Market Reports can be Customized to Provide Highest Profits

- MPM Markets

- LTCOV Principles

- Individual MPM Forecasts

- References

MPM MARKETS

The goal of Combust, Flow and Treat ( CFT) companies is to maximize profits. Market forecasts should be the foundation of the business strategy. Instead they are usually treated as a peripheral tool The reason is that market forecasts typically quantify the Total Available Market (TAM) which includes geographies and product requirements which cannot be served. The reports are customized at some expense to provide the Serviceable Obtainable Market (SOM) which reflects a market which can be served at some profit margin even if meager.

Management does not want to be chasing orders which have meager unit margins when there are opportunities with high margins. By creating a Most Profitable Market (MPM) forecast they create a very valuable foundation for the whole business program

The MPM is defined as the market which yields the highest profit given the resources and knowledge available.

This market is some fraction of the SOM. The MPM can further be defined as the market where the company has products with the lowest total cost of ownership (LTCO) and attractive resultant profit margins. The MPM is further restricted to those opportunities where Lowest Total Cost of Ownership Validation (LTCOV) can be demonstrated. The MPM is calculated based on the targeted market share.

Every company should strive to maximize the market share and sales of higher performance products and services. Its R&D should be oriented to increasing the number of products with high margins due to their lowest total cost of ownership (LTCO). It should also be striving to increase the amount by which it does have the LTCO over competitive products. This will result in higher gross profit. The opposite side of this coin is that the competition will be striving to do the same. So the LTCO is always a function of the differential to all of the competitors.

Market forecasts should be prepared in such detail that they shape the specific initiatives relative to products, processes, industries and even individual large owners. Most combust, flow, and treat products and services are purchased by less than 20,000 companies around the world. More than half the coal fired power plant, refinery, oil and gas, mining, and steel purchases are made by a very small number of companies.

The forecast should determine the gross profit which is achievable with the TCO of present products. This should be prepared for all the major purchasers.

| Company | Product | Function | Units | Margin | Gross Profit |

| BASF | Gate Valve | Isolation | |||

| BASF | Gate Valve | Control | |||

| BASF | Globe Valve | Isolation | |||

| BASF | Globe Valve | Control |

These forecasts should be prepared for each product for a company such as BASF and then for the individual plants. R&D and engineering design decisions should be made on the basis of potential gross margin and profit and not just on the total market. If the gross profit forecast is reduced because of a competitor’s better design, then the magnitude of the problem should be quantified. Decisions can then be made as to whether the investment in a new design is warranted. The knowledge of the LTCO for each process in chemical plants such as operated by BASF also needs to be considered. BASF is in a number of industries. It increasingly makes chlorine with the membrane processes but is phasing out its mercury process based chlor alkali facilities. Valve requirements are different for each process. So the processes at each plant have to be considered.

LTCOV PRINCIPLES

Suppliers blame the owners for being too conservative and not purchasing a newer and better product. However, the blame rests on the suppliers for not clearly providing the Lowest Total Cost of Ownership Validation (LTCOV). This has to be so convincing that it is as easy for the customer to justify the purchase of the newer product to top management as it is to justify the lowest priced product.

“Newer” can mean widely used, but just not by the target customer. It can mean widely used in other industries, but not in the industry of the target customer. “Newer” can also mean that there are none or just a few installations in total. The LTCOV has to include a discount based on lack of experience. In the first case, the discount is negligible. At the other end of the spectrum there may have to be concessions to obtain the first installation. In all cases, the LTCOV has to be prepared so that it is absolutely convincing. The problem is that there is not even a standardized procedure which ensures accuracy or validation.

To present a case that is absolutely convincing the following elements are needed

- Understanding and utilization of the cost factors which apply to the industry, process, and specific customer.

- The comparison to alternatively available products.

- An analysis which takes all the factors and options into consideration and accurately weighs them to come to the best possible conclusion.

Cost factors: The compilation of all the cost factors which are shaped by the process and the industry is a task which could cost millions of dollars. Unless this compilation is already available the validation of a newer and better product is cost prohibitive. McIlvaine is addressing this availability problem with some of its own products. It is also working with publishers and associations to create “Decision Guides”. Coal Fired Boiler Decisions 44I Coal Fired Power Plant Decisions and Frac Sand Decisions 204I Frac Sand Plant CFT Decisions are two examples. The guides are also prepared for individual processes. Dry Scrubber Decisions includes the analysis of the options for coal-fired power, cement, waste-to-energy and other industries.

There are product oriented Decision Guides. The fiber, media, and bag options for frac sand dryers and dry scrubber systems are all included in the Fabric Filter Decision Guide. The McIlvaine Fabric Filter Knowledge Network has been published since 1976. Prior to the internet it was a set of loose leaf binders with thousands of pages. Abstracts of new articles were provided monthly on 3x 5 library cards. Subscribers could then order the full text. New pages for replacement or insertion in the binders were also furnished. This is the level of effort needed to provide the cost factors. With the internet this process is much easier on a per fact basis. It is even harder on the basis that there are orders of magnitude more facts and opinions which need to be included. The entire spectrum of IIoT and Remote O&M products and options are included in McIlvaine’s IIoT & Remote O&M. There are separate analyses by industry and then each product category from process management software to the individual sensors for each type of flowing solid, liquid, or gas.

Competitive alternatives: The Decision Guides and McIlvaine Product Directories provide information on each of the suppliers. The LTCOV has to address each of the relevant alternatives and convince the customer that the new product is better. One way that comparisons are conducted is in webinars where each product supplier presents his case. McIlvaine has conducted and recorded hundreds of such discussions. Subject matter experts are being encouraged to specialize in niches and help organize the information in that nice. This will allow them to become subject matter ultra-experts ( SMUEs).

Continually updated analyses: The LTCOV for each product should be continuously available for all to see on line. It should be supported by evidence. This means that the viewer can reference many other documents which are also accessible. The summary should include the adverse comments of the competition and the refutation of those comments. The viewer will have the ability to view the detailed data to see that it supports the conclusions.

INVIDUAL MPM FORECASTS

Thanks to digital technology it is now possible to economically forecast the market opportunity for each potential customer for each type of combust, flow and treat product. Traditionally the market program has been based on sales leads. If the customer is interested in a general performance product such as small valves for a fresh water line, the order may be placed by a contractor and the lead time from project inception to sale could be a matter of weeks. The purchasing agent or project manager may be the sole decision maker. Here is how marketing programs are set up around sales leads.

High performance products such as a severe service valve or a cross flow membrane filter are purchased as a result of initiatives which will span months or years. There is often a preferred bidders list. Decisions are made based on total cost of ownership more than on initial price. Most purchases are to replace existing products or by owners who have products of this type in operation.

Some general performance products are now being purchased as if they were high performance. For example if a supplier of small fresh water valves offers a package which includes remote monitoring and replacement of all the valves in the corporation, his offering will need the time and scrutiny that high performance products receive.

For high performance products it is possible to forecast the yearly purchase opportunity for each product at each plant and for the total corporation. This would have been an impossible quest before the digital age. Now it is economically attractive to make these determinations. Forecasts can be made for each plant owned by thousands of corporations.

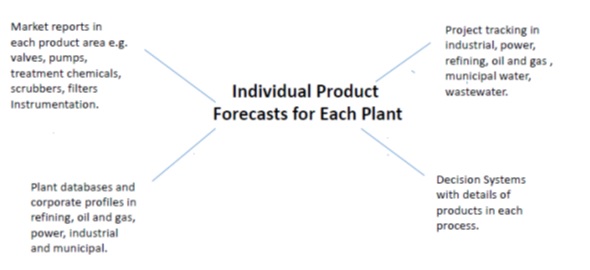

McIlvaine has many market reports each of which projects revenues for each type of product in each industry. The purchases for the top 100 customers are also included. Details on each report are shown at http://home.mcilvainecompany.com/index.php/markets.

Forecasts for individual plants are created based on McIlvaine databases. Plant databases and corporate profiles as well as tracking systems for individual projects are included in a number of services described at http://home.mcilvainecompany.com/index.php/databases.

Links start here

References

Dry Scrubbing: Most Profitable Markets

Hydraulic Fracturing Presents a Most Profitable Market Opportunity for Pump Manufacturers

Individual MPM prospects