEW

- Market Program based on Reliable Forecasts of Purchases by Each Customer

- Forecasting your Sales Opportunity for Each Customer, Large or Small

- Cost/Benefit of Individual Prospect Forecasts

PROGRAM DETAILS AND BENEFITS

- Navigating the Sea Change in the Combust, Flow and Treat Markets

- Improving the Right-to-Win Ability for High Performance Flow Control and Treatment Products

- The Power of Innovation for Suppliers of Combust, Flow and Treat Products

- Lowest Total Cost of Ownership Validation (LTCOV) will be Essential for High Performance Combust, Flow and Treat Products and Services Success

DIRECT SALES PROGRAM CANDIDATES

- Pump Purchaser Direct Sales Program Candidates

- Wastewater Direct Sales Program Candidates

- Power Industry Direct Sales program Candidates

- Semiconductor Direct Sales Program Candidates

- Chemical Industry direct sales program Candidates

- Pharmaceutical Industry Candidates for Direct Sales ProgramsThis email address is being protected from spambots. You need JavaScript enabled to view it.

Market Program based on Reliable Forecasts of Purchases by Each Customer

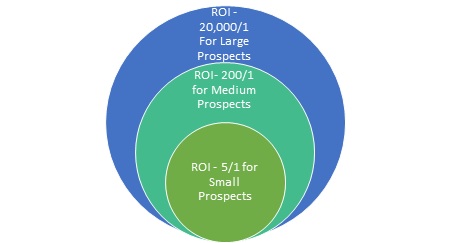

Reliable forecasts can be obtained for each of 50,000 purchasers of combust, flow and treat (CFT) products and services. The Total Available Market (TAM) forecasts for specific products e.g. valves, pumps, cartridges, treatment chemicals, membranes, dust bags etc. can be purchased for as little as $1 per prospect. The average ROI will be 200 to 1. This is based on a yearly opportunity of $ 200,000, an increase in market share of 0.5% and a profit margin of 10%. The ROI for the very largest customers will be 20,000 to 1 whereas the ROI for the small customers will be just 5 to 1.

A program starting with the prospects with the highest ROI can be progressively expanded to eventually cover all customers.

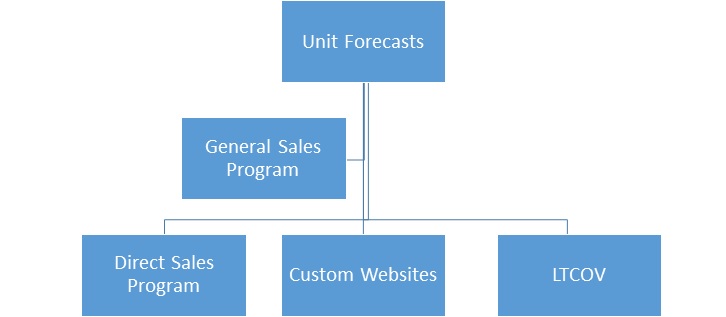

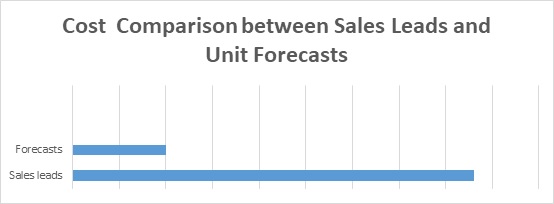

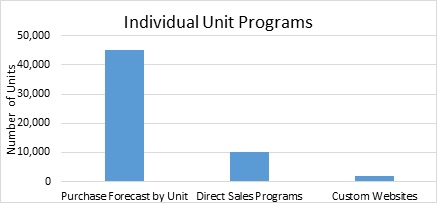

The purchase forecasts for all customers is the first step in a complete business program to address the sea change in CFT market. There will be a high ROI achieved with direct sales programs for larger prospects. Custom websites can easily be justified for top prospects.

If you sell high performance CFT products you will benefit from a business program which is oriented around specific customers and not sales leads. . If you start with the low hanging fruit the program will be self-supporting. Here are the details.

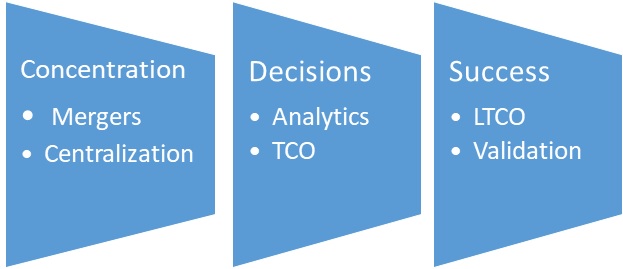

Concentration: Large CFT purchasers are expanding internationally and locating production sites where there are growing markets. These corporations are also centralizing decision making through the corporate staff.

Decisions: Remote monitoring and data analytics provide the basis for decision making based on total cost of ownership.

Success: Suppliers who develop products with the lowest total cost of ownership (LTCO) and can provide ongoing validation (LTCOV) will be the most successful

More than half CFT products are or will be considered high performance (initial price is less important than performance). The Industrial Internet of Wisdom (IIoW) is empowering the corporate staff to validate the lowest total cost of ownership for each product in a process in each plant.

The challenge will be to persuade a knowledgeable corporate staff that the supplier’s product has the lowest total cost of ownership for a specific process. This in turn requires knowledge of the customer’s processes and a mechanism to convey this to the decision makers.

These forecasts can be used as the primary navigation tool. They can replace sales leads as a basis for focusing the sales and marketing efforts.

The second stage of the program can be direct sales programs for the larger customers. For the top prospects this will include custom websites. A separate but equally valuable initiative will be creation of the LTCOV for each product in each application.

Forecasting your Sales Opportunity for Each Customer, Large or Small

Thanks to digital technology it is now economically possible to forecast the market opportunity for each potential customer for each type of combust, flow and treat product. Traditionally the market program has been based on sales leads. If the customer is interested in a general performance product such as small valves for a fresh water line, the order may be placed by a contractor and the lead time from project inception to sale could be a matter of weeks. The purchasing agent or project manager may be the sole decision maker. Here is how marketing programs are set up around sales leads.

High performance products such as a severe service valve or a cross flow membrane filter are purchased as a result of initiatives which will span months or years. There is often a preferred bidders list. Decisions are made based on total cost of ownership more than on initial price. Most purchases are to replace existing products or by owners who have products of this type in operation.

Some general performance products are now being purchased as if they were high performance. For example if a supplier of small fresh water valves offers a package which includes remote monitoring and replacement of all the valves in the corporation, his offering will need the time and scrutiny that high performance products receive.

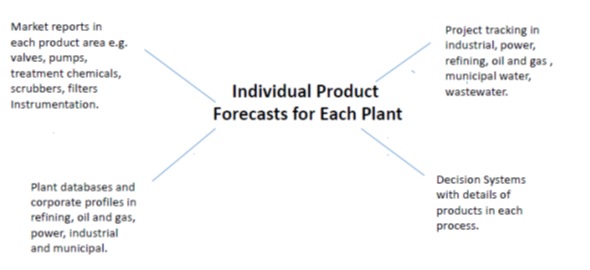

For high performance products, the most valuable estimate is the yearly purchase opportunity for a product at each plant and for the total corporation. Since there may be 100,000 plants who are potential customers this would have been an impossible quest before the digital age. Now it is economically attractive to make these determinations. With the Industrial Internet of Wisdom and a number of services available from McIlvaine product forecasts can be made for each plant.

McIlvaine has many market reports each of which projects revenues for each type of product in each industry. The purchases for the top 100 customers are also included. Details on each report are shown at http://home.mcilvainecompany.com/index.php/markets.

Forecasts for all the plants are created based on McIlvaine databases. Plant databases and corporate profiles as well as tracking systems for individual projects are included in a number of services described at http://home.mcilvainecompany.com/index.php/databases.

The ability to accurately forecast the opportunities for specific products is contingent on understanding the processes and potential changes to those processes. This data is extracted from Decision Systems at http://home.mcilvainecompany.com/index.php/decisions

Cost/Benefit of Individual Prospect Forecasts

McIlvaine already has the production rates for hundreds of thousands of plants but also the details on the processes at each plant. For decades McIlvaine has been gathering important information on factors such as the cost of electricity in each country and the electricity consumption for specific products in specific processes.

Most CFT products have life spans of less than 10 years. This means that the largest market is in replacement and not new greenfield plants. Therefore the purchases for each plant can be accurately predicted. A sales program based on reliable purchase forecasts instead of sales leads is better and much more cost effective.

Navigating the Sea Change in the Combust, Flow and Treat Markets

The industrial internet of things (IIoT) will greatly increase opportunities but also the threats to suppliers of combust, flow and treat (CFT) products. The opportunities include larger markets and higher margins. The threats include the insertion of third parties between the supplier and his traditional customers. The process management system supplier will share profits with the CFT suppliers based on the application and product knowledge each has. Suppliers who leverage the Industrial Internet of Wisdom (IIoW) to empower IIoT will be the beneficiaries. Leveraging will require new approaches.

| New Approaches to Succeed in the IIoT World | ||

| Subject | Old Approach | New Approach |

| Market Research | Top down periodic general guesstimates | Bottoms up forecasts with detailed continuously updated analyses |

| Sales Initiation | Uncoordinated Sales Leads | Identification and pursuit of large prospects |

| Sales Persuasion | Sales Experts | Application Experts |

| Selection Criteria | Price and Service | Total cost of ownership (TCO) and service |

| Location of Specifiers | Individual Plants | Corporate staff with TCO data |

| Acceptance of New and Better Products | Slow | Rapid |

| Collaboration with Other Suppliers | Haphazard | Important to Success |

| Decision Process | Not Systematic | Decision Systems |

| Subject Matter Experts (SMES) | Lots of SMES but not well utilized | Subject Matter Ultra Experts (SMUES) contributing to and improving decision systems |

| Remote Monitoring | Unusual | Prevalent |

| Data Analytics | Unusual | Prevalent |

| TCO Analyses | Expensive and Inadequate | Voluminous and Continuous |

| Third Party Operation | Minor | Major |

| Component Supplier Role | Initial Sale, Spare Parts, Service On Demand | Cloud Based Continuous Involvement |

McIlvaine has a complete program to help CFT companies navigate the sea change in the industry. The market structure and opportunities are analyzed in N031 Industrial IOT and Remote O&M.

The specific opportunities at the 500 largest purchasers are included in each of the product market reports MARKETS

Detailed programs to pursue specific markets are included in DATABASES

Improving the Right-to-Win Ability for High Performance Flow Control and Treatment Products

The right-to-win for high performance flow control and treatment products can be enhanced by leveling the playing field and changing the scoring method. Right-to-win is the ability to engage in any competitive market with a better-than-even chance of success. Four strategies have been used to improve the right-to-win ability. They are position, execution, adaptation and concentration.

In flow control and treatment there are two types of products and services: high performance and general performance. The right-to-win strategies for them differ significantly.

The challenge of large U.S. and European based suppliers of high performance flow control and treatment products is to not only improve the right-to-win ability in the existing market, but to be pro-active in changing the rules of the game to level the playing field and even the scoring method in developing countries. Most of these large companies have not achieved the sales and profits in the fast growing developing market. McIlvaine, therefore, proposes that “creation” be considered a fifth right-to-win strategy. The importance of each strategy has been ranked from very important to irrelevant.

|

Right-to-Win Strategies for High Performance and General Performance Products |

||

| Right-to-Win Strategy | High Performance | General Performance |

| Position | 3 | 5 |

| Execution | 3 | 5 |

| Adaptation | 5 | 3 |

| Concentration | 3 | 4 |

| Creation | 5 | 2 |

The creation strategy changes the playing field by making it easier for purchasers to buy the best rather than the lowest cost product. This entails finding an easier way to determine the lowest total cost of ownership (LTCO). Arcelor Mittal is doing this by global sourcing and then providing LTCO analyses for its 200 plants around the world. McIlvaine is accomplishing this in certain industries with free Decision Guides for end users.

The Power of Innovation for Suppliers of Combust, Flow and Treat Products

There is a sea change in the route to market for suppliers of combust, flow and treat products. It is being caused by the adoption of digital technologies. Suppliers have to navigate a course every bit as challenging as did Eastman Kodak. The monumental failure of this company was to underestimate the power of innovation and overestimate the power of positioning in a non-digital market. The result was a company which was best able to achieve what Apple has accomplished and instead stifled R&D and tried to delay or prevent the transition to digital cameras.

Suppliers of Combust, Flow and Treat (CFT) products can harness the power of innovation only if they understand customer needs in every niche where there is potential. There is voluminous data already available to facilitate this understanding. With process management software and data analytics the availability of useful data will expand by orders of magnitude. The individual supplier is already overwhelmed by this avalanche of information. However, just as IIoT connects things in vastly large numbers the Industrial Internet of Wisdom (IIoW) can connect knowledge and people and harness the power of the avalanche rather than be buried by it.

Innovation will potentially generate large revenues and profits as per the Apple example. It starts with understanding customer needs. This is prohibitively expensive for any one company. Companies such as Primex and MOGAS have found ways to share this cost using the Wikinomics concept. Many companies support Users Groups. However, harnessing the power of the avalanche is going to require even more interconnection in the new digital world.

Ultimately there should be interconnection addressing all segments with potential power in the avalanche. Organized decision systems around industries, processes and products should exist in millions of niches. Google and other search engines employ large numbers of people. However, IIoW will need to employ even more to keep up with the avalanche in an organized and decisive way.

Who should spearhead this activity: governments, consultants, associations or suppliers? The group with the most to gain are the suppliers and there is a strong case to be made as to why they should lead rather than follow. The McIlvaine Company believes its primary role should be as a consultant rather than leader even though it has developed Decision Systems such as Coal Fired Boilers. McIlvaine can aid suppliers. This assistance comes as part of a 5-step program

THE FIVE STEP BUSINESS PROGRAM is the navigation tool and the Lowest Total Cost of Ownership Validation (LTCOV) is the ship most likely to insure a successful voyage. Innovation is the fuel to maximize the speed and quantity delivered. The foundation of successful innovation is the Industrial Internet of Wisdom (IIoW)

With IIoT, remote monitoring and data analytics, the customer will possess continuing total cost of ownership analyses of each product. To persuade the customer to buy more of his product the supplier will need to deliver insights which are superior to those already in his possession. Persuading the customer to buy a new product requires the supplier to demonstrate greatly superior knowledge. The advantage of the new environment is that the customer is much more receptive to products which will provide LTCO.

In order for the supplier to create the LTCOV for a specific product in a specific process he will first need

- Information about the plant process

- Performances of competitive products in that process

- Relevant general factors such as cost of electricity, weather and geography.

- Relevant customer factors such as production cycles, financial criteria and personnel capabilities

If the supplier has a product which is proven in a similar process, then it is valuable to establish the similarities and differences between the two processes. This is particularly relevant if

- This is a new product and only used to date in the other process

- The severity and criticality of the other process is similar to the given process.

INNOVATION: Innovation will be more important in the new market environment. The reason is that customers have the process management systems and data analytics to analyze the new product potential. They already will have documented the short comings of existing products and processes.

This new and better innovation must be validated for each application. This requires a high level of process and product knowledge to first develop the product and then to communicate that knowledge convincingly.

EXAMPLES: Here is the way some companies are gaining and communicating this knowledge.

PRIMEX: This company has been involved with dry scrubbing systems for coal fired boilers for decades. They helped create the Dry Scrubbers Users Group (DSUA) and are very active in the annual conference. They consult for several NAES power plants and have access to the continuous process management data supplied by the OSIsoft systems.

They are analyzing the performance of all the components. Because of their extensive experience they have recommended changes which have greatly improved operations.

The bag design was causing some problems. Primex patented a modification and then licensed this patent to the bag manufacturers. At the latest conference, there was a good sharing of information among suppliers and users relative to the control valve washing protocol. Primex will be able to incorporate this knowledge into their advisory service.

McIlvaine has proposed to the DSUA and to Primex that the McIlvaine Dry Scrubber Decision Guide be used to create an ongoing decision system on dry scrubber components and processes. This would provide currency and organization to the overall effort and provide the four knowledge needs: Alerts, Answers, Analysis and Advancement.

MOGAS: This valve manufacturer and severe service technology company organizes a biennial conference on autoclaves for extraction of metals from ores. Ekato, an agitator supplier, Koch-Knight who furnishes autoclave components, NobelClad, a supplier of explosively clad alloys, and Caldera, a consultant specializing in extraction are co-sponsors.

MOGAS has captured a large share of the severe service valve market for these applications. Their process knowledge and innovative engineering philosophy have resulted in special valve designs with unique coatings to reduce corrosion and erosion.

There are similar applications with larger markets. One is tight oil including oil sands and shale. Another is the power plant FGD where Ekato is the leading supplier of agitators. Scaling is a problem in both applications. Improved valve and agitator designs for one market can be applied to others.

The bi annual autoclave conference has spurred innovation. Wouldn’t on going decision systems on this subject be a logical next step forward? Application oriented decision systems can be supplemented by product-oriented systems such as valve decisions for severe service slurry valves: or “agitators for abrasive and corrosive applications”.

HRSGS USERS GROUP: The organizers of this bi annual conference and McIlvaine are ready to help suppliers organize decision systems around HRSG products. There is already a good start with a decision guide on HRSG valves. The next step is to identify suppliers willing to support this effort.

The sea change in the CFT markets will require major adjustments by the suppliers. Those who follow the Apple rather than Eastman Kodak example will be able to navigate the route to maximum ROI and profits. Details on the 5-step business program are provided at www.mcilvainecompany.com

Lowest Total Cost of Ownership Validation (LTCOV) will be Essential for High Performance Combust, Flow and Treat Products and Services Success

The sea change in the market route for combust, flow and treat companies has been assessed at www.mcilvainecompany.com . One aspect is that IIoT and data analytics will be providing vast amounts of data on total cost of ownership. Current data will be available to the corporate specialists who increasingly will be making the major purchasing decisions.

These corporate specialists will have not only current TCO’s on each product but they will have the knowledge of their processes and the unique TCO parameters. These will not be people easily persuaded by a standard sales presentation or even a comprehensive analysis which does not take into account unique TCO parameters for the process in question.

TCO has long been a desired but expensive, time consuming and difficult basis for decision making. As a result initial price has had unwarranted influence on purchasing decisions for high performance products. More than half of the combust, flow and treat products are in the high-performance category. This includes both critical and severe service where performance has a bigger impact than initial price.

The most important navigation tool for this sea-change in the route to market will be the Lowest Total Cost of Ownership Validation (LTCOV). The obvious question is how does the LTCOV differ from the common “white paper”. Here are the differences

- The LTCOV addresses the unique process parameters for a specific purchase

- Validation is achieved by the input of Subject Matter Ultra Experts (SMUES)

- The unique process parameters and cost factors are supported by decision systems with case histories, analyses and economic tables.

- The LTCOV is kept current

- The LTCO is further validated by addressing criticisms of third parties including competitors

- This input from third parties is implemented through the decision systems.

The digital generation with access to data analytics and the Industrial Internet of Wisdom” will be leading the way in the market sea-change. The LTCOV will be a primary navigation tool. Therefore, those suppliers who have the best products and can validate LTCO will be the most successful. How can a supplier address this sea-change and provide the desired LTCOV’s? Here is the step by step recommendation.

- Use “Advanced Forecasting” to prioritize industries, processes and even all the major individual prospects

- Start with the most potentially lucrative segment and create an LTCOV for it.

- The LTCOV process steps are

- Select a vendor to coordinate the LTCOV. McIlvaine would be one of the consulting companies to consider

- Understand the process as well as the process operator does.

- Gather all the cost data relevant to the application of your product or service relative to that process

- Support that data with case histories, customer testimony. and verifiable analyses

- Validate the LTCO with the input from one or more Subject Matter Ultra Experts

- Disseminate the LTCOV to the potential purchasers

- Provide open on line discussions of the LTCO

- Support decision systems covering the process and all the relevant products and services

- Provide continuous review and updating of the LTCO

- Encourage the development of subject matter ultra-experts both within the organization and without

- Interconnect all the people within the supplier organization to improve and leverage the LTCO market approach.

This sea-change will not only impact market shares but margins, R&D and the fundamental building blocks for success. Those companies who leverage TCO information to develop better products will find ready acceptance. The result will be faster process improvement and higher profit margins to those companies who divert more funds from promotion to R&D.

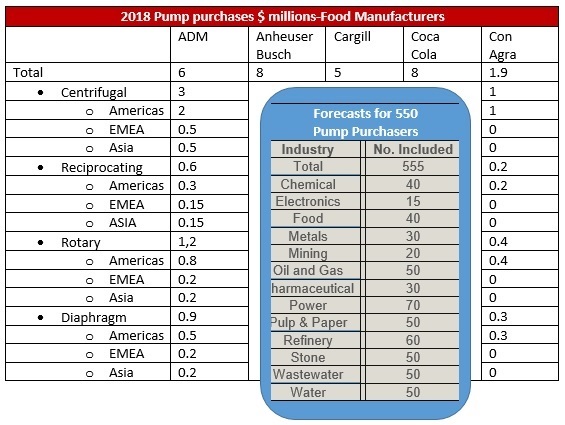

Pump Purchaser Direct Sales Program Candidates

The sea change in the market for pumps will require prioritizing corporate prospects and then initiating a program for each on a progressive basis? Which is the best first target? Here are the criteria.

Size. The top 3000 purchasers are buying most of the high-performance pumps (performance is more important than initial price). Their average purchases are $7 million. However the top 50 each purchase over $50 million per year. The largest is Sinopec with purchases of over $800 million per year. Gaining a market share of 10% with any of these 50 companies could therefore add revenues of $5 to $80 million per year. So any of the top 50 prospects would warrant significant effort.

| Pump Purchases in 2018 | ||||

| Company | Type | Corporate Location | Industry |

Pump Purchases |

| Sinopec | Operator | China | Oil & Gas | 607 |

| Sinopec | Operator | China | Chemical | 108 |

| Sinopec | EPC | China | All | 90 |

| Sinopec | Total | China | Multiple | 805 |

| NTPC | Operator | India | Power | 224 |

| EDF | Operator | France | Power | 220 |

| Eskom | Operator | South Africa | Power | 192 |

| Bechtel | EPC | U.S. | All | 320 |

| BASF | Operator | Germany | Chemical | 157 |

Product Fit

There are a number of different pump types. Each is available in multiple materials depending on the service. A pump company specializing in exotic alloy pumps would want to focus on industries such as chlorine manufacture where exotic alloys are required. Here are pump purchases for the top chlorine manufacturers.

| Chlorine Producer Pump Purchases $ millions - 2018 |

||

| Company | % | $ |

| Total | 100 | 300 |

| Olin | 6 | 18 |

| Oxy | 4 | 12 |

| Formosa | 3 | 9 |

| Dow | 3 | 9 |

These are just purchases for chlorine service. All these manufacturers also purchase pumps for processes using chlorine, as well as for power, water, wastewater and cooling. For these specialized applications it is possible to achieve high market shares. A 30% market share at one company can result in revenues of more than $5 million/yr.

There is lots of differentiation in materials to withstand corrosion, temperature and erosion. Manufacturers are willing to spend whatever is necessary to minimize leaks of dangerous acids. The company which can provide the lowest total cost of ownership validation (LTCOV) can capture a large market share.

Sales Fit

The corporate office is likely to be the primary decision maker but local sales and service will also be important. If you have strong sales and service support in the Americas you will want to consider that the second largest purchaser in the food industry (ADM) buys 66% of its pumps for the Americas region.

The McIlvaine Company has a 5-step customer based market program which is explained at www.mcilvainecompany.com

Forecasts of pump purchases for hundreds of pump companies are included in N019 Pumps World Market

For answers to your questions contact Bob McIlvaine at 847 784 0012 ext. 112 or This email address is being protected from spambots. You need JavaScript enabled to view it..

Wastewater Direct Sales Program Candidates

It is now economically beneficial to forecast pump purchases at many thousands of plants. Since the average industrial pump is replaced every 10 years and since repairs and service generate costs equal to 75 percent of the initial price over the 10 year period, the market for replacement pumps and repairs/service is seven times higher than the market for new pumps for new systems. Since most of the new systems are purchased by companies which already own pumps, the purchases by existing known companies represent 99 percent of the market.

The takeaway from these statistics is that 99 percent of the purchasers are already known and can be pursued based on detailed forecasts of their annual purchases. McIlvaine identifies each plant, the processes within that plant, the flow rates, and the annual purchases of new and replacement pumps as well as the potential for repairs and services.

The conventional way to pursue the market is through sales leads. However, there is a new approach. The Industrial Internet of Wisdom empowers IIoT and IIoT in turn enriches IIoW. The result is that an increasing percentage of pumps will be purchased based on a continuing lowest total cost of ownership evaluation. The sea change in the route to market will occur first for high performance pumps and for higher quantities. The recommendation is to set up parallel sales programs: one for high performance pumps and high volume sales, and one for general performance pumps and for small volumes of high performance pumps.

Both programs should take advantage of Advanced Forecasting. It is now possible to identify all the purchasers and predict 99 percent of the orders. The municipal wastewater industry can be used as an example.

BEWG owns a number of wastewater treatment plants, operates others and supplies waste treatment systems which include pumps. They are active in Singapore, Portugal and other countries. However, the bulk of their plants are in China. They will spend just under $20 million for pumps this year.

| BEWG Pump Purchases – 2018 - $ millions | |||||

| Total | Centrifugal | Diaphragm | Reciprocating | Rotary | |

| New Pumps | 1.8 | 1.3 | 0.2 | 0.1 | 0.2 |

| Replacement Pumps | 10.3 | 7.2 | 1.0 | 0.8 | 1.2 |

| Repairs | 7.7 | 5.4 | 0.8 | 0.6 | 0.9 |

| Total | 19.8 | 13.9 | 2.0 | 1.5 | 2.3 |

There are more than 90,000 municipal wastewater treatment plants worldwide including 16,000 in the U.S. There are 3500 wastewater treatment plants in the U.S. which spend more than $100,000 per year for pumps. Another 3500 spend more than $50,000 per year. The largest plants spend over $30 million per year each. California has a number of large wastewater treatment plants whose purchases range from $7 million per year to over $35 million.

| Large California Wastewater Treatment Plant Pump Purchases - $ millions - 2018 | ||||||

| All Pumps | Centrifugal | Diaphragm | Reciprocating | Rotary | ||

| Hyperion | 35.2 | 24.7 | 3.5 | 2.8 | 4.2 | |

| L.A County | 21.4 | 15.0 | 2.1 | 1.7 | 2.6 | |

| Fountain Valley | 16.8 | 11.8 | 1.7 | 1.3 | 2.0 | |

| San Vincente | 11.7 | 8.2 | 1.2 | 0.9 | 1.4 | |

| Sacramento | 11.1 | 7.8 | 1.1 | 0.9 | 1.3 | |

| Northpoint | 10.1 | 7.1 | 1.0 | 0.8 | 1.2 | |

| East Bay | 8.6 | 6.0 | 0.9 | 0.7 | 1.0 | |

| San Diego | 8.0 | 5.6 | 0.8 | 0.6 | 1.0 | |

| San Jose /Santa Clara | 7.4 | 5.2 | 0.7 | 0.6 | 0.9 | |

| San Francisco | 6.7 | 4.7 | 0.7 | 0.5 | 0.8 | |

| San Jose Creek West | 6.7 | 4.7 | 0.7 | 0.5 | 0.8 | |

There are 69,000 industrial plants in the U.S which are treating wastewater and then discharging it to lakes and streams. There are 400,000 plants treating wastewater worldwide. Some of these plants also treat municipal wastewater. ConAgra treats municipal wastewater in the small towns where it has food processing plants.

BASF has more than 100 plants worldwide. At the Ludwigshafen site it also treats industrial hazardous waste from nearby industries. It is a sizable purchaser of wastewater pumps at its U.S. plants.

| BASF Wastewater Pump Purchases in the U.S. - 2018 | |||

|

City |

State |

Discharge Rate MGD |

Pump Expenditures |

| Geismar | LA | 9.3 | 623,000 |

| Hannibal | MO | 1.9 | 127,000 |

| Joliet | IL | 0.1 | 6,700 |

| Freeport | TX | 5.4 | 361,800 |

| Portsmouth | VA | 0.7 | 46,900 |

| Wilmington | NC | 1.0 | 67,000 |

| Beaumont | TX | 1.2 | 80,400 |

| Wyandotte | MI | 24.1 | 1,614,000 |

Wastewater represents a small percentage of the total pump applications at BASF plants. Pump purchases for other processes can be determined based on the production and use of various fluids. For example acids are produced at some plants and then used in downstream processes. BASF Antwerp, Belgium is highly integrated with 50 individual production operations within the plant confines. BASF is a relatively small producer of chlorine. The Ludwigshafen plant produces 385,000 tons per year of chlorine. Dow, Germany produces 1.5 million tpy of chlorine. Its other chlorine operations were merged with Olin. This makes Olin the largest producer (5.6 million tpy). World production is now 70 million tpy.

Chlorine producers use 70 percent of the amount produced for chemical processes within the plant boundaries. The requirements for lined and exotic metal pumps can be determined from primary and secondary use of a specific acid at a specific plant. Wacker Chemie produces chlorine and then reuses each chlorine atom 15 times in downstream processes.

BASF has one professional interface for all global suppliers and has a suite of strategic procurement processes for all plants worldwide. This centralization of decision making is one of the factors in the sea change in the route to market.

Program for general performance pumps and for small volumes of high performance pumps

The conventional market program can continue to be used for this category of pumps. Advanced forecasting of purchases by individual customers can be used as an evaluation tool for the sales network and for the marketing program. In the past sales leads served this purpose. Since replacement pumps and repairs dominate the market the forecasts for individual plants and for individual sales territories are reliable and less expensive than sales leads.

Program for high performance pumps and high volume sales of general performance pumps.

High performance pumps by definition are purchased because of their lower total cost of ownership rather than initial price. The process to obtain Lowest Total Cost of Ownership Validation (LTCOV) or to be a most preferred supplier, or even a accepted supplier is lengthy and needs to be pursued with a continuous effort. It is therefore critical to apply Advanced Forecasting and assess the opportunity with each customer and then formulate a program which may include direct sales to the largest customers and use of representatives for the smaller opportunities. In either case the knowledge of the likely opportunity at each plant is important.

The forecasts including pump purchases by the largest customers are provided in N019 Pumps World Market

Power Industry Direct Sales Program Candidates

It is now possible to obtain product forecasts for each potential power plant customer. These forecasts can become the foundation of a sales program. McIlvaine can provide forecasts for more than 20,000 large units and another 30,000 smaller utility and industrial units.

The power industry represents a large market for combust flow and treat (CFT) products and services. Coal fired power plants will be the largest purchasers but the gap is shrinking as gas turbine capacity grows. Nuclear plants will continue to rank below coal and gas.

The amount of CFT purchases by solar and wind generators will remain small even though the share of generation by these plants will be growing robustly. Geothermal and biomass are big purchasers of CFT products but their share of total generation will be small. Hydropower will remain a big market for pumps and valves but not for most other CFT products.

Between 2018 and 2021 the capacity of coal plants worldwide will grow from 2440 GW to 2600 GW. The average boiler size is 0.2 GW. There are 12,200 existing boilers. The average size of new boilers is 500 MW. So the number of boilers will grow by 320 during the next three years Each existing unit and details on the new boilers are provided in 42EI Utility Tracking System.

Nuclear capacity will grow from 433 GW in 2018 to 453 GW in 2021. The average reactor is approaching 1 GW and many sites have multiple reactors. So the number of units is less than 500 and the number of sites less than 300. Weekly details on these plants are included in 41F Utility E-Alert.

Gas turbine capacity will rise from 1670 GW in 2018 to 1890 GW in 2021. The average unit size is 0.1 GW resulting in 18,900 units in place by 2021 Data on all existing plants as well as new projects is included in 59EI Gas Turbine and Reciprocating Engine Supplier Program.

There are thousands of geothermal, biomass, biogas and hydro plants. Most are small. Each is tracked in 31I Renewable Energy Update and Projects.

The projected CFT product revenues for each type of generator are included in the market reports http://home.mcilvainecompany.com/index.php/markets

Innovations and insights to future revenues are included in Decision Systems 44I Coal Fired Power Plant Decisions and 59D Gas Turbine and Reciprocating Engine Decisions

This aggregation of services allows McIlvaine to cost effectively predict product purchases at each plant.

Operators of simple cycle and combined cycle gas turbine plants will spend $180 billion per year for hardware, consumables, instrumentation and services on an annual basis over the next 10 years.

The top 15 power companies will spend more than $750 million for gas measurement devices in 2022. This includes analyzers to measure CO, CO2, O2, NOx, NH3, SO2, SO3, mercury and dust. The requirements for mass measurement of dust are boosting the market because their cost is considerably greater than the previously required opacity monitors.

Five Companies will be Responsible for 39 Percent of the Combust, Flow and Treat Purchases in the Nuclear Power segment in 2018.

Global nuclear power generation is now predicted to grow by 2.3 percent per annum out to 2035. Over 90 percent of the combust, flow and treat expenditures will be made by fewer than 50 companies. Thirty-nine percent will be made by just three operators and one supplier.

|

Nuclear Power Plant Combust, Flow and Treat Purchases 2018 - $ millions |

|||||

| World | EDF | Bechtel | KEPCO | Exelon | |

| Percent | 100 | 20 | 10 | 5 | 4 |

| Guide | 1400 | 280 | 140 | 70 | 56 |

| Control | 2200 | 440 | 220 | 110 | 88 |

| Measure | 1200 | 240 | 120 | 60 | 48 |

| Valves | 2000 | 400 | 200 | 100 | 80 |

| Macrofiltration (Belt Presses, Sand Filters) | 200 | 40 | 20 | 10 | 8 |

| Pumps | 1100 | 220 | 110 | 55 | 44 |

| Treatment Chemicals | 1400 | 280 | 140 | 70 | 56 |

| Sedimentation and Centrifugation | 300 | 60 | 30 | 15 | 12 |

| Variable Speed Drives and Motors | 600 | 120 | 60 | 30 | 24 |

| RO/UF/MF Cross Flow Membrane Systems | 200 | 40 | 20 | 10 | 8 |

| Air Purification and Protection | 400 | 80 | 40 | 20 | 16 |

| Total | 11,000 | 2200 | 1100 | 550 | 440 |

Nuclear plants will spend $200 million for cross flow membranes. This represents 20 percent of the total membrane purchases by the power industry.

Most new coal fired plants will incorporate flue gas desulfurization. Many existing plants have FGD systems or will install them. So this is a big market for pumps, valves, controls, chemicals, nozzles, fans, packing, seals and other CFT products. The purchases are concentrated among a few large operators. Guodian and Shenhua are merging and will make 12 percent of global purchases FGD purchases.

| FGD System, Component, Consumables and Repair Purchases in 2018 | ||||

| Company | Country | Rank | % of Total Coal-fired FGD Purchases in 2018 | FGD Purchases ($ millions) |

| AEP | U.S. | 9 | 1.1 | 209 |

| BWE | U.S. | 14 | 0.6 | 114 |

| Datang | China | 3 | 7 | 1,330 |

| Duke | U.S. | 10 | 1 | 190 |

| Enel | Italy | 13 | 1 | 190 |

| Eskom | South Africa | 5 | 6 | 1,140 |

| Guodian | China | 2 | 7.5 | 1,425 |

| Huaneng | China | 1 | 9 | 1,710 |

| Huadian | China | 6 | 6 | 1,140 |

| J-Power | Japan | 16 | 0.5 | 95 |

| National Thermal Power Corporation (NTPC) | India | 4 | 7 | 1,330 |

| NRG | U.S. | 11 | 1 | 190 |

| Shenhua | China | 7 | 4.5 | 855 |

| Southern | U.S. | 12 | 1 | 190 |

| Uniper | Germany | 15 | 0.6 | 114 |

| Vietnam Power (EVN) | Vietnam | 8 | 2 | 380 |

| Sub Total | 55.8 | 10,602 | ||

| Other | 44.2 | 8,398 | ||

| TOTAL | 19,000 | |||

Forecasts can also be supplied for power plants at industrial sites.

| Boilers at BASF Freeport Texas | ||||

| Boiler # | Fuel | Size mm btu/hr | Operating Hours | Date Installed |

| B 20C | Natural gas | 325 | 8500 | 1991` |

| B2500 | Natural gas | 178 | 8592 | 2001 |

| BX 5470 | Natural gas | 210 | 4350 | 1996 |

|

*H1 Reformer |

Natural gas/Process gas |

404 |

8000 |

1998 |

* SCR included on this reformer

There are nearly 30,000 industrial boilers in the U.S. However, there are only 350 plants with coal fired boilers and 2000 plants with large gas fired boilers. In the case of a chemical plant such as BASF Freeport, the total market for valves and pumps is large. The boilers just become one of a number of relevant processes within the plant. In Asia there are a large number of independent coal fired power plants operated in conjunction with mining, steel, and chemical products.

Setting Up a Program Built Around Individual Power Plants

The program can be structured to place larger effort on the plants with the greatest potential.

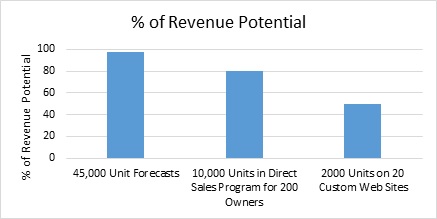

Maximum effort with custom websites can be set up for 2000 individual units at the top 20 purchasers with 50 percent of the potential. So this would be just 20 custom websites. There would be 200 direct sales programs covering corporations with 10,000 units representing 80 percent of the potential. Forecasts for 45,000 units would account for 95 percent of the potential and would be an evaluation tool for the general sales effort.

The forecasts for each individual plant will allow the sales team to effectively deploy resources and maximize sales.

| Steps to a Program Based on Forecasts for Each Plant |

| Segment products in to two categories: High performance and general performance |

| Determine product revenue for each potential purchaser at each plant |

| Post the forecasts in the CRM System |

| Prioritize customers based on size of Serviceable Obtainable Market (SOM) and product category |

| Where the product is in the general performance category use the forecasts as an evaluation tool on a retrospective basis and to replace sales leads on a proactive basis. |

| Where the SOM is below a revenue size warranting direct sales the existing sales approach can be used. |

| For high performance products and for prospects with sizable SOM revenue potential initiate a 5 step program as explained at www.mcilvainecompany.com |

| Revise specific forecasts based on feedback from the sales personnel |

Semiconductor Direct Sales Program Candidates

The semiconductor industry is a large and growing market for combust, flow and treat (CFT) products. In 2019 the industry will spend $15.4 billion for these products. The top five purchasers will account for 40 percent of the total.

Four of the top five purchasers are integrated suppliers with both chip fabrication and proprietary designs. TSMC is not an integrated supplier but has a 56 percent share of the independent foundry market.

The processes used by these manufacturers include ultrapure water to wash chips, acids to etch them, cleanrooms with sophisticated HVAC systems to prevent particulate damage, wastewater treatment and air pollution control. There are many individual steps as a chip moves from tool to tool.

The top 100 purchasers represent over 80 percent of the market. These companies are centralizing decision making and purchasing. They are also remotely monitoring operations and utilizing total cost of ownership evaluations to make decisions.

Consolidation is continuing and it is likely that the top 100 purchasers will account for 90 percent of the market within a decade. These purchasers have plants throughout the world. Therefore market research based on the market size in China or the U.S. is not nearly as relevant as the market size for each of the top 100 purchasers.

| Semiconductor Purchases - $ millions – 2019 - World | ||||||

| Company |

Total |

Intel | Samsung | TSMC | SK Hynix | Micron |

|

Cleanroom Hardware |

5500 | 935 | 715 | 605 | 330 | 275 |

|

Cleanroom Consumables |

2800 | 476 | 364 | 308 | 168 | 140 |

| Ultrapure Water Systems | 900 | 153 | 117 | 99 | 54 | 45 |

|

Scrubbers, Oxidizers |

240 | 41 | 31 | 26 | 14 | 12 |

| Pumps | 240 | 41 | 31 | 26 | 14 | 12 |

| Valves | 400 | 68 | 52 | 44 | 24 | 20 |

| Cartridges | 475 | 81 | 62 | 52 | 29 | 24 |

|

Other Filters, Separators |

380 | 65 | 49 | 42 | 23 | 19 |

|

Cross Flow Membranes |

250 | 43 | 33 | 28 | 15 | 13 |

| Fans, Compressors | 290 | 49 | 38 | 32 | 17 | 15 |

| Treatment Chemicals | 420 | 71 | 55 | 46 | 25 | 21 |

| Guide | 700 | 119 | 91 | 77 | 42 | 35 |

| Control | 600 | 102 | 78 | 66 | 36 | 30 |

|

Measure - Liquids |

140 | 24 | 18 | 15 | 8 | 7 |

|

Measure - Gases |

70 | 12 | 9 | 8 | 4 | 4 |

|

Measure -Powders |

40 | 7 | 5 | 4 | 2 | 2 |

| Other | 2,000 | 340 | 260 | 220 | 120 | 100 |

| Total | 15445 | 2627 | 2008 | 1698 | 925 | 774 |

The challenges to improve performance increase as line size decreases. Chips with 7nm line sizes are now in production and 5nm production is slated for 2020. This progression needs to be accompanied by similar advancement of CFT products. This means that suppliers must understand the processes generally but also the unique variations applied by individual purchasers.

This focus on individual purchasers and their unique processes dictates collaboration among disparate supplier divisions. ABB makes cleanroom robots as well as a range of guide, control and measurement products. Danaher has acquired Pall and Chemtreat to supplement its Hach operations and now can supply a range of filters, treatment chemicals and measurement equipment.

| Company |

Total |

Danaher | Eaton | Emerson | ITW | ABB | Crane | IDEX | CECO |

|

Cleanroom Hardware |

5500 | x | xx | ||||||

|

Cleanroom Consumables |

2800 | xxx | |||||||

| Ultrapure Water Systems | 900 | xxx | |||||||

|

Scrubbers, Oxidizers |

240 | xx | |||||||

| Pumps | 240 | x | x | xx | xx | x | |||

| Valves | 400 | x | xxx | x | xx | xx | |||

| Cartridges | 475 | xx | xx | x | x | ||||

|

Other Filters, Separators |

380 | xx | xxx | x | x | ||||

|

Cross Flow Membranes |

250 | xxx | xx | ||||||

| Fans, Compressors | 290 | x | |||||||

| Treatment Chemicals | 420 | xx | |||||||

| Guide | 700 | x 0 | xxx 0 | xxx 0 | 0 | xxx 0 | 0 | 0 | 0 |

| Control | 600 | x | xxx | xxx | xxx | x | x | ||

|

Measure - Liquids |

140 | xxx | xxx | x | xx | x | |||

|

Measure - Gases |

70 | xxx | xxx | x | xx | ||||

|

Measure – Powders |

40 | xx | xxx | x | xx | ||||

| Other | 2,000 | x | x | x | xxx | xxx | x |

x= some market share, xx= significant market share, xxx= market leader, 0 = Edge computer package opportunity

Danaher can use its strong position in cross flow membranes and measurement to increase penetration for its other products. The right treatment chemical in an accurately measured amount is necessary to keep the cross-flow membrane clean. Danaher how has all the products to provide the operational synergy to maximize membrane performance.

Emerson purchased Tyco Valves from Pentair. This expands its synergy between valves, controls and instrumentation.

Now with low cost sensors, wireless technology and capable partners, CFT suppliers can add remote monitoring and edge computer packages to their offerings and substantially increase revenues.

Multi product suppliers would be well served to determine the opportunity at each of the top semiconductor purchasers and then devise a strategy to encourage collaboration among divisions to pursue each. This represents a sea change in the route to market caused by international consolidation, IIoT and the Industrial Internet of Wisdom (IIoW) to empower IIoT.

The opportunity for controls and instrumentation for each large purchaser is included in N031 Industrial IOT and Remote O&M.

The potential for purchases of specific products such as valves, pumps, scrubbers, filters, etc. by each large semiconductor purchaser as well as purchasers in other industries is included in the individual market reports shown at http://home.mcilvainecompany.com/index.php/markets.

Chemical Industry Direct Sales Program Candidates

Forecasts of combust, flow and treat products can be obtained for each plant and each corporation based on plant capacity. The investment for new products, replacement products and repairs can all be related to projected and existing capacity. The power industry forecasts start with the capacity of each generator. Municipal wastewater forecasts can be determined based on the MGD of primary and secondary treatment. The same approach can be used for refineries. Pulp and paper forecasts can be achieved with tons/yr of pulp.

Mining is more of a challenge because purchases vary with each type of ore. The industry which is most challenging is the chemical/fertilizer industry. There are many different products requiring many different processes. This necessitates forecasting production of each chemical and then grouping these chemicals by common requirements. For example, TDI, Cl, and MOP/DAP all include processes with highly corrosive fluids. The forecasts for corrosion resistant products for each plant can be determined based on the production or usage of corrosive chemicals at each plant. Here is an example tabulation for Chlorine.

| France - 2017 Chlorine Production – kT/yr | ||

| Company | Location | Production |

| PPChemicals | Thann | 43 |

| Vencorex | Pont de Claix | 170 |

| Kem One | Fos | 340 |

| Arkema | Jarrie | 72 |

| Kem One | Lavera | 363 |

| Arkema | St. Auban | 20 |

| MSSA | Pomblière | 42 |

| PC Harbonnières | Harbonnières | 23 |

| Inovyn | Tavaux | 360 |

| PC Loos | Loos | 18 |

| Total | 1451 | |

The same procedure can then be repeated for other corrosive chemicals and forecasts made for each CFT product. McIlvaine routinely forecasts purchases for the top 30 chemical companies. However, many of the top purchasers of corrosion resistant products are not in the top group for all CFT products. The challenge is to segment the corrosion resistant purchases separately from the others. The following companies are all significant purchasers of corrosion resistant products.

| CFT Purchases by Process and Revenue - 2018 Chemical Industry Example | |||||||||||

| TDI | Cl |

MOP/ DAP # |

2018 Rank |

Valves $ mill |

Plastic | Rubber | Ceramic |

Thermal Spray |

Other CFT products | ||

| Air Liquide | 84 |

6 types of On/off Valves 6 types of Control Valves 4 types of Pumps 13 types of Treatment Chemicals Stack gas Neutralizing Agents such as lime and sodium 4 types of Cartridges 6 types of Liquid Filtration equipment 5 types of Sedimentation /Centrifugation equipment Cross-Flow RO, UF, MF membranes Ultrapure Water Systems Stainless Steel plate FRP Vessels and Piping Thermal Coatings Hose and Couplings Drives and Motors Dampers and Stacks DuctworK HVAC Filters |

|||||||||

| Agrium | 10 | ||||||||||

| Akzo Nobel | x | 80 | |||||||||

| Anwil | |||||||||||

| Aventis | |||||||||||

| BASF | x | x | 2 | 311 | Analysis with 150 slides | ||||||

| Braskem | 69 | ||||||||||

| Bayer | |||||||||||

| Belaruskali | |||||||||||

| Covestro | x | 65 | |||||||||

| CUF | |||||||||||

| Degussa | |||||||||||

| DOW-Dupont | x | x | 1 | 339 | Analysis with 100 slides | ||||||

| DSM | |||||||||||

| Ercos | |||||||||||

| Evonik | 73 | ||||||||||

| Exxon | 7 | 137 | Also separate oil/gas forecasts | ||||||||

| Formosa | x | 5 | 142 | ||||||||

This group includes the top 20 chemical companies and the top companies in the chlorine, TDI and MAP, DAP segments. Exxon is the seventh largest purchaser of valves in the chemical industry (their oil, gas and refining purchases are determined separately). However they are not a major player in production of the three corrosive chemicals displayed in this chart.

Advanced Forecasting to determine the purchases of a specific product by a specific company in the next year allows for a direct effort by the supplier well in advance of the actual purchase. This effort can result in specifications and decisions ahead of time which greatly improve the order potential. The cost of this type of analysis is no longer prohibitive.

Pharmaceutical Industry Candidates for Direct Sales Programs

Consolidation and international expansion are resulting in the concentration of decision making about cleanroom consumables. The top 25 pharmaceutical companies will purchase 45 percent of cleanroom consumables in 2020. The top three will purchase more than 10 percent of the total. The top 100 pharmaceutical manufacturers will make 70 percent of the purchases.

| Purchases of Cleanroom Consumables by Pharmaceutical Manufacturers $ millions - 2020 |

||||

| Rank | Company | Gloves | Wipes | Disposable Clothing |

| 1 | Pfizer | 7.70 | 4.66 | 8.36 |

| 2 | Roche | 5.76 | 3.49 | 6.25 |

| 3 | Merck | 5.25 | 3.18 | 5.70 |

| 4 | Sanofi | 5.23 | 3.17 | 5.68 |

| 5 | Johnson & Johnson | 4.88 | 2.96 | 5.30 |

| 6 | Novartis | 4.74 | 2.87 | 5.15 |

| 7 | AbbVie | 3.75 | 2.27 | 4.07 |

| 8 | Gilead | 3.57 | 2.16 | 3.88 |

| 9 | AstraZeneca | 3.36 | 2.04 | 3.65 |

| 10 | Amgen | 3.36 | 2.04 | 3.65 |

For more information on this program contact Bob Mcilvaine at rmcilvaine@mcilvaine company.com 847 784 0012 ext 112