NEWS RELEASE April 2022

Air, Water, Energy (AWE) Suppliers Can Guide Program to Replace Russian Energy

AWE products are critical in producing various fuels to replace Russian oil and gas. The free world is united in a program to achieve this replacement. People are motivated in a way not seen since the OPEC oil embargo in 1973. At that time an alternative fuels program was immediately launched. In retrospect the technology choices were not optimum. The AWE industry can lead governments and purchasers to the best choices in the current crisis.

In 2021, Russian crude and condensate output reached 10.5 million barrels per day (bpd), making up 14% of the world’s total supply. Russia has oil and gas production facilities throughout the country, but the bulk of its fields are concentrated in western and eastern Siberia. In 2021 Russia exported an estimated 4.7 million bpd of crude to countries around the world. China is the largest importer of Russian crude (1.6 million bpd), but Russia exports a significant volume to buyers in Europe (2.4 million bpd).

Russia is the world’s second-largest producer of natural gas, behind the United States, and has the world’s largest gas reserves. Russia is the world’s largest gas exporter. In 2021 the country produced 762 bcm of natural gas and exported approximately 210 bcm via pipeline.

Russia has a wide-reaching gas export pipeline network, both via transit routes through Belarus and Ukraine, and via pipelines sending gas directly into Europe (including Nord Stream, Blue Stream, and TurkStream pipelines). Russia completed work on the Nord Stream II pipeline in 2021, but the German government decided not to approve certification in the wake of the Russian invasion of Ukraine. Russian natural gas accounted for 45% of imports and almost 40% of European Union gas demand in 2021.

It will be more difficult for Russia to sell its gas if Europe does not purchase it. Oil is more easily delivered around the world. However, oil sold to China or India at a discount will substantially reduce Russian revenues. Furthermore the lack of international products including pumps will make production less efficient.

AWE products will play a major role in providing alternative fuels for Europe and other free countries.

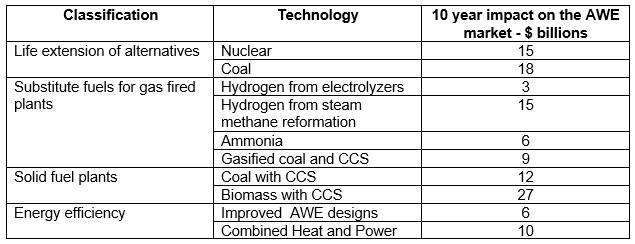

Impact of Alternative Fuels on the AWE Industry

This is the impact over 10 years of replacing Russian energy. Even though the primary activity will be in Europe, higher gas and oil prices around the world will also incentivize other countries to select alternative options. The largest potential is bioenergy with carbon sequestration. The 4000 MW Drax power plant in the UK is now burning wood pellets primarily imported from the U.S. It is completing a project to sequester CO2 in the North Sea. This is a carbon negative technology.

A 4000 MW BECCS plant reverses the CO2 contribution to the atmosphere. The significance is twofold.

- Even though a temporary alternative fuels program can add CO2 there is no tipping point. BECCS can bring down CO2 levels in the future.

- Any BECCS will offset carbon producing options. So 4000 MW of conventional coal plant life extension plus 4000 MW of BECCS = 8000 MW of carbon neutral electricity.

The U.S. faced a similar situation in 1973 when OPEC banned oil exports to a country supporting Israel. A number of technology choices were made without access to an organized evaluation system. Highest on the priory list were

- oil shale (not shale oil)

- new coal fired power plants

The plan was to make Colorado the oil capital of the world with a technology used for tar sands in Canada. Huge construction sites were built in a short time. Electric heat was to replace gas heat. 85,000 MW of new coal fired power plants were ordered by U.S. utilities. Six months later the oil embargo was lifted. No oil shale plants were built in Colorado. In the 50 years since the big coal plant orders less than 30,000 MW of new coal plants have been built. So cancelations have exceeded new orders.

In similar crisis situations South Africa and Nazi Germany made a different choice. Germany opted for coal to liquids (CTL). During World War II most of the airplane and tank fuel was produced by CTL. South Africa during the apartheid era built the huge Sasol complex and made both fuels and chemicals. Today that technology is being extensively employed in the Chinese chemical industry.

The only relic of the 1973 program is the Great Plains plant in North Dakota. It has produced coal gas, ammonia, and hydrogen from coal. It has piped CO2 for enhanced oil recovery to Canada. The plant is being revamped to use shale gas to produce hydrogen and ammonia.

If it had not been for the inventions around shale fracturing in the 1990s the failure of the U.S to develop an alternative fuels program would have resulted in $200/barrel oil today and a dominance of Russia and OPEC. The free world cannot afford to make the same haphazard decisions made in 1973.

The AWE suppliers should have been in a guiding role in 1973. They knew coal gasification and liquefaction was reliable whereas retorts for oil shale were problematic. It is easy to ignore all the available knowledge. Coal gasification was widely used for town gas starting in the 1890s. It was critical to remove flyash and SO2. A high energy scrubber was invented for the purpose. Within a few decades natural gas and fuel oil replaced coal gas and the scrubber was forgotten.

In 1945 the U.S. was looking for a way to remove particulate and acid gases in steel and pulp mills. Johnstone of U of I became famous for inventing or actually reinventing the venturi scrubber.

In the 1970s one variation captured acids and particulates incidentally including rare earths. In the 1990s Siemens adopted it for coal gas but ignored the potential for insitu rare earth production along with a leaching solution free of charge. Today rare earth production is important and suppliers have a low cost solution if they would just use what they know.

AWE suppliers should be at the forefront in crafting alternatives to Russian energy. The McIlvaine company can support their efforts with assistance relative to

- market forecasts

- predicate evidence

- disputed evidence

Market Forecasts. Suppliers want to pursue the most profitable markets (MPM). McIlvaine can identify the specific opportunities for a particular design of filter, valve, or compressor. There is the potential for shale oil and gas to replace much of Russian energy. How big is this potential? What is the market for fracking pumps which develop higher pressures and fracture shale deeper into the earth?

Will natural frac sands be available or will there be a need for filters, pumps and valves to process synthetic sands?

Predicate Evidence. Market forecasts need to focus on opportunities where a lowest total cost of ownership (LTCOV)I is achievable. This is determined in part by predicate evidence such as what flow rates and pressures are needed. This predicate evidence is also the foundation for addressing the disputed evidence.

Disputed Evidence. The supplier needs to convince purchasers that his product will have the lowest total cost of ownership. This entails analysis of competitors. McIlvaine identifies competitors and the claims they are making relative to the cost of ownership for their products.

Providing alternatives to Russian energy is an extremely valuable contribution to the world and one which can be profitable for AWE suppliers.

McIlvaine has market reports which can be used as the basis for the full pursuit of the alternative energy solutions.

For more information contact Bob McIlvaine at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.