NEWS RELEASE June 2021

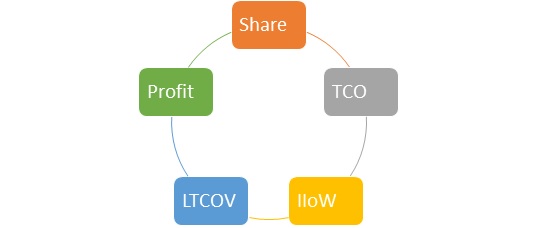

Market Share -TCO - Profitability Causation Loop

The extent to which market share correlates or causes profitability is debatable. To answer this question for the Flow and Treat industry, it is desirable to separately analyze the general performance and high performance segments.

The general performance segment depends on price and delivery. There are economies of scale. The large producer achieves lower production costs and potentially higher margins.

The high performance Flow and Treat purchases are $300 billion per year. For this segment there are a number of related factors forming a causation loop consisting of

- Market share

- Total cost of ownership (TCO)

- Industrial Internet of Wisdom (IIoW)

- Lowest Total Cost of Ownership Validation (LTCOV)

- Profit margin and total profits

TCO is dependent on the performance of the product. Higher prices and margins can be achieved if the customer can be persuaded that the product is the best choice (LTCOV).

If a company has a high market share it can infer LTCO. It does not need proof but only to point to the many happy users. So market share is an important factor in LTCOV. Competitors have to prove that their product is better. This is not an easy task.

It is necessary to gather all the available information and provide evidence or opinions of experts. Due to digitalization and the willingness of media to provide permanent access to published articles there is now an IIoW.

This path provides the opportunity for LTCOV of better products. It is enhanced to the extent that the TCO can be more accurately assessed with on line monitoring (IIoT).

A new valve or pump may only be installed at a few sites. However if there is continuous monitoring of TCO there is considerable validation. Therefore IIoW including IIoT becomes a route for suppliers with low market share to overcome a disadvantage.

IIoW allows companies to provide LTCOV in each niche area. The purchaser at a vaccine manufacturer is going to be swayed by case histories and analysis of the product use at other vaccine plants.

This LTCOV in each niche eliminates the market share advantage of the large company with a major share of the broader market e.g. hygienic. The multi product company can show that lots of food and pharmaceutical plants use his product. But if the smaller supplier shows LTCO in the niche, he has the advantage with the customer in that niche.

Knowledge of the industry and all the niches becomes important. The large companies with many products serving a specific niche have the advantage of more cost effectively gathering the knowledge. If they do not leverage IIoW this is no longer an advantage.

There is a new environment where market share is more quickly impacted by new and better products. There is a causation loop where leveraging each of the factors can lead to higher profits.

McIlvaine Company tracks market share and profitability of many thousands of flow and treat companies. This is reflected in multi-client market reports and private consulting. There are global market shares in the reports.

For individual clients, the level of detail can be as specific as trunnion not floating ball valves for mid-stream gas applications for 18-24 inch sizes in Algeria.

Information on the multi-client reports is shown at www.mcilvainecompany.com under markets at the top of the page.

Relative to private consulting you can contact Bob McIlvaine at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it..