Power Industry Direct Sales Program Candidates

It is now possible to obtain product forecasts for each potential power plant customer. These forecasts can become the foundation of a sales program. McIlvaine can provide forecasts for more than 20,000 large units and another 30,000 smaller utility and industrial units.

The power industry represents a large market for combust flow and treat (CFT) products and services. Coal fired power plants will be the largest purchasers but the gap is shrinking as gas turbine capacity grows. Nuclear plants will continue to rank below coal and gas.

The amount of CFT purchases by solar and wind generators will remain small even though the share of generation by these plants will be growing robustly. Geothermal and biomass are big purchasers of CFT products but their share of total generation will be small. Hydropower will remain a big market for pumps and valves but not for most other CFT products.

Between 2018 and 2021 the capacity of coal plants worldwide will grow from 2440 GW to 2600 GW. The average boiler size is 0.2 GW. There are 12,200 existing boilers. The average size of new boilers is 500 MW. So the number of boilers will grow by 320 during the next three years Each existing unit and details on the new boilers are provided in 42EI Utility Tracking System.

Nuclear capacity will grow from 433 GW in 2018 to 453 GW in 2021. The average reactor is approaching 1 GW and many sites have multiple reactors. So the number of units is less than 500 and the number of sites less than 300. Weekly details on these plants are included in 41F Utility E-Alert.

Gas turbine capacity will rise from 1670 GW in 2018 to 1890 GW in 2021. The average unit size is 0.1 GW resulting in 18,900 units in place by 2021 Data on all existing plants as well as new projects is included in 59EI Gas Turbine and Reciprocating Engine Supplier Program.

There are thousands of geothermal, biomass, biogas and hydro plants. Most are small. Each is tracked in 31I Renewable Energy Update and Projects.

The projected CFT product revenues for each type of generator are included in the market reports http://home.mcilvainecompany.com/index.php/markets

Innovations and insights to future revenues are included in Decision Systems 44I Coal Fired Power Plant Decisions and 59D Gas Turbine and Reciprocating Engine Decisions

This aggregation of services allows McIlvaine to cost effectively predict product purchases at each plant.

Operators of simple cycle and combined cycle gas turbine plants will spend $180 billion per year for hardware, consumables, instrumentation and services on an annual basis over the next 10 years.

The top 15 power companies will spend more than $750 million for gas measurement devices in 2022. This includes analyzers to measure CO, CO2, O2, NOx, NH3, SO2, SO3, mercury and dust. The requirements for mass measurement of dust are boosting the market because their cost is considerably greater than the previously required opacity monitors.

Five Companies will be Responsible for 39 Percent of the Combust, Flow and Treat Purchases in the Nuclear Power segment in 2018.

Global nuclear power generation is now predicted to grow by 2.3 percent per annum out to 2035. Over 90 percent of the combust, flow and treat expenditures will be made by fewer than 50 companies. Thirty-nine percent will be made by just three operators and one supplier.

|

Nuclear Power Plant Combust, Flow and Treat Purchases 2018 - $ millions |

|||||

| World | EDF | Bechtel | KEPCO | Exelon | |

| Percent | 100 | 20 | 10 | 5 | 4 |

| Guide | 1400 | 280 | 140 | 70 | 56 |

| Control | 2200 | 440 | 220 | 110 | 88 |

| Measure | 1200 | 240 | 120 | 60 | 48 |

| Valves | 2000 | 400 | 200 | 100 | 80 |

| Macrofiltration (Belt Presses, Sand Filters) | 200 | 40 | 20 | 10 | 8 |

| Pumps | 1100 | 220 | 110 | 55 | 44 |

| Treatment Chemicals | 1400 | 280 | 140 | 70 | 56 |

| Sedimentation and Centrifugation | 300 | 60 | 30 | 15 | 12 |

| Variable Speed Drives and Motors | 600 | 120 | 60 | 30 | 24 |

| RO/UF/MF Cross Flow Membrane Systems | 200 | 40 | 20 | 10 | 8 |

| Air Purification and Protection | 400 | 80 | 40 | 20 | 16 |

| Total | 11,000 | 2200 | 1100 | 550 | 440 |

Nuclear plants will spend $200 million for cross flow membranes. This represents 20 percent of the total membrane purchases by the power industry.

Most new coal fired plants will incorporate flue gas desulfurization. Many existing plants have FGD systems or will install them. So this is a big market for pumps, valves, controls, chemicals, nozzles, fans, packing, seals and other CFT products. The purchases are concentrated among a few large operators. Guodian and Shenhua are merging and will make 12 percent of global FGD purchases.

| FGD System, Component, Consumables and Repair Purchases in 2018 | ||||

| Company | Country | Rank | % of Total Coal-fired FGD Purchases in 2018 | FGD Purchases ($ millions) |

| AEP | U.S. | 9 | 1.1 | 209 |

| BWE | U.S. | 14 | 0.6 | 114 |

| Datang | China | 3 | 7 | 1,330 |

| Duke | U.S. | 10 | 1 | 190 |

| Enel | Italy | 13 | 1 | 190 |

| Eskom | South Africa | 5 | 6 | 1,140 |

| Guodian | China | 2 | 7.5 | 1,425 |

| Huaneng | China | 1 | 9 | 1,710 |

| Huadian | China | 6 | 6 | 1,140 |

| J-Power | Japan | 16 | 0.5 | 95 |

| National Thermal Power Corporation (NTPC) | India | 4 | 7 | 1,330 |

| NRG | U.S. | 11 | 1 | 190 |

| Shenhua | China | 7 | 4.5 | 855 |

| Southern | U.S. | 12 | 1 | 190 |

| Uniper | Germany | 15 | 0.6 | 114 |

| Vietnam Power (EVN) | Vietnam | 8 | 2 | 380 |

| Sub Total | 55.8 | 10,602 | ||

| Other | 44.2 | 8,398 | ||

| TOTAL | 19,000 | |||

Forecasts can also be supplied for power plants at industrial sites.

| Boilers at BASF Freeport Texas | ||||

| Boiler # | Fuel | Size mm btu/hr | Operating Hours | Date Installed |

| B 20C | Natural gas | 325 | 8500 | 1991 |

| B2500 | Natural gas | 178 | 8592 | 2001 |

| BX 5470 | Natural gas | 210 | 4350 | 1996 |

| *H1 Reformer |

Natural gas/Process gas |

404 | 8000 | 1998 |

* SCR included on this reformer

There are nearly 30,000 industrial boilers in the U.S. However, there are only 350 plants with coal fired boilers and 2000 plants with large gas fired boilers. In the case of a chemical plant such as BASF Freeport, the total market for valves and pumps is large. The boilers just become one of a number of relevant processes within the plant. In Asia there are a large number of independent coal fired power plants operated in conjunction with mining, steel, and chemical products.

Setting up a program built around individual power plants

The program can be structured to place larger effort on the plants with the greatest potential.

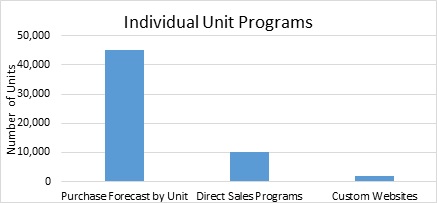

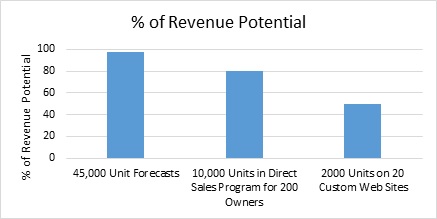

Maximum effort with custom websites can be set up for 2000 individual units at the top 20 purchasers with 50 percent of the potential. So this would be just 20 custom websites. There would be 200 direct sales programs covering corporations with 10,000 units representing 80 percent of the potential. Forecasts for 45,000 units would account for 95 percent of the potential and would be an evaluation tool for the general sales effort.

The forecasts for each individual plant will allow the sales team to effectively deploy resources and maximize sales.

| Steps to a Program Based on Forecasts for Each Plant |

| Segment products in to two categories: High performance and general performance |

| Determine product revenue for each potential purchaser at each plant |

| Prioritize customers based on size of Serviceable Obtainable Market (SOM) and product category |

| Where the product is in the general performance category use the forecasts as an evaluation tool on a retrospective basis and to replace sales leads on a proactive basis. |

| Where the SOM is below a revenue size warranting direct sales the existing sales approach can be used. |

| For high performance products and for prospects with sizable SOM revenue potential initiate a 5 step program as explained at www.mcilvainecompany.com |

| Revise specific forecasts based on feedback from the sales personnel |