NEWS RELEASE May 2022

Value of Acquisitions in the Pump Industry

There are firms who acquire companies based on their standalone profit potential. This is a strategy that works for general service pumps which are sold more on price and delivery. For high performance pumps success depends on having better products, knowledge of customer needs, and a route to convince them of the product superiority.

EBITA as high as 30% is achievable with this strategy. However the investment in gathering needed knowledge and converting it to wisdom is substantial. By acquiring companies with unique and synergistic wisdom the goals can be achieved more quickly than through organic growth.

The wisdom to be acquired includes the following

Wisdom Benefits

- complimentary products with lower total cost of ownership than competitors

- synergistic application and industry knowledge

- customer access by geography and industry

- new products and industries

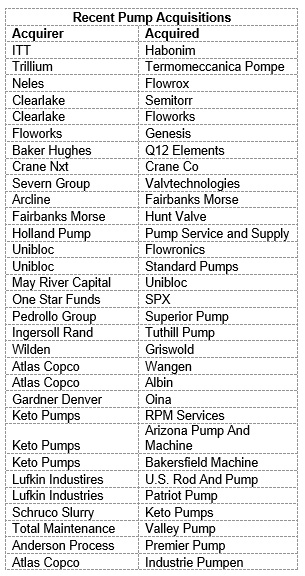

A review of recent pump company transactions shows that one or more of these wisdom benefits has been acquired in each case.

Atlas Copco has acquired Idustie Pumpen Vertriebs Gmbh. The company has sales of less than $10 million but is a significant player in the European chemical industry. So customer access was an important wisdom gain. (3)

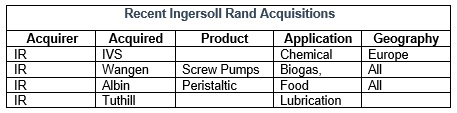

Atlas Copco also purchased Pumpenfabrik Wangen, a German manufacturer of progressive cavity pumps used for transferring fluids mainly in the biogas and wastewater sectors. The company also manufactures twin-screw pumps used in sectors like food and beverage and cosmetics. Revenues are $50 million.(1) (2) (3)

The Ingersoll Rand purchase of Albin pumps was based on the belief that Electric peristaltic pumps are one of the fastest growing positive displacement technologies and yield strong aftermarket opportunities. The conclusion was that the business possesses strong technological expertise in niche applications and end markets.

Another justification was products commonly used in the same strategic markets as other Ingersoll Rand products, including water (municipal and industrial), chemical processing, food and beverage and mining. Albin will complement the product lines of ARO®, Milton Roy® and other Ingersoll Rand brands. (1) (2)

Tuthill manufacturers lubrication pumps which fit well with the compressor products sold by the company. (1) (2) (3

Gardner Denver purchased Oina due to “strong history of delivering innovative products and building excellent customer relationships. This acquisition complements and expands their existing peristaltic pump offering and provides increased access to and expertise in the market. (1) (2) (3)

The McIlvaine Pumps: World Market report has been reporting pump acquisitions on a monthly basis since May 2003 when the following the following was reported.

May 2003 Pump Acquisitions Updates

Wilo Acquires EMU Unterwasserpumpen

January 1, 2003, the Etschel & Meyer GmbH + Co. KG, Hof/Saale has sold its shares in the EMU Unterwasserpumpen GmbH (founded in 1949), as well as its shares in the three German and eight foreign subsidiaries and in its sister company, EMU Anlagenbau GmbH, Hof, to the family company WILO AG, a joint stock company not listed on the stock exchange. EMU Unterwasserpumpen GmbH belongs to the leading worldwide suppliers of submersible pumps and sewage plant technique for municipal and industrial water supply, sewage disposal and sewage purification. Contractor’s pumps for dewatering and for flood control are another part of the EMU manufacturing program. EMU Anlagenbau GmbH specializes in Germany in projecting and installation of complete water supply systems and booster plants. The transaction still needs to be approved by the Monopolies Commission.

The EMU companies complement without any conflict the portfolio of WILO AG. With 3050 staff members and an annual turnover of 535 million Euro, WILO is one of the world market leaders in the field of pumps and pump systems for application in the building services segment. The EMU group of companies with its roughly 500 employees worldwide achieved in FY2002 its historically highest turnover of almost 50 million Euro. At the company’s headquarters in Hof, Germany, EMU employs 440 people.

KSB Plans to Acquire Dutch Pump Manufacturer

KSB AG plans to acquire Dutch pump manufacturing company DP Industries B. V., based in Alphen a/d Rijn. An agreement to this effect is planned to be signed in mid-May. DP Industries has 280 employees and would be turned into a KSB Group sheet metal competence center. KSB Group aims to strengthen its positioning in the sheet steel and stainless sheet steel pump markets and will sell DP Industries products worldwide.

There have been hundreds of pump acquisitions since 2003. Even this 19 year old data is valuable because it has the sales revenue and employees for what is now a division where results for the segment are not available.

A review of these acquisitions over the last 20 years reveals the areas of acquired wisdom over time along with the perceived value at the time of purchase

All this historic data plus current periodic updates are included in Pumps: World Market. Details are found at http://home.mcilvainecompany.com/index.php/markets/water-and-flow/n019-pumps-world-market

Bob McIlvaine can answer your questions at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.