Private Equity Aggregators Can Take Advantage of the Sea Change in the Pump and Valve Markets

Table Of Contents

Introduction

Sea Change in the Pump and Valve Markets

Evidence Based, Forecast Driven Strategy for Pump and Valve Suppliers

The Role of Private Equity Firms

- May River Capital

- Warburg Pincus

- First Reserve

- Audax

- Clearlake

Summary

Analysis of 400 Pump and Valve Company Acquisitions

_________________________________________________________________________________________

Introduction

There is a sea change in the pump and valve industry which will greatly increase EBITA for companies which adapt but will negatively impact those who do not. Small and midsized companies will be at a disadvantage if they continue business as usual.

One solution is to join a private equity firm with a compatible portfolio. This article explores the ramifications and options for addressing this sea change.

Sea Change in the Pump and Valve Markets

Digital technology is creating a sea change in the markets and profit potential for pump and valve suppliers. It will create the fairest of winds for those who adapt. For those who do not it will be a Tsunami. Navigation is going to be difficult due to a change in the international order triggered by the Russian invasion and the COVID uncertainties.

Medium and small sized pump and valve companies will find the environment particularly challenging. Joining a group of companies with synergistic operations is one of the options.

The total combined pump and valve market is over $200 billion per year. The performance needs include severe, critical, unique and general service. All except general can be considered high performance. The revenues in high performance applications are over $80 billion per year.

The sea change is taking place in all segments but is critical to the high performance products.

Here is the evolution which makes this sea change so important.

- High performance products are sold by demonstrating lowest total cost of ownership (LTCO).

- The supplier must understand the customer’s needs in order to develop an LTCO product.

- Digital technology such as condition and performance monitoring provides evidence of LTCO.

- Purchasers have avoided new and better products previously due to challenges in determining LTCO.

- The supplier who can validate LTCO can now easily reach new markets and customers.

- Digital technology pinpoints product weaknesses and provides a guide for product improvement.

- With the expanded market the supplier can afford the R&D for product improvement.

- The supplier develops unique knowledge about the role his product can play in lowering customer TCO.

- This knowledge allows the supplier to become a solutions provider who with 24-7 access can help minimize TCO over the life of the plant.

The tsunami for those suppliers who don’t adapt includes usurpation of the LTCO determination by the digital systems integrators. They can reduce the pump or valve supplier role to just delivery of specified hardware.

There is one major hurdle to catching the fair winds. While vast amounts of digital evidence is now available there is little organized access to it.

McIlvaine is working with the media as well as suppliers serving the pump and valve industry to assist them in organizing predicate and disputed evidence relative to valve and pump choices. .

This organization of knowledge can be considered an Industrial Internet of Wisdom (IIoW) which is integral to IIoT.

This sea change is also caused by unprecedented international events as described at a recent European conference for private equity firms.

“As with any disruption, there are always opportunities for M&A, but the trick is to differentiate between short-term disruption and long-term fundamental change,” said Jurgis V. Oniunas, Chairman of IMAP (International M&A Partners), a leading global middle market M&A partnership.

More than 130 advisors from partner firms as well as guest speakers joined the bi-annual IMAP conference to discuss and help distinguish between the short- and long-term disruptions, which have become increasingly difficult to navigate amid lingering COVID-19 supply chain issues, rising commodities prices, prolonged inflation, fuel shortages, increasing interest rates, and sanctions against Russia, all of which have collectively caused ripple effects worldwide.

Krisztián Orbán, Founder and Managing Partner of private equity firm Oriens , shared his perspective on the long-term impact of Russia’s invasion on Ukraine, which he described as being a catalyst to expedite the division into a dual world economy. This division would be characterized by a Transatlantic-centric economy driven by the U.S. and by a China-centric economy aligned with Russia, with several countries including India, Brazil, and South Africa still in question as to how they will align. Importantly, this schism is expected to create two disparate economic climates and businesses should not expect the same rules to apply across the bifurcated economies.

His comments highlight the challenge for the mid-range valve and pump companies which need to understand

and navigate this sea change.

U.S. Secretary Janet Yellen recently commented on this division of international order during a speech to the Atlantic Council on April 13: “The course of the global economy over the past two years has been shaped by COVID-19 and our efforts to fight the pandemic. It’s now evident, though, that the war between Russia and Ukraine has redrawn the contours of the world economic outlook. Russia’s horrific conduct has violated international law, including core tenets of the U.N. Charter, challenging countries to demonstrate where they stand with respect to the international order that has been built since World War II. Therefore, when I speak about a changed global outlook, I’m not just talking about growth forecasts. I’m also referring to our conception of international cooperation going forward.”

Most mid -sized pump and valve companies have unbalanced international strengths and will find it difficult to adapt to the new international cooperation realities.

Evidence Based, Forecast Driven Strategy for Pump and Valve Suppliers

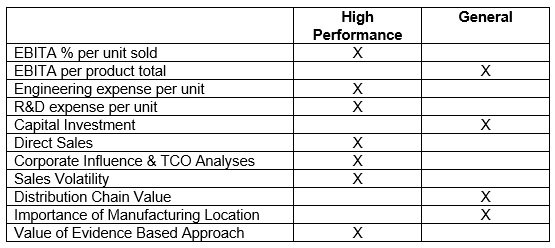

The evidence based, forecast driven sales approach can maximize profits for pump and valve companies. There are two variations of the approach based on whether the valve is in general or high performance service.

The capital investment and sales decisions are different for the two performance classifications. The evidence needed is also different with one based on logistics and the other based on product performance.

Pump and valve performance categories are

- Severe service

- Critical service

- Unique service

- General service

Severe service includes abrasive, corrosive, high temperature and high pressure applications. Critical service includes sanitary and other applications where performance is important to product quality or safety. Unique includes special valve designs for a specific customer. General includes valves and pumps which are purchased based more on cost and delivery and less on performance.

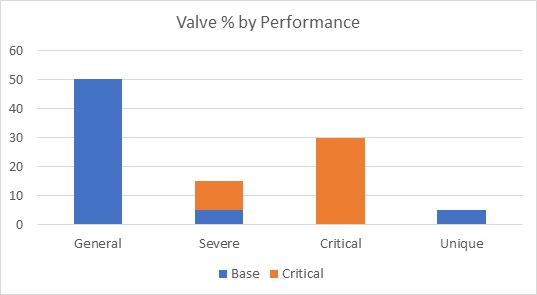

Figure 1 shows the market share percentage for each type of valve. The critical service category excludes critical valves which are also in severe service.

The severe service, critical and unique, are high performance service categories. In high performance service the performance is more important than price or delivery.

General service includes valves and pumps sold more as a commodity. So, in a food processing plant the valves on the municipal water intake pipeline would be in the general category. The ones moving food products would be critical. The ones on the high pressure steam would be severe service.

From a profitability strategy perspective it is advantageous to contrast the high performance and general performance important business factors. The comparison in Figure 2 shows which type produces higher results.

High performance valves and pumps can be sold at higher prices because of their unique qualities. So high EBITA can be achieved for a relatively sales volume. Many general valves are sold in large quantities. So EBITA based on total revenue is higher than for a small niche market.

EBITA can also be increased with lower production costs than the competition. This is more likely with large volume general performance products.

Engineering and R&D expenses per unit sold are greater for high performance products. It is critical to develop the unique features.

Engineering and R&D for general performance valves can be substantial if the focus is reducing manufacturing costs. But the cost per unit sold would be low due to the high volume.

Capital investment will typically be higher for general performance valves due to the likelihood that the valves are produced in a supplier owned facility. High performance valves are likely to include castings and components supplied by others.

Sales of high performance valves depend on conveying knowledge of the superiority. Direct sales by specialists is important.

General purpose valves and pumps can be purchased with the simple total cost of ownership analysis based on price. The purchase of high performance valves and pumps warrant a total cost of ownership analysis. One large steel company found that local purchases tended to be based on price and experience.

This precluded consideration of new and better valves and pumps.

Corporate staff took over the high performance valve and pump decision making for all the plants. The result was a considerable reduction in total cost of ownership.

A large chemical company has a corporate staff assigned to valves and pumps. It strives to take advantage of all the improvements as they occur.

There is volatility in the sales of high performance products. For example, the market for valves for fracking fluctuates considerably. The market for valves used in water intakes in plants is relatively steady.

The manufacturing location is typically important for general purpose products where freight costs and delivery time are more important than for high performance products.

Importance of Detailed and Current Forecasts: Very detailed forecasts are needed for general and high performance valves and pumps. Segmentation of high performance opportunities by critical, severe and unique is necessary in order to determine the profit potential.

This forecast will guide R&D and engineering efforts. In the case of general performance products the forecast will guide manufacturing investment.

Due to the Russian invasion of Ukraine, and the Chinese lockdown the valve and pump markets are rapidly changing. So continuous forecasts are necessary.

The most profitable market can be a large number of small niches. IDEX is an example of a company with close to 30% EBITA and fairly large volume. However, the company consists of a number of independent divisions each pursuing unique niches. Identifying these profitable niches requires much more detailed market analysis than is typically pursued by valve and pump companies.

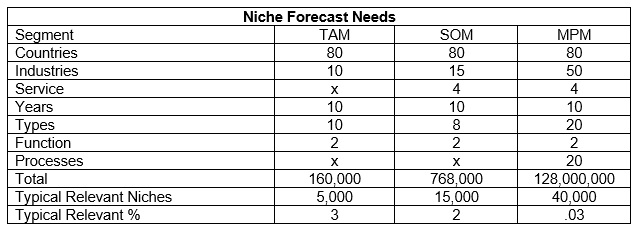

There are various levels of forecasting. The Total Available Market (TAM) includes all the opportunities whether or not they can be serviced and whether or not they are obtainable. The Serviceable Obtainable Market (SOM) reflects the market which can be pursued. However much of this market will not be very profitable. A much more detailed forecast is needed which analyzes all the niches and determines where the most profit can be achieved.

The ability to calculate any of 128 million niches relies on top down, bottoms up and horizontal iteration. It would be prohibitively expensive to conduct for just one category such as valves. But if the expense is diluted by including forecasts of equipment using valves plus complimentary air, water, energy products the cost for the valve analysis is reduced.

A typical example would be a company of medium size who would be involved in 5000 niches or 3% of the TAM. With further segmentation in SOM the number expands to 15,000. The percentage drops to 2.

The most profitable market may involve 40,000 niches or just .03% of the total. If competitor market shares and sales quotas for territories are also included, the number can rise significantly.

This effort will be relatively expensive but as part of an evidence based sales program the benefits far outweigh the costs.

Evidence Based Strategy: The same evidence needed to select the most profitable market niches is also what is needed to convince purchasers in those niches that a product is superior.

This evidence includes understanding the process needs in each industry.

Once the most profitable market is determined, the evidence can be used to validate the lower total cost of ownership.

This requires analysis of the competitors’ products and determining the comparative costs.

There is a sequence to the evidence gathering process

- Raw data

- Predicate evidence

- Disputed evidence

- Claims based on the evidence

- Rebuttal to counter claims made by competitors

Suppliers have the opportunity to accomplish steps 2-5 in advertisements, magazine articles, exhibition activities, white papers and webinars.

It is not enough to prove the lower total cost of a product it is necessary to convince the customers with solid evidence. This is a challenge but a rewarding one with the potential to greatly increase revenues and EBITA.

The Role of Private Equity Firms

Knowledge will be the currency of the new realm. Those who can create an Industrial Internet of Wisdom will be the beneficiaries. The cost of achieving this is best shared by multiple mid-sized companies with similar IIoW needs.

Private equity firms are routinely using their expertise to help guide portfolio companies. Providing an evidence based, forecast driven program will be a logical extension of present activities.

Examples

May River Capital

The firm is focused on pumps and points out that “Within the flow control industry, pumps constitute the second-largest industrial product category – behind motors – with an $80B+ global market size. The pump market is highly fragmented and populated by specialized companies with significant engineering content, product application-specific design, and strong margins. The abundance of small founder, family, and entrepreneur owned companies with under $50M in revenue makes for a compelling buy-and-build opportunity.”

May River Capital has been acquiring companies who will benefit from the same IIoW. Pump companies with complementary products and industries need the same knowledge about processes, industries, major purchasers, and important developments.

A company which can monitor leakage from pumps has considerable synergy. A company with enclosed conveyors has the monitoring needs and shares the same industry focus.

Industrial Flow Solutions (“IFS”) was formed to implement May River’s strategy of building a global flow control platform focused on wastewater pumps and IIoT controls solutions, including predicative maintenance and spill protection control.

The strategy was launched in 2017 with the acquisition of BJM Pumps and accelerated with the acquisitions of Stancor Pump & Control Solutions (2019), OverWatch Direct In-Line Pump Systems (2019), Clearwater Controls (2021), and Dreno Pompe (2022).

Industrial Flow Solutions goes to market through trade brands that preserve and build upon the original owner/operator identities: BJM Pumps®, Stancor®, Oil Minder®, DERAGGER™+, and Dreno Pompe. These brands are recognized throughout the wastewater industry for their problem-solving abilities and focus on severe service environments. IFS offers a comprehensive portfolio of electric submersible & direct in-line pumps and intelligent control and monitoring systems for industrial, commercial, and municipal wastewater applications.

May River Capital, recently acquired Unibloc Pump, a US manufacturer of positive displacement pumps, strainers, valves, bubble traps and other solutions for sanitary flow control applications.

Unibloc Pump is headquartered in Kennesaw, Georgia with a second facility in Beckum, Germany.

The company’s markets include the food and beverage, pharmaceutical, bakery and confection, meat and poultry, brewery, and transportation industries.

“Unibloc Pump is launching a new and exciting chapter with May River Capital,” says the Unibloc CEO. “May River’s approach to building business through collaboration is exactly what I was seeking as I looked ahead to the opportunities awaiting our company. We are pleased we’ve found a partner who values the engineering, skills, craftsmanship and most importantly, the culture we’ve nurtured here. This partnership will enable us to accelerate our growth initiatives and better serve our customers’ needs.”

Cross-selling across brands and geographies was implemented to optimize shared distribution channels. Detailed forecasts of the markets can then be used for each brand.

Dickson is a leading Test & Measurement compliance partner that develops environmental monitoring systems (temperature, humidity, pressure and other variables) to meet regulatory requirements and protect products for various markets including health services, pharmaceutical, medical devices, and food & beverage.

In 2019, Dickson acquired Oceasoft, a European leader in environmental monitoring systems with a full suite of innovative solutions.

Dickson is very active selling monitoring to the cleanrooms in food and pharmaceutical applications. Glaxo Smith Kline is a client. All of these end users are also primary targets for Unibloc pumps.

Municipal wastewater water plants are notorious for releasing VOCs and creating major problems with odors. Fugitive emissions due to leaking pumps can be one source. Monitoring is needed to pinpoint the leakage problems.

Automated Handling Solutions (AHS) is a leading provider of automation solutions, also provides specialized material handling equipment such as enclosed conveyor systems. AHS’ products serve customers in regulated end markets such as food and beverage, pharmaceutical, nutraceutical, specialty chemical, and general industrial processing.

The effectiveness of the enclosure is related to environmental emissions. The effectiveness can be monitored by instruments such as made by Dickson.

These companies all have common interests. So, the sharing of relevant international data will be very useful.

Warburg Pincus

Warburg Pincus is a leading global private equity firm focused on thesis-driven growth investing at scale. With more than $80 billion in assets under management, the firm’s active portfolio of more than 245 companies is highly diversified by stage, sector and geography.

As an experienced partner to outstanding management teams, Warburg Pincus helps build durable companies with sustainable value. Warburg Pincus has raised 21 private equity funds and 2 real estate funds, which have invested more than $100 billion in over 1,000 companies in more than 40 countries.

Warburg cites the following advantages

- Exclusive energy focus for over 35 years

- Experienced team with single industry focus

- Deep industry insight (These would be enhanced with the Evidence based program)

- A partner to accomplished management teams

- Building value by building companies

- Broad industry network of key global relationships (can be integrated in to the IIOW)

- Diversified exposure

All of these Warburg companies can benefit from the latest insights on the rapidly changing markets. With the energy focus there are new developments weekly. Many factors impact the various energy companies in the portfolio. For those producing oil and gas in the U.S. the challenge will be increased production.

For others the challenge is to help reduce energy consumption in Europe. An example is the boiler feedwater pump made by Sundyne. It is uniquely fitted for use in combined heat and power plants. With the shortage of natural gas in Europe the use of CHP will expand. Having an IIoW with this degree of granular insight is quite valuable.

Sundyne also makes compressors for hydrogen, CO2 and other gases which are now in high demand. There are often pumps and compressors in the same project. In fact, every compressor needs a lube pump. One way to iterate the lube pump market is to identify every compressor and turbine.

First Reserve

Trillium Flow Technologies, formerly Weir Flow Control (“WFC”), was sold to First Reserve, a leading global private equity investment firm exclusively focused on energy.

Trillium Flow Technologies consists of the same 15 established global pump and valve brands servicing the power generation, oil and gas, water and wastewater, mining, and industrial sectors. These include Sarasin-RSBD™, Blakeborough®, Atwood & Morrill®, Hopkinsons®, SEBIM™, BDK™, Batley Valve®, AutoTork™, and Tricentric® for valves, and Gabbionetta™, WSP™, WEMCO®, Roto-Jet®, Floway®, and Begeman® for pumps.

Trillium focuses on every stage of the process including design, installation, and operation utilizing its global footprint and supply chain, aftermarket parts and service, and seeks to provide unmatched responsiveness to demanding schedules.

First Reserve is a leading global private equity investment firm exclusively focused on energy. With over 38 years of industry insight, investment expertise and operational excellence, the Firm has cultivated an enduring network of global relationships and raised more than USD $32 billion of aggregate capital since inception.

First Reserve has completed over 700 transactions (including platform investments and add-on acquisitions), creating several notable energy companies throughout the Firm’s history.

Its portfolio companies have operated on six continents, spanning the energy spectrum from upstream oil and gas to midstream and downstream, including resources, equipment and services, and associated infrastructure.

First Reserve invests in targeted sectors throughout the energy industry through its Private Equity platform.

Venterra Group Plc, the offshore wind energy services business, announced that First Reserve has participated as a strategic investor in its third funding round since formation in early 2021. First Reserve is a leading global private equity investment firm exclusively focused on industrial, infrastructure, and energy businesses.

Venterra was formed to create a global services champion supporting the offshore wind industry’s rapid expansion and leading role in the energy transition. It is building a service offering across the windfarm lifecycle by a combination of acquisition and investment to generate accelerated growth in the fast-growing market.

The offshore wind market is indirectly important to Trillium because its success comes at the expense of pump and valve sales in oil and gas, So Trillum needs to know the market impact of offshore wind.

Audax

Audax says “Our mission is to partner with management teams and financial sponsors to build long term value in our companies.

Audax made a strategic growth investment in Flow Control Holdings ("FCH"S) a premier provider of sanitary flow components to producers of foods, beverages and pharmaceuticals.

FCH supplies highly engineered sanitary and high purity flow components (e.g. fittings, valves, hoses, pumps, and other components) for market-critical applications within the food, beverage and pharmaceutical industries around the world.

The Company’s brands and products, including Steel & O’Brien and Ace Sanitary, encompass a broad assortment of highly engineered sanitary and high purity flow control components and services.

Liquid Environmental Solutions is a provider of non-hazardous liquid waste management and disposal services for the restaurant, hospitality, automotive, manufacturing, power plant, petrochemical and other industries, as well as environmental services companies. The waste disposal systems use valves and fittings and are used in the same industries as served by FCH.

Clearlake

Founded in 2006, Clearlake Capital Group, L.P. is an investment firm operating integrated businesses. With a sector-focused approach, the firm seeks to partner with experienced management teams by providing patient, long term capital to dynamic businesses that can benefit from Clearlake’s operational improvement approach, O.P.S.®

The firm’s core target sectors are technology, industrials, and consumer. Clearlake currently has over $72 billion of assets under management, and its senior investment principals have led or co-led over 300 investments. The firm is headquartered in Santa Monica, CA with affiliates in Dallas, TX, London, UK and Dublin, Ireland.

Clearlake acquired a global pump and valve distribution company. So, sharing insights on the world markets in semiconductor, food and pharmaceuticals with other portfolio companies will be advantageous

FloWorks, a specialty flow control distribution platform backed by Clearlake Capital Group, has acquired SemiTorr Group, a specialty fluid handling systems and components distributor.

Founded in 1988 and based in Tualatin, Oregon, SemiTorr offers products and services to the high purity, sanitary and general industrials sectors. The Company’s family of products includes processing equipment, pumps, tubing, hoses, fittings, valves, filtration, and instrumentation, among others. SemiTorr provides end-to-end project management, including early-stage specifications, engineering, design, implementation and supply chain management.

SemiTorr has completed several acquisitions over the last seven years, expanding to 11 distribution centers across the U.S. in Oregon, California, Arizona, Utah, New Mexico, Colorado, Texas, Virginia, Pennsylvania, and New York.

Together with SemiTorr, FloWorks will have over 40 branches globally, all strategically located in key markets to support customers focused on the chemical, sanitary, utility, refining semiconductor, microelectronics, life sciences, food & beverage, and general industrials end markets.

Summary

1. Midsized and small pump and valve companies will need to address the sea change primarily created by IIoT and Remote O&M and secondarily by international political instability.

2. Much of the potential EBITA opportunity will come from the sale of high performance products.

3. Success will depend on creating products with lower total cost of ownership in selected niches which will result in the greatest profits.

4. The millions of analyses needed for this effort will be made possible by utilizing all the available intelligence.

5. The cost of creating an internet of wisdom is beyond the means of a single mid-sized company,

6. A private equity firm with a compatible portfolio is a logical solution to the cost sharing and collaboration needed to navigate this sea change.

ANALYSIS OF 400 PUMP AND VALVE COMPANY ACQUISITIONS

In the last 20 years Mcilvaine has compiled data on over 400 valve and pump company acquisitions. All are included in the Mcilvaine Pump and Valve Market reports. The information provided at the time of the acquisition is uniquely valuable. It often has the revenues, purchase price, and perceived strengths. The information on 20 acquisitions by Tyco and now Emerson provides invaluable niche market insights. Clarkson was a leader in 30,000 gpm FGD knife gate slurry valves at the time of the acquisition. A current evaluation of the Emerson strength in this market is greatly enhanced with the acquisition information.

Here are some of the pump acquisitions and conclusions

http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1716-nr2702ere are some of the valve acquisitions and conc

Here are some of the valve company acquisition and conclusions

http://home.mcilvainecompany.com/index.php/other-services/free-news/news-releases/47-uncategorised/news/1717-nr2703