NEWS RELEASE September 2020

Dynamic Filter and Media Market Could Reach $80 billion in 2022

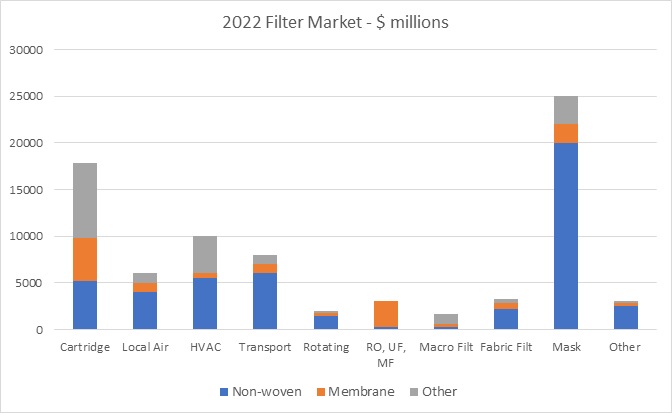

The segments of the filtration industry which use non-woven and membrane filter media are poised to grow to $80 billion in 2022. This represents an increase of 33% over the 2019 revenues. Most of the growth is attributable to coronavirus related mitigation efforts. The assumption is that the filtration industry will be able to deliver the needed masks and filters. Air pollution and drought caused by climate change create the balance of the growth. The air pollution prevention benefits of masks, HVAC filters, and dust collectors are greater due to the steady increase in wildfires. Increasing use of desalination and water reuse will be another consequence of climate change. Battery separator markets will also increase as electric vehicles are viewed as a climate change solution.

If the filtration industry can not meet the demand or if it fails to convince purchasers of the real benefits of better filtration, revenues could plateau at 2019 levels or even fall depending on the havoc wrought by COVID.

These are filter revenues FOB manufacturer.

Media revenues range from 20 % for masks to 60% for fabric filters.

There is now strong evidence the Coronavirus is spread by small aerosols. Cloth masks and inefficient filters act as aerosol generators. The medical community is finally realizing that the solution lies in high efficiency masks and filters. In the past the assumption was that these products could not be made available to the general public. The filtration industry is capable of meeting the very large demand with a mix of meltblown, nanofiber, membrane and other media.

The same media which can be used in masks and HVAC filters has applicability in gas turbine intake filters, dust collectors, and liquid cartridges. The non-woven media market will be over $25 billion of which only 40% will be mask media. Concerns that media manufacturers have about building capacity which will go unused after a vaccine is perfected are unwarranted. Not only are there non mask uses but air pollution, indoor pollution, wildfires, and new viruses will boost mask demand.

The “other segment” includes vacuum cleaner bags and battery separators. It does not include medical and cleanroom garments. However, these can use the same media and are analyzed in McIlvaine Cleanroom and other publications.

This is a very dynamic market. The U.S. election in November will determine the extent of future trade barriers and the amount of international trade. Technical developments in media and products will continue to shape the market.

It is therefore essential that filter and media companies prepare comprehensive strategies which are flexible enough to adjust as conditions change. The Mcilvaine Company has a Filter and Media Strategic Management Program which includes continually updated and detailed forecasts plus tools to pursue the market opportunities.

Bob McIlvaine can provide more information on the program. He can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it. or 847 226 2391.