NEWS RELEASE May 2019

Flow and Treat Purchases by TSMC and Other Chip Producers

A small number of semiconductor companies purchase most of the flow and treat products and services used by the industry. Forecasts for each one are available with segmentation for each product category.

There is a centralizing of purchasing and use of data analytics and total cost of ownership which makes it important to determine the corporate purchases. The involvement of the corporate staff was made clear when McIlvaine was contracted to provide a large worldwide semiconductor company with the sales analysis of a large HEPA filter supplier segmented by industry. The purpose was to better negotiate quantities and price with the filter company.

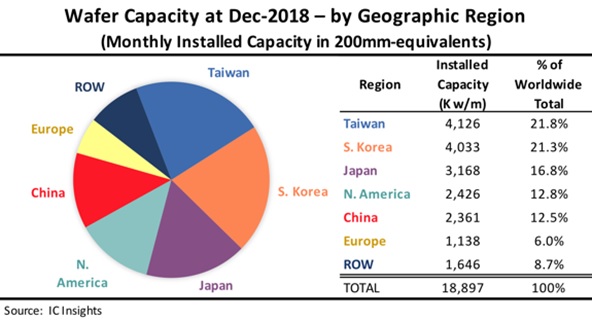

The flow and treat forecasts by region and by specific producer can be determined by iterating a number of factors. One is wafer starts per month.

China presently has a 1.5 percent market share. SEMI forecasts that front-end fab capacity in China will grow to account for 16 percent of the world's semiconductor fab capacity this year, a share that will increase to 20 percent by the end of 2020. With the rapid growth, China will top the rest of the world in fab investment in 2020 with more than $20 billion in spending, driven by memory and foundry projects funded by both multinational and domestic companies.

Top Chinese foundries such as Semiconductor Manufacturing International Co. (SMIC) are working to scale production at 14 nm, while AMD, TSMC, and others are reaching 7 nm. By this measure, Chinese foundries are two to three generations behind global leaders. However, China spends more to import chips than it does oil. It is targeting producing 75 percent of the world’s chips in the next decade. It is turning to a Taiwanese company for help.

At a Semicon West show in the 1980s, the editor of the McIlvaine Cleanroom newsletter had the opportunity to interview Morris Chang regarding starting up a foundry in Taiwan to supply chips to the device producers. No one at the time could have predicted the spectacular success of this venture. Today the company Chang founded Taiwan Semiconductor is a world leader in chip production.

Annual capacity of the manufacturing facilities managed by TSMC and its subsidiaries exceeded 12 million 12-inch equivalent wafers in 2018. These facilities include three 12-inch wafer GIGAFAB® fabs, four 8-inch wafer fabs, and one 6-inch wafer fab – all in Taiwan – as well as one 12-inch wafer fab at a wholly owned subsidiary, TSMC Nanjing Company Limited, and two 8-inch wafer fabs at wholly owned subsidiaries, WaferTech in the United States and TSMC China Company Limited. In 2016, TSMC Nanjing Company Limited was established, with a 12-inch wafer fab and a design service center.

TSMC will spend more than $1 billion on Flow and Treat products and services in 2019.

| TSMC Flow and Treat Purchases 2019 | |||||||

| Flow | Cleanroom | Chemicals | Environment | ||||

| Type | $ Mill | Type | $ Mill | Type | $ Mill | Type | $ Mill |

| Pumps- Cen | 11 | Wipes | 55 | Act Carbon | 5 | Absorbers | 7 |

| Pumps-Rot | 5 | Gloves | 90 | Chelants | 0.3 | Adsorbers | 8 |

| Pumps Rec | 3 | Furniture | 9 | Cor. Inhib | 6 | Therm-Ox | 1 |

| Pumps - Dia | 5 | Ionizers | 2 | Defoamers | 0.6 | Dust Coll- | 7 |

| Valves- Ball | 11 | Disinfect | 50 | Inorg-Coag | 11 | Filter Press | 0.1 |

| V-Butterfly | 8 | Floors | 5 | Ion Exch | 4 | Leaf Filter | 0.1 |

| V-Check | 2 | HVAC | 40 | Odor | 0.5 | Sand Filter | 0.6 |

| V-Gate | 16 | Walls | 4 | Org. Floc | 13 | Centrifuge | 2 |

| V-Globe | 17 | Disp. Gar. | 16 | Ox/Biocide | 15 | Clarifier | 4 |

| V- Plug | 5 | Rent/Laund | 50 | Ph Adjust | 6 | Hydrocyl- | 0.2 |

| V-Safety R. | 1 | Rooms | 90 | Scale Inhib | 30 | RO | 30 |

| Hose/Coup | 16 | Engineer | 9 | Air Filtration | UF-MF | 5 | |

| Guide | 50 | Devices | 45 | Gas Phase | 20 | Cart-Mem | 60 |

| Control | 75 | Monitor | 9 | HEPA | 50 | Cart Non- Woven | 15 |

|

Measure Liquid |

18 | Filters/FFU | 25 | G1-4 | 5 | Cart -Strng | 0.2 |

| Meas Gas | 25 | Walls | 4 | M5-9 | 18 | Cart-Cer | 0.5 |

| Meas Solid | 8 | Paper | 5 | ||||

| Sub -Total | 276 | 508 | 184.4 | 140.7 | |||

| Total | 1109.1 | ||||||

TSMC is a major flow and treat purchaser. Next year it will spend $90 million for gloves and an equal amount for new cleanrooms. It will pay $50 million for the rental (including processing) of reusable garments. It will spend $50 million for HEPA filters. Guide, control and measure expenditures will exceed $175 million. Purchases of cross flow membranes and cartridges will exceed $100 million. More than $80 million will be spend on pumps and valves. Chemical purchases will exceed $90 million.

TSMC is an example of the forecasts for individual purchases which are part of the Most Profitable Market Program.

The advantages of this program to the supplier are

- More accurate global forecasts

- Specific sales targets for direct marketing program

- Potential for feedback on accuracy from local sales people

- Understanding of the individual customer needs

- Potential to collaborate with other divisions or companies with complimentary products

The subjects in orange are products furnished by Danaher. Chemtreat supplies the chemicals. Hach supplies the instrumentation, and Pall supplies the cross flow membranes and cartridges. The total potential for Danaher is $378 million. The Taiwanese sales people in each division can work together on a bottoms up basis to improve the sales success ratio. The local sales people in the U.S. and China can also collaborate to the mutual benefit of all.

The Most Profitable Market Program is described at www.mcilvainecompany.com

Cleanroom Projects and People tracks the projects and is described at 80A World Cleanroom Projects

The cleanroom hardware and consumables is covered in N6F World Cleanroom Markets

The air related markets are covered in

N007 Thermal Catalytic World Air Pollution Markets

N008 Scrubber/Adsorber/Biofilter World Markets

N018 Electrostatic Precipitator World Market

N021 World Fabric Filter and Element Market

N022 Air Filtration and Purification World Market

The water related market reports are described at

N028 Industrial Valves: World Market

N026 Water and Wastewater Treatment Chemicals: World Market

N031 Industrial IOT and Remote O&M

(including instrumentation and automation)

N024 Cartridge Filters: World Market

N006 Liquid Filtration and Media World Markets

N005 Sedimentation and Centrifugation World Markets

Bob McIlvaine can answer your questions at 847 784 0012 ext. 122 This email address is being protected from spambots. You need JavaScript enabled to view it.