NEWS RELEASE August 2021

Would an Ingersoll Rand/SPX Merger Increase Flow and Treat Profitability?

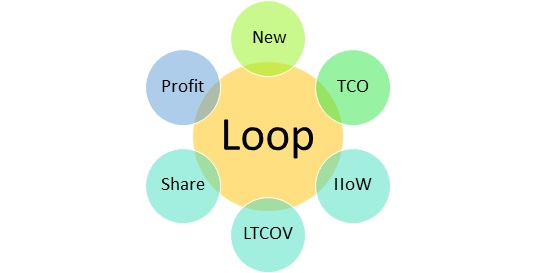

There is a causation loop which can result in higher industry profits due to greater value to customers. SPX is debating its future. The route which increases industry profitability is likely to be the best choice for shareholders.

The innovation – validation - profit causation loop can increase profits for the entire flow and treat industry. The total cost of ownership (TCO) for new and better products is validated (LTCOV) through the Industrial Internet of Wisdom (IIoW). This increases both market share and EBITA. Part of the increased profit is used for R&D to create new and better products.

One of the potential benefits for an IR acquisition of SPX is to expand into food and beverage. It is less than 5% of sales for IR but 47% for SPX. This is an industry where improved flow and treat translates directly into food industry profits. Homogenization is a good example. New homogenized products increase food industry sales. Other flow and treat innovations decrease costs of production. The result is the that flow and treat companies can not only increase market share but increase the entire market revenues and profits.

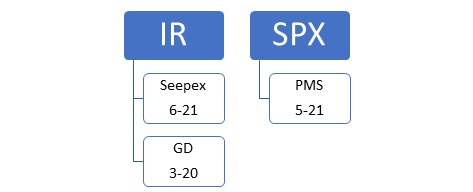

We can then ask the question as to whether an IR/ SPX flow merger would increase the flow and treat industry profits? The first part of the question is how do the recent acquisitions by both companies change the picture.

Ingersoll Rand is acquiring Seepex GmbH. It will be part of the Precision and Science Technologies Segment. Seepex is the second largest progressive cavity (pc) pump supplier with a strong patent position and a $10 million recent investment in a digital platform including software as a service (SaaS). It is a strategic fit in water, wastewater and food and beverage. Growth has been high single digits on current sales of Euro 160 million. Aftermarket is 40% of sales

“Adding progressive cavity pumps to our portfolio has been a strategic priority, and Seepex sets us up for future growth as well as complements our existing PST brands,” said Nick Kendall-Jones, vice president and general manager of the Precision and Science Technologies segment. “The proven capability and expertise of the Seepex team is second to none with their intellectual property outpacing key competitors in terms of new patents and product development.”

Gardner Denver merged with Ingersoll Rand Industrial last year. Flow and treat equipment includes compressors, blowers, pumps and valves. Ingersoll Rand has a number of different blower types and added multi centrifugals with the acquisition of Gardner Denver. The true cost of each blower type for aeration of sewage sludge differs depending on the specific applications but also the plant location. Energy costs vary widely from country to country. Aeration is the leading energy consumer in a wastewater plant. The TCO differs so greatly by application that large blowers in some plants are being replaced by several blowers with different designs. Each is better suited for the volume and pressure requirements for a specific segment of the aeration process. The need to analyze blower cost of ownership with inclusion of all the factors is covered in

http://home.mcilvainecompany.com/images/MW_Blower_True_Costs_2019-08-19.pdf

SPX Flow has authorized a review of strategic alternatives, including a possible sale or merger. SPX Flow had previously rejected a bid from IR which exceed $3 billion. SPX Flow purchased Philadelphia Mixing Solutions (PMS) last year for $65 million. PMS revenue in 2020 revenue was $50 million.

A merger of IR and SPX Flow could have the following positive impact on profits of the combined companies.

- Increasing revenues for the food industry: Homogenization in the food industry provides a good example. People pay more for better tasting or convenient foods. Homogenization can involve pumps and valves but also mixers. In addition the separation prior to homogenization can involve Plenty Filters or Seital Centrifuges made by SPX. A merged company can devote more resources to understanding the processes. This is necessary in order to develop better products.

- Decreasing costs for the food industry: Food safety is a big expense. To the extent flow and treat products reduce maintenance needed to make food safe the lower the costs for the industry.

Better products result in increased sales and profits only if the advantages can be validated. The McIlvaine company is working with the media to provide a flow and treat industrial internet of Wisdom (IIoW) Articles extracting the IIoW value from industry magazines are being created. Here are examples of how magazine search engines can be utilized for an IIoW on TCO advantages for pumps in the food industry.

SPX Flow Designs PD Pump With Better Seal Location

Positive displacement pumps, or PD pumps, have long been used in food processing. Over time, designs have been enhanced to improve pump efficiency and performance across fluids of varying viscosity. With new food safety standards in the process of being introduced, pumps are also advancing in their "cleanability."

Responding to the shift in focus by the FDA with the FSMA, pump manufacturers are working to continually improve the cleanability and increase the hygiene while ensuring easy maintenance. One such enhancement includes redesign of the front-loading seal area. This was required because some front-loaded PD pump seals resided within the pump head. This created a risk where the seals could fracture, break or wear and lead to worn seal components ending up in the pumped product. Another area of weakness with existing pump designs was the dead space (where the rotor nuts reside) in the front cover.

To address these specific issues, pumps such as the Waukesha Cherry-Burrell (WCB) Universal 3 Series now incorporate a seal design that is located in the back of the pump body. So while it is accessible from the front, should it wear or break it will be forced out of the pump in the open area between the pump body and gear case. The seal design also incorporates a profiled gasket instead of an O-ring seal on the front cover.

One manufacturer of yogurts had issues with seeds from the fruit in the product becoming trapped in the front cover area. The use of the latest PD pump design with a flat, profiled gasket and reduced dead space in the front cover area offered this user significant improvements in cleanability and reduced maintenance with longer seal life.

Another producer of baby food required PD pumps to move its highly viscous, lumpy product but cleanability and ease of maintenance was of paramount importance. Again, the improved cleanability and reduced spares requirements of the latest PD pump designs offered this manufacturer clear benefits.

TCO Advantage: redesigned seal location improves cleanliness, reduces maintenance and provides longer seal life

https://www.processingmagazine.com/pumps-motors-drives/article/15587336/designing-positive-displacement-pumps-for-modern-food-safety-guidelines

Pumps used to Move Solids Play an Important Role in Processed-Meat Preparation

One good option is use of vertically mounted, open-hopper progressive-cavity pumps with something the maker calls "smart-stator technology" (SST) to process boneless, chunked or ground meat, as well as soups, stew or chili — without product damage.

Other meat-handling pumps include air-driven diaphragm pumps or lobe pumps. These pumps have higher energy and maintenance costs than do progressive-cavity pumps, and more often damage product.

The Seepex, BCSO 70-6LS vertical cone hopper, progressive-cavity pump with smart-stator technology (SST) can be designed to fit a variety of sizes and other conditions. The case of chicken breasts that were not marinated but that were slightly frosty is cited in the article. With the custom design there was not product damage.

TCO Advantages

- PC pumps better than centrifugals in terms of product damage

- less energy consumption

- lower maintenance

https://www.processingmagazine.com/pumps-motors-drives/article/15582477/pump-poultry-without-product-damage

The question of whether an SPX Flow merger with IR would raise revenues and profits for the flow and treat industry is much more complex than presented. McIlvaine has over one million forecasts for pumps and valves of each type in each application in each country. Equal numbers are forecasted for air and liquid filtration and separation. Millions of compressor and blower forecasts are also being generated. Each niche has its own unique TCO factors.

The answer also depends on prediction of the process trends. Dry scrubbers for waste incinerators and power generators use very little of the equipment offered by the two companies. On the other hand wet scrubbing with gypsum production is a major market. The future of hydrogen fuel, hydraulic fracturing, bioenergy carbon capture and sequestration is important to the flow and treat industry. McIlvaine Company also provides analysis of these processes.

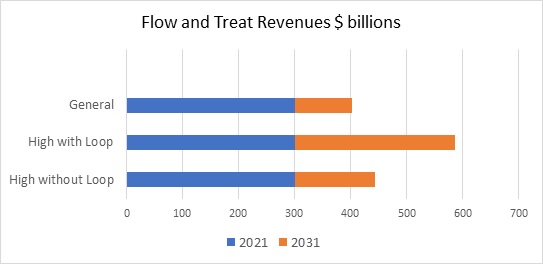

The present flow and treat market worldwide is approximately $600 billion. It is evenly divided between high performance and general products. Price and delivery are secondary to performance in the high sector. The general sector is likely to grow to $400 billion over the next 10 years. The high performance sector without the causation loop could grow to $440 million but with the causation loop could grow to $580 billion.

The total market without the causation loop in 2031 would be $840 billion but $980 billion with it.

More information on the causation loop program is found at http://home.mcilvainecompany.com/index.php/30-general/1658-holistic-content-marketing-program

Bob McIlvaine can answer your questions at This email address is being protected from spambots. You need JavaScript enabled to view it. you can reach him at 847 226 2391