NEWS RELEASE November 2021

$100 Billion Annual Market for Pumps, Valves, and Other Air, Water, and Combustion Products in Energy Applications

There is a $100 billion annual market for air, water, and combustion products in energy applications over the next 20 years regardless of climate change policies.

Solar and wind require little investment in air, water, and combustion products. Their percentage of total energy production will grow rapidly. Nevertheless these two sources will not eliminate the need for other technologies over the next 20 years.

Some CO2 neutral or negative technologies such as BECCS and nuclear require more investment in air, water, and combustion products than do conventional coal fired plants.

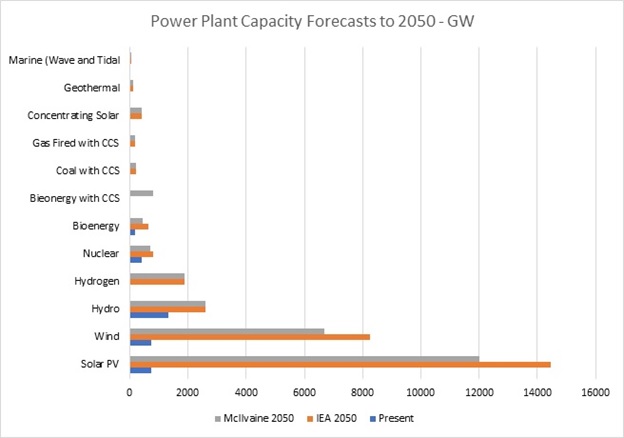

The mix of utility power generation sources as forecasted by IEA and separately by McIlvaine show reliance on a number of fuel sources.

In addition there will be large purchases by industrial and commercial sources. These include

- Off road engines

- Stationary Engines

- Marine

- Rail

- Industrial Power and CHP

- Waste to Energy

There is a new business strategy to pursue these markets: The Most Profitable Market Program http://home.mcilvainecompany.com/images/Most_Profitable_Market_Program.pdf

The unique deliverable is the forecast of potential EBITA for each major prospect.

The segmentation of forecasts should include the following criteria

- Market potential by application

- Correlation to specific prospects

- Cost of ownership factors

- Geographical aspects

Market potential in each application: Selective Catalytic Reduction (SCR) can be used as an example. The supplier of catalysts, valves, or pumps wants to know how big the SCR market is in coal, gas turbines, marine, stationary engines etc.

Market potential by process: SCR is an application which requires unique types of catalyst, pumps, and valves. So determining the process potential is important. There are variations such as when hydrogen is used as a fuel source.

Correlation to specific prospects: Each of these fuel sources will have unique purchasers but there is overlap. A utility such as NTPC in India is involved in all the utility fuel sources. Maersk is buying catalyst for marine applications. There are more 90,000 ships of which 10% already have SCR systems. They represent a market for replacement catalyst as well as repair parts for pumps and valves.

Cost of ownership factors: Each fuel source has unique cost of ownership factors. Many sources require SCR. In the case of coal fired boilers the particulate contamination of catalyst requires special designs. Marine SCR systems have space constraints.

Geographical aspects: Regulations are not uniform across the world. There has been no requirement for SCR on gas turbines in many countries. The coal fired capacity is shrinking in some countries and expanding in others

Market forecasts detailed enough to provide segmentation based on all five of the important criteria provide the foundation of a business strategy. The supplier can then determine where they can offer products with the lowest cost of ownership and maximize EBITA and revenues.

McIlvaine provides reports on products such as valves, pumps, filters etc. on all applications as well as well as process oriented reports such as NOx control or cleanrooms. Descriptions for each are found at www.mcilvainecompany.com

Custom consulting is also available. Bob McIlvaine can answer your questions at 847 226 2391 or email him at This email address is being protected from spambots. You need JavaScript enabled to view it.