NEWS RELEASE May 2024

$80 billion market for AWE products in LNG

Introduction

The LNG market for AWE products is $80 billion per year and growing rapidly. But the question for the manufacturers of the products is whether this is one of the most profitable opportunities to pursue. The answer is found with awe digital forecaster.

- Analysis of the main segments: liquefaction, transport, and regasification.

- Find each $10 million/yr. opportunity with 30% EBITDA and 40% market share.

These favorable opportunities are created by product, technology, customer, and location synergies.

LNG Market

Oil and Gas can be viewed as a $300 billion dollar galaxy in the $2.5 trillion air, water, energy universe.

Natural gas is growing at 3% per year. What is most impressive is that the percentage of gas converted to LNG is predicted to increase at 6% per year through 2040.

The primary reason for the high level of growth is the ability to economically move natural gas from source to use.

This economy is due to liquefaction and the fact that the process reduces the gas to 1/600th of its original un-liquified volume and to half the weight of water.

Russia and Middle East countries have been the leading gas producers in the past. But horizontal drilling and hydraulic fracturing have created large new sources of gas.

According to IEA In 2024, global gas demand is forecast to grow by 2.5%, or 100 billion cubic metres (bcm). Price-sensitive industrial sectors will see a return to growth. Power generation is forecast to increase only marginally, as higher gas burn in the Asia Pacific region, North America and the Middle East is forecast to be partly offset by reduced demand in Europe.

While growth in natural gas use will be modest, the percentage which is converted to LNG will grow by 6%/yr. through 2040.

The U.S. has leveraged hydraulic fracturing to become the world’s largest gas producer. It has invested in liquefaction terminals and exports LNG around the world.

As of October 2023, U.S. terminals for liquefied natural gas exports had a combined capacity of 92.9 million metric tons per year.

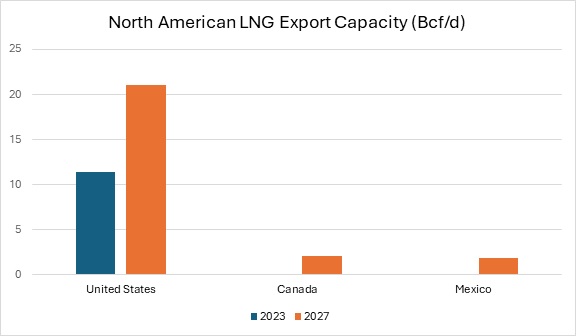

North America’s liquefied natural gas (LNG) export capacity will expand to 24.3 billion cubic feet per day (Bcf/d) from 11.4 Bcf/d today as Mexico and Canada place their first LNG export terminals into service and the United States adds to its existing LNG capacity. By the end of 2027, LNG export capacity will grow by 1.1 Bcf/d in Mexico, 2.1 Bcf/d in Canada, and 9.7 Bcf/d in the United States from a total of 10 new projects across the three countries.

Five LNG export projects are currently under construction in the U.S. with a combined 9.7 Bcf/d of LNG export capacity - Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. Developers expect LNG exports from Golden Pass LNG and Plaquemines LNG to start in 2024.

Exxon Mobil and other major oil and gas companies have invested in large tankers which have double the capacity of the earlier models.

In addition to ship and rail, virtual pipelines are experiencing strong growth. Gas which was formerly flared due to lack of a pipeline is now liquefied and moved by tanker trucks to power generators and other users. Recipient countries in Europe and Asia have invested in regasification facilities.

Companies active in Qatar can synchronize LNG with other opportunities. Synchronization can be segmented into the three main LNG activities: Exxon Mobil and other large oil and gas companies are involved in the complete supply chain but may not be involved in the tanker process equipment decisions.

Mcilvaine provides a digital forecaster for each industry for the air, water, energy industry which is part of the Most Profitable Market Program. For more information click on https://home.mcilvainecompany.com

AWE Digital Market Forecaster

AWE digital market niche forecaster now available. This tool has market forecasts for each product in each location and industry. This tool can immediately be used to set targets for territory and product managers.

In many cases that will be necessary to add segmentation.

So, in the above example, LNG would be added as a sub segment to midstream oil and gas.

Triple office triple offset would be an additional segment under butterfly valves.

This digital tool is updated continually in its standard format and customized as needed by individual subscribers.

For more information contact Bob Mcilvaine at 847-226-2391 This email address is being protected from spambots. You need JavaScript enabled to view it. or Stacy Hall This email address is being protected from spambots. You need JavaScript enabled to view it.