NEWS RELEASE August 2018

The Changing Market for Gas Turbine Combust, Flow and Treat Products and Services

Sales of combust, flow and treat products and services for gas turbine power plants will exceed $80 billion this year. This is the latest forecast in 59EI Gas Turbine and Reciprocating Engine Supplier Program

This forecast does not include the gas turbines, steam turbines or HRSGS but does include all the valves, pumps, piping, filters, emission control and other products. It includes the instrumentation and the process management software. It includes the repair and replacement of all these components as well. It includes consumables such as inlet air filters and water treatment chemicals, GTCC plant owners will spend $ 1.4 billion this year just for corrosion and scale inhibitors.

The details on this market are covered in a McIlvaine YouTube analysis https://youtu.be/OBeeTfWgb9A

Third party operation is expanding and will accelerate the adoption of IIoT and Remote O&M. Large plant suppliers such as MHPS and Doosan are moving into remote monitoring and operational support. ITOCHU/NAES is now operating hundreds of plants.

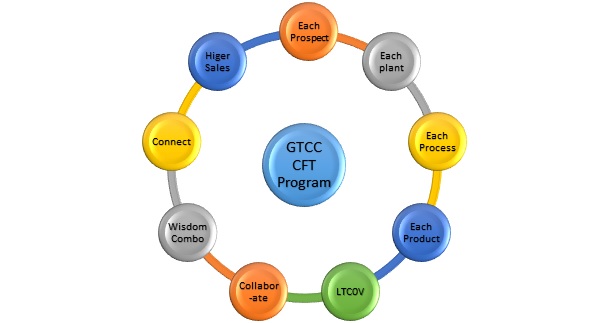

CFT suppliers should be out in front leading the march into the post digital age and selling a wisdom based program to their customers. In the McIlvaine 59EI Gas Turbine and Reciprocating Engine Supplier Program there is a recommended approach to identifying each prospect. For each product the supplier can prepare a lowest total cost ownership validation (LTCOV). This is accomplished with collaboration and a combination of Wisdom tools which not only present the LTCO but validate it (LTCOV) by connecting with the individual purchasers. This is the route to higher sales.

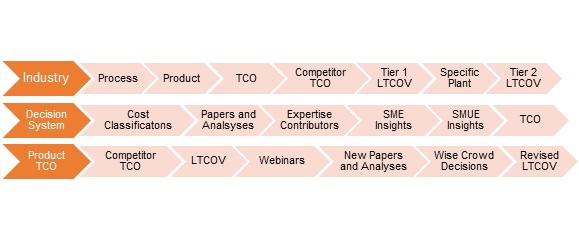

In the post digital age with experts analyzing an avalanche of data it will be possible to determine the total cost of ownership for each product. The supplier can determine where he can validate the lowest total cost of ownership on a Tier 1 basis. Tier 1 is a general validation for most applications. In making a presentation to a specific customer the supplier should offer a Tier 2 LTCOV which takes into account variables such as local regulations and electricity cost differences between plants.

The LTCOV to be credible has to be backed up with papers and analyses most of which are already available but need to be made accessible. The LTCOV needs to be the product of decision systems with subject matter ultra-expert input. The Validation is a continuing process based on changing competitor offerings and industry developments which can be determined and analyzed through wise crowd decisions.

59EI Gas Turbine and Reciprocating Engine Supplier Program provides details on 20,000 GT plants and a program to determine the total available market and the basis for determining the Serviceable Obtainable Market and the Wisdom based Obtainable Market which includes the knowledge support and remote monitoring.

There is sufficient detail on each plant to determine the Tier 2 LTOCV factors. McIlvaine can provide assistance to continually update the right to win analysis.

Bob McIlvaine is available to conduct a GoToMeeting on the report and program. Arrangements can be made by contacting him at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 784 0012 ext. 122, mobile 847 226 2391