NEWS RELEASE SEPTEMBER 2015

Water/Wastewater Treatment Chemical Market Could Be Slowed By the Chinese Slowdown and Oil Price Drop

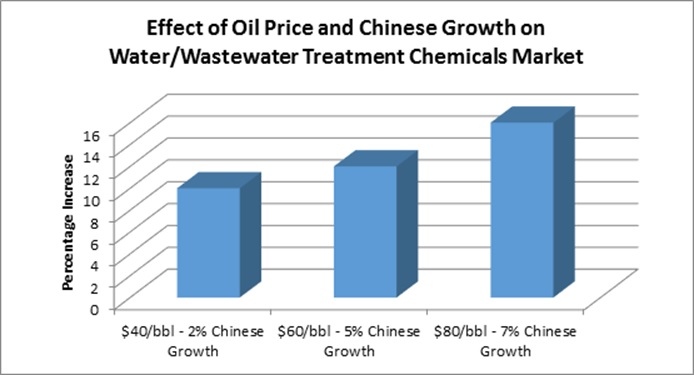

The market for water and wastewater treatment chemicals will grow by over 16 percent from 2015 to 2019 at oil prices of $80/barrel during the period and Chinese economic growth of 7 percent per annum. At $40/barrel and 2 percent economic growth in China, the treatment chemicals market growth will only be 10 percent. These are the latest forecasts in Water and Wastewater Treatment Chemicals: World Market published by the McIlvaine Company. (www.mcilvainecompany.com)

There are a number of variables which will determine the growth for the treatment market. New insights are continually generated which justify changes in the forecasts. The Iran nuclear agreement is just one example. The plunging economy in China and the drop in oil prices to $40/barrel are the most significant.

Lower oil prices will impact the oil and gas industry. But this is a small segment of the water and wastewater treatment chemicals market. Chemicals used in drilling are not included in the scope of the report. The chemicals used in extraction are less sensitive to prices. Furthermore, the oil and gas segment represents only 4 percent of the treatment market.

Municipal drinking water and wastewater treatment facilities account for 40 percent of the world’s treatment chemical purchases. This sector is relatively insensitive to oil price fluctuations.

The Chinese economic turmoil is causing more uncertainty relative to the market for treatment chemicals. First of all, China is a major purchaser of treatment chemicals. It will account for 21 percent of the purchases in 2015. Secondly, it is a major importer of products e.g. iron ore which generate treatment chemical purchases in other countries.

China has been embarked on an aggressive program to increase municipal wastewater treatment capability. It has been building 200 new treatment plants per year. But there are still nearly 600 million people who are not connected to treatment facilities.

China is embarking on transforming the economy from export based to consumer based and has prioritized environmental improvements for its citizens. So regardless of economic growth, it is likely that the environmental improvement programs will continue.

A slowing Chinese economy will impact the power industry. This segment accounts for 40 percent of the treatment chemical purchases. Coal-fired generators are the biggest purchasers. There is 900,000 MW of coal-fired capacity. However, new capacity additions have fallen from a high of 100,000 MW per year a decade ago to 20,000 MW per year at present. A slowing economy could reduce capacity additions by 10,000 MW per year but this would only have a 1 percent impact on treatment chemical consumption.

A slowing Chinese economy will impact treatment chemical purchases for mining, semiconductors, chemicals, pulp and paper and other industries. But the impact on the world market will be minor at least over the next four years.

Some of these developments are more predictable than others. The low oil prices lead to lower extraction activity which eventually leads to shortages and higher prices. On the other hand, the Chinese economy, wars, oil spills and earthquakes cannot be easily predicted. The Fukushima disaster is a good example. It immediately increased the world treatment chemical market by 0.5 percent. As a result, there will be the need for continuous changes in the forecasts to take into account the surprises.

For more information on N026 Water and Wastewater Treatment Chemicals: World Market, click on: http://home.mcilvainecompany.com/index.php/markets/27-water/449-n026-water-and-wastewater-treatment-chemicals