NEWS RELEASE October 2019

Woven Belts and Cloths for Coal Fired Power Plants

The McIlvaine Company has continued to grow vertically in terms of industries and technologies and horizontally in terms of the number of Air, Water, and Energy products it covers. It has added to its air pollution control, cleanroom, centrifuge, cartridge, membrane, oxidizers, burners, pumps, valves, chemicals with new efforts on dryers, fans, compressors, seals, hose, and couplings. In terms of industries it has added lithium, biopharmaceuticals, and manufactured frac sands to its industry coverage. In each industry segment it has added sub segments e.g. in food there are now nine sub segments

The major clients are the suppliers. But by providing the end users with the true costs of various products a whole new route to market is created. This true cost analysis approach also allows suppliers to pursue their most profitable markets.

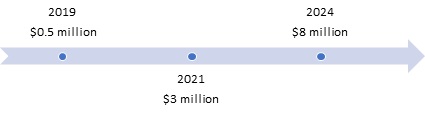

One example would be the market for woven belts and cloths for the Indian power plant market. Because India is installing 100,000 MW of wet limestone FGD systems the market for replacement gypsum dewatering vacuum filter belts will rise substantially to $8 million/yr by 2024.

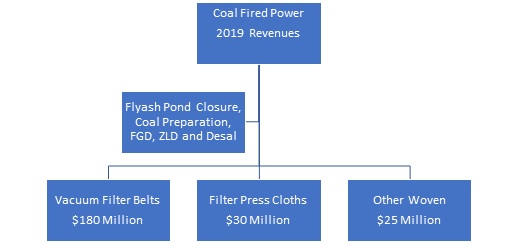

Coal fired power plants will spend $235 million for belts and cloths this year.

Revenues will increase at greater than five percent a year due to the growing use of wet limestone systems, the need to eliminate flyash ponds in the U.S. and a number of other countries, the adoption of zero liquid discharge, and the requirement that Chinese plants near oceans use desalinated water.

There are only major 500 coal plant owners (both industrial and utility) around the world. A few dominate the purchases. Shenhua Guodian will spend over $30 million for belts and cloths this year. NTPC in India will be spending more than $4 million/yr for belts and cloths by 2024.

In terms of pursuing the most profitable market, there are only a few companies capable of making belts with 50 m2 of belt surface. The Chinese market is very large but there are established suppliers. The markets in India and South East Asia are just being established. So in terms of profitability there is a justification for pursuing this segment.

The fact that McIlvaine is also providing true cost analysis to owners adds to the potential profit margins of those with the lowest total cost of ownership products. But this effort can also shape the total market. For example by using lime instead of limestone a very white gypsum can be produced. This can replace precipitated calcium carbonate as a paper coating and generate a significant byproduct revenue stream. However the function of the belt filter becomes more critical and thus increases the potential market.

The market for belts and cloths for all applications is analyzed in N006 Liquid Filtration and Media World Markets.

The market for FGD is analyzed in FGD Markets and Strategies http://home.mcilvainecompany.com/index.php/markets/air/n027-fgd-market-and-strategies

Bob McIlvaine can answer your questions at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 784 0012 cell 847 226 2391.